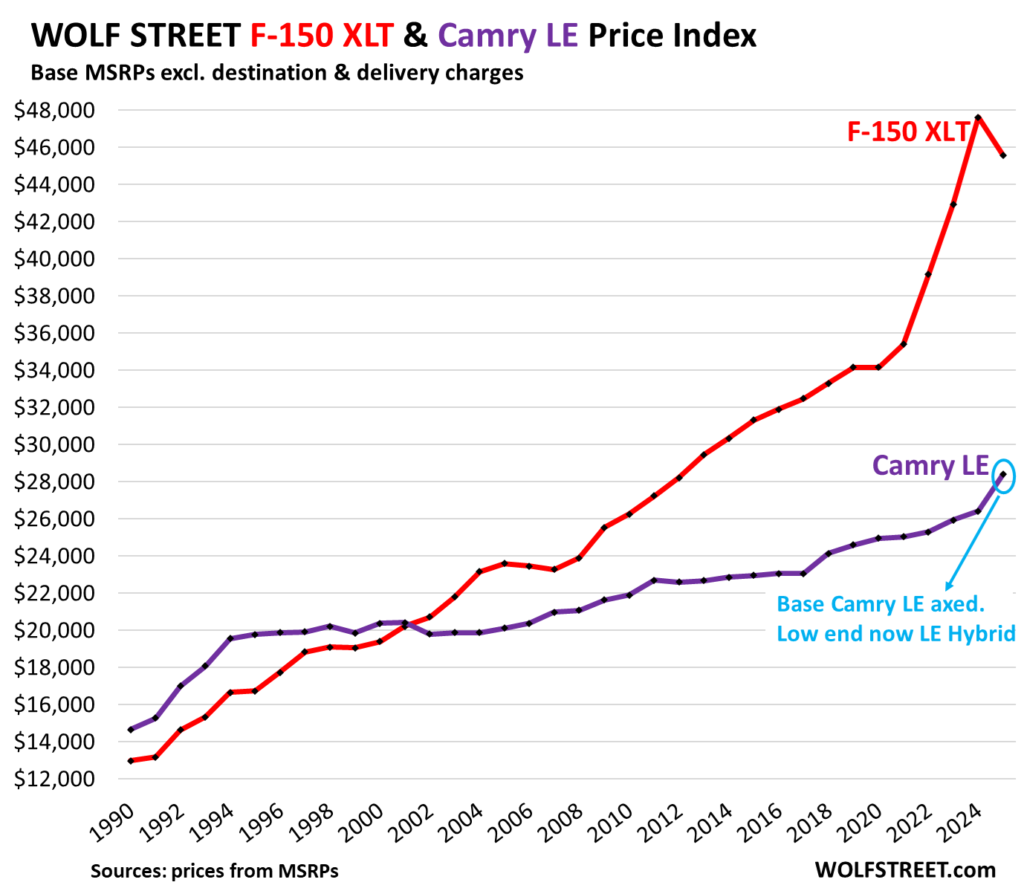

In recent developments in the auto industry, Ford is reversing the trend of soaring truck prices by cutting the manufacturer’s suggested retail price (MSRP) for its 2025 F-150 models. The price of the base two-door, rear-wheel-drive F-150 XLT has been reduced by $2,025, bringing it down to $45,595, a decrease of 4.3%. This is notable as it marks the first significant price cut since the data on vehicle pricing began tracking in 1990. However, it’s essential to note that this cut comes after a staggering 35% price increase over the past three years, suggesting that the current reduction only minimally addresses the previous price hike.

In contrast, Toyota has taken a different approach with its 2025 Camry model, eliminating the traditional base Camry LE. The company has introduced the Camry LE Hybrid as the new entry-level model, resulting in an MSRP increase of $1,980, raising the starting price to $28,400. The hybridization of the base model means that consumers who previously sought a lower-priced gasoline-only Camry now must opt for the more expensive hybrid variant, regardless of their preference. This shift in strategy raises concerns about affordability, as it combines the challenges of rising initial costs with a fundamental change in the vehicle’s nature.

Historically, the pricing dynamics between the Ford F-150 and the Toyota Camry have shifted significantly. In the 90s, the Camry LE often commanded a higher price than the F-150 XLT, reflecting the truck’s status as a more utility-focused vehicle. However, over the last couple of decades, the trend has reversed, with the F-150 becoming nearly twice as expensive as the Camry LE by the 2024 model year. This shift demonstrated the truck’s elevation to a premium product, catering to consumer preferences for larger vehicles. Despite this newfound status, economic realities show that there exists a limit to consumer tolerance for high vehicle prices.

With significant price increases in recent years, particularly for pickups, sales have begun to stagnate, leading to increased inventory for dealerships. Automakers, including Ford, are now faced with the challenge of stimulating demand amid a challenging sales landscape. These challenges have prompted Ford to reduce MSRPs as a strategy to attract buyers, although there remain questions about the adequacy of these cuts in relation to the hefty price hikes seen previously. The automotive market is currently experiencing considerable pressure, necessitating an environment of incentives and discounts to move lingering inventory.

Taking a broader perspective, the consumer price index (CPI) for new vehicles has shown fluctuations over the past year, indicating that prices have indeed reached unsustainable levels. The CPI, which measures the average change over time in the prices paid by consumers, observed a notable spike in vehicle prices, displaying a correlation with the pricing strategies of major manufacturers. A comparison reveals that overall new vehicle prices climbed 27.8% since 2010, significantly outpacing the 20.6% rise in the price of the Camry LE during the same period. The redesign of the Camry, now a hybrid, has pushed its price trajectory above this benchmark.

The Ford F-150 XLT, despite the recent price cut, has seen its MSRP rise by 73.7% since 2010. This dramatic increase emphasizes the ongoing inflationary pressures in the auto market and highlights the disparity in pricing between competing models. Additionally, the discontinuation of the traditional Camry and its replacement with a hybrid variant has altered the baseline for comparisons, effectively changing the market landscape. Even though these shifts may complicate price tracking and indexing, they reflect ongoing trends in consumer preferences and technological advancements within the automotive industry.

Overall, the current auto market is undergoing significant transformations marked by shifting pricing strategies and consumer expectations. Ford’s decision to cut prices comes as a response to rising inventory levels and declining sales, while Toyota’s pivot to a hybrid base model signifies broader trends toward sustainability. With inflation and changes in consumer preferences, both manufacturers are adapting in real-time to remain competitive, though the long-term impact of these pricing strategies on consumer purchasing power remains to be seen. As the auto industry navigates these evolving challenges, both companies must address rising costs while ensuring that their offerings align with consumer demand in an increasingly complex market.