On October 9, 2024, Mastercard will trade ex-dividend for its declared quarterly dividend of $0.66, which is scheduled for payment on November 8, 2024. This dividend is relatively modest when considered against the backdrop of Mastercard’s recent stock price, which sits at approximately $497.70. As such, the dividend represents about 0.13% of the current share price. This ex-dividend date provides investors with a crucial benchmark as they make decisions regarding their investments. Understanding the implications of the dividend declaration and the company’s performance in relation to previous dividends can help investors gauge the potential for future income from their holdings in Mastercard.

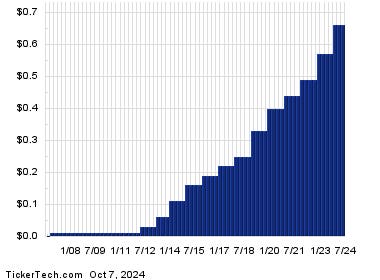

Examining the historical dividend chart for Mastercard, we can see a track record of dividends that precede this latest announcement of $0.66. This historical data is essential because it can aid investors in determining whether the latest dividend is consistent with past performance and whether it is a reasonable expectation for ongoing dividends. While dividends can be unpredictable, analyzing past patterns allows investors to assess the likelihood of the dividend being maintained or increased in future periods, thereby providing a clearer picture of the company’s financial health and commitment to returning capital to shareholders.

Currently, Mastercard’s estimated annual yield stands at 0.53%. This figure reflects the company’s ongoing approach to dividend declarations and expectations. The yield is relatively low compared to other investment opportunities; however, Mastercard’s strong market position and consistent financial performance lend credibility to maintaining a steady dividend policy. Evaluating the annualized yield against historical performance can provide insights into investors’ expectations regarding returns and help them decide the attractiveness of adding or retaining Mastercard shares in their portfolios.

When analyzing the performance of Mastercard shares over the past year, one can observe fluctuations alongside its 200-day moving average. The data reveals a 52-week trading range for Mastercard that spans from a low point of $359.77 to a high of $501.80. Currently, the shares are trading near $497.11, which shows they are close to the high end of the trading range. This performance can be seen as a testament to Mastercard’s resilience in the marketplace and reflects investor confidence, likely bolstered by positive financial results and growth prospects.

As these developments unfold, it is also noteworthy to highlight the recent trading activity of Mastercard. On the day prior, shares increased by approximately 0.6%, indicating positive market sentiment towards the company’s stock. Such incremental gains underscore the broader context of investor confidence and may be influenced by various factors, including robust financial performance, effective management strategies, and favorable market conditions. As Mastercard consistently sets the stage for dividend distributions and gauges future earnings potential, these elements can play a pivotal role in maintaining shareholder loyalty and interest.

In conclusion, as Mastercard approaches the ex-dividend date for its quarterly payment, shareholders are equipped with a historical context that aids in evaluating the sustainability and potential growth of future dividends. Understanding the trends in Mastercard’s stock price, its dividend history, and market performance provides a comprehensive view that allows investors to make informed decisions regarding their investments. Overall, Mastercard remains a significant player in the financial services sector, and its small yet consistent dividends reflect both a solid business model and a commitment to returning value to its shareholders.