In late September, the repo market faced a significant disruption caused by a sudden shortage of systemic liquidity. This situation emerged as a direct consequence of the Federal Reserve’s quantitative tightening (QT) policy, which led to declining balances at the Fed. Notably, the figure of $3 trillion has been highlighted as a critical threshold for what is termed the Lowest Comfortable Level of Reserves (LCLoR). As a result of these dynamics, repo rates skyrocketed, reaching levels reminiscent of the turmoil experienced during the peak of the COVID-19 pandemic. This sudden spike in rates underscored vulnerabilities within the financing system, raising concerns among traders and investors about the stability and functioning of the repo market.

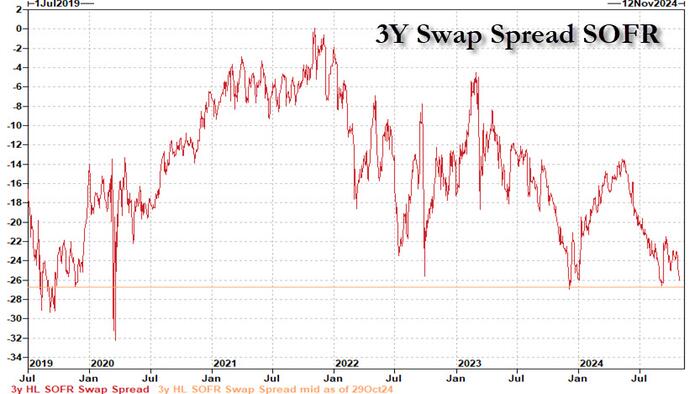

Fast forward to the present, and the repo market is again showing signs of distress. This renewed turmoil has left even seasoned traders, such as Vincent Mistretta from Goldman Sachs, grappling for answers. The market’s indicators, particularly in swap spreads, have demonstrated significant deviations that are puzzling to stakeholders. Mistretta’s admission of uncertainty highlights the complexity of the situation, suggesting that the factors influencing these changes are multifaceted and not easily decipherable. The ongoing fluctuations are raising questions about the adequacy of liquidity measures and the overall health of financial institutions involved in repo transactions.

The market’s response to these fluctuations has further illustrated the intricate relationship between the Fed’s policies and market behavior. The adjustment in reserve balances, alongside the QT measures, is pivotal in understanding how liquidity in the banking system is managed. As reserves fall to historically low levels, banks face increased challenges in meeting their short-term funding needs, leading to spikes in repo rates. This dynamic creates a cascading effect where fluctuations in liquidity can quickly escalate into broader market stress, impacting a range of financial instruments and ultimately affecting monetary policy effectiveness.

Historically, similar disruptions in the repo market warrant a close examination of the interplay between market participants and regulatory frameworks. The repo market serves as a crucial component of the broader financial system, facilitating short-term borrowing and lending among institutions. When systemic liquidity dries up, not only do repo rates rise sharply, but the market can also experience severe dislocations as institutions scramble to secure funding. The current situation is urging regulators and market participants to reconsider how liquidity is managed and whether existing frameworks are sufficient to mitigate future risks.

Amidst this challenging landscape, investors are urged to remain vigilant as they navigate the complexities of the repo market. The volatility observed in recent weeks indicates that traditional trading strategies may need to be re-evaluated in the face of rapidly changing conditions. Moreover, the lack of clear explanations for current market behaviors emphasizes the need for enhanced transparency and communication among financial institutions. As the Fed continues its monetary strategies, stakeholders must be attentive to shifts in market dynamics that could signal further instability or opportunities.

In conclusion, the current challenges facing the repo market highlight the interconnectedness of monetary policy, liquidity management, and market behavior. As traders like Mistretta struggle to find clarity in the prevailing conditions, it becomes increasingly clear that a comprehensive understanding of these dynamics is essential for making informed decisions. This ongoing saga serves as a reminder of the importance of resilience in the financial system, prompting a reassessment of existing frameworks to better support market stability in the face of future disruptions.