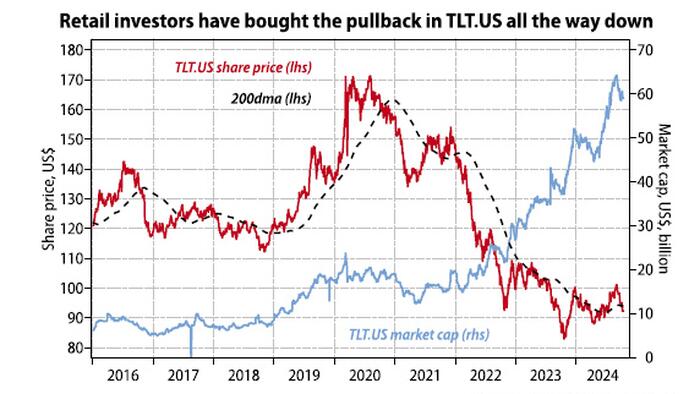

In his recent commentary for the Evergreen Gavekal blog, Louis-Vincent Gave analyzes the current state of the long-dated US Treasury ETF, TLT.US, which is trading below its 200-day moving average. Despite significant retail enthusiasm for US bonds, particularly evident in the ETF’s market capitalization increase from $10 billion in 2019 to $60 billion today, the sell-off in long-dated bonds persists. Gave highlights that such market dynamics often lead to sell-offs being attributed to numerous factors, and he identifies four primary reasons driving the current bear market in bonds.

Firstly, Gave argues that the market is gradually recognizing the end of the post-2008 “new normal” characterized by depressed nominal growth. The effects of prior real estate bubbles are being absorbed, leading to healthier bank and consumer balance sheets. As a result, major central banks are unlikely to return interest rates to zero anytime soon, as this was an unusual historical phenomenon. Given that short-term Treasury bills now offer better yields than long-term bonds, investors are reevaluating the attractiveness of long-dated securities. This emerging sentiment could even prompt a potential rally in the bond market as upcoming economic data is expected to reflect temporary weaknesses due to recent natural disasters, thus allowing investors to reconsider their positions.

The second factor impacting bond performance is the rising issuance of government debt. Gave notes the lack of serious discourse regarding the US government’s burgeoning budget deficit in recent electoral campaigns, with candidates avoiding the topic in favor of vague promises of efficiency and fairness. Meanwhile, US government spending is projected to reach an astounding $13 trillion annually by 2029. Notably, influential investors such as Paul Tudor Jones and Stanley Druckenmiller have begun to publicly express concerns over the sustainability of this fiscal trajectory. This evolving sentiment among investors signals a shift in behavior where selling bonds in reaction to rallies may take precedence over buying dips.

Inflation, the third major concern highlighted by Gave, remains unexpectedly resilient despite a sharp decline from its previous highs in 2022-23. Although conditions appeared favorable for a collapse of consumer inflation rates due to various economic pressures, the reality has shown inflation persisting above 2.4%. Gave raises pertinent questions regarding how central banks will respond to this persistent inflation, especially as they pursue rate cuts while encountering depleting oil inventories and potentially inflationary effects stemming from recent hurricanes. This complexity suggests that inflationary pressures could remain a significant concern, thereby influencing investor behavior and the overall bond market.

The geopolitical landscape adds another layer of complexity to the bond market’s current state. The overlapping schedules of the IMF meeting in Washington and the BRICS summit illustrate the growing divide between the “old” Western world and a “resurgent” Global South. Leaders from countries like Russia and China have expressed intentions to reduce reliance on the dollar and create independent trade and settlement systems. This shift is accompanied by rising precious metal prices, indicating a potential decline in confidence toward long-dated US treasuries. As these geopolitical forces unfold, investors are left to ponder the implications for future bond market behavior.

Gave presents several key questions for investors to contemplate as they navigate these turbulent waters. Primarily, he questions whether global growth will continue its recent trend, especially with indications that US economic data might soften in the near-term following recent hurricanes. However, he suggests that stimulus efforts from governments—particularly in China—could bolster growth prospects in the longer term. Additionally, Gave raises doubts about the likelihood of the US government reducing its debt issuance, especially in light of the persistent fiscal pressures faced by the administration.

In conclusion, Gave’s analysis points towards an evolving landscape for investors in long-dated US treasuries. The converging issues of improving economic fundamentals, mounting government debt, stubborn inflation, and geopolitical strains suggest a complex future for the bond market. With global uncertainty continuing to shape investor sentiment, those engaged in bond markets must consider the underlying trends that may signal further decoupling from past norms. As policymakers grapple with these challenges and uncertainties, the potential for significant shifts in the bond market remains a vital consideration for investors looking ahead.