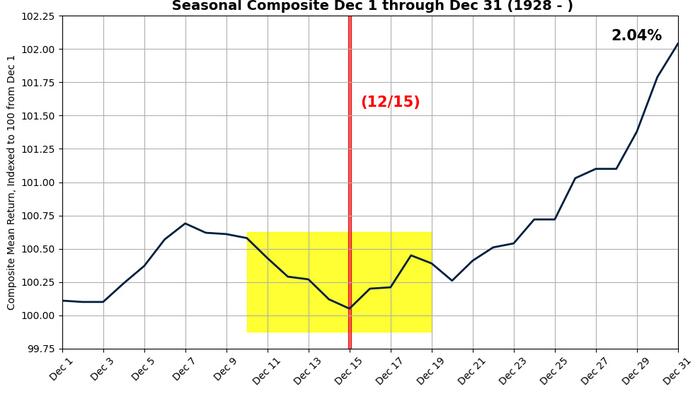

In a recent note to clients, Scott Rubner, a leading voice at Goldman Sachs on flow of funds, expressed optimism about the upcoming months for U.S. equities, citing the historically favorable seasonal patterns observed during this time of year. Rubner emphasized that the current market dynamics create a challenging environment for bearish sentiment, particularly with only 12.5 trading days remaining in the analysis period. This implies that traders are facing a heightened bar for maintaining pessimistic views, suggesting there may be a strong continued demand for equities amidst the existing economic uncertainties.

The conversation around supply and demand has emerged as a crucial narrative for the market as we enter 2024. Investors need to closely monitor the flow of funds – how capital shifts between investment vehicles – as it serves as a key indicator of market direction and sentiment. As trends continue to unfold, the inflows and outflows of capital will dictate the performance of U.S. equities, with demand potentially outpacing supply in periods of optimism. This delicate interplay suggests that investors ought to remain agile, as the landscape can shift swiftly based on macroeconomic developments and investor sentiment.

Furthermore, the idea of “Twelve Days of Flow-of-Funds” underscores the strategic importance of timing in capital allocation decisions. The brief window for trading highlights both urgency and opportunity for investors as they look to capitalize on seasonal advantages. This situation encourages a more tactical approach, where decisions regarding entry and exit points in the market can significantly impact portfolio performance. For traders and institutions, understanding these dynamics can yield tighter control over risk and enhance chances of achieving favorable returns.

Additionally, the current market conditions are influenced by a range of external factors, including interest rates, inflation pressures, and corporate earnings reports. The interplay of these variables affects investor behavior, with many puzzled about the realistic prospects for growth amidst ongoing inflationary concerns. As firms report their Q4 earnings, insights provided by these results may either reinforce or challenge existing narratives on market health, further impacting the flow of funds. Moreover, the adaptability of fund managers and their willingness to pivot in response to new economic data will be tested during this period.

The implications of the flow of funds extend beyond just short-term trading strategies. They also highlight broader themes in investment management, including strategic asset allocation and the importance of maintaining a diversified portfolio. As historical trends suggest that certain sectors might outperform others during bullish periods, investors are encouraged to adopt a holistic view that incorporates various asset classes. Engaging in sector rotation – strategically moving investments across different sectors based on performance and growth potential – may provide an avenue for enhanced returns, particularly if certain segments of the market are expected to outperform.

Ultimately, as we reflect on Scott Rubner’s market insights and the critical role of the flow of funds, it becomes clear that a judicious approach to investing in U.S. equities is paramount. The combination of favorable seasonal patterns, the challenging environment for bearish sentiments, and the complex interplay of supply and demand dynamics set the stage for potential market growth. Keeping a vigilant eye on economic indicators and adjusting strategies accordingly will be essential for investors looking to navigate the complexities of the current financial landscape as the year unfolds.