Turkey’s central bank is anticipated to maintain its interest rate at 50% for the seventh consecutive month in response to September’s inflation data, which exceeded expectations. Economists surveyed by Bloomberg largely agree on this forecast, although one analyst foresees a possible 250 basis-point cut. The Monetary Policy Committee (MPC), under the leadership of Governor Fatih Karahan, has recently softened its stance on the prospect of rate reductions, suggesting that improvements in services inflation could emerge in the fourth quarter. However, the disappointing inflation figures have led economists to revise their predictions for potential cuts from November to January next year.

The decision to cut rates hinges on two critical factors: a sustained decrease in monthly price growth and enhanced inflation expectations from corporations and households. Governor Karahan has pointed out that considerable progress is still required in both areas before any rate cuts can be considered. Erik Meyersson, chief emerging-markets strategist at SEB AB, cautions against a dovish approach in the current climate of persistent inflation and uncertainties stemming from global events, including the forthcoming U.S. elections and tensions in the Middle East.

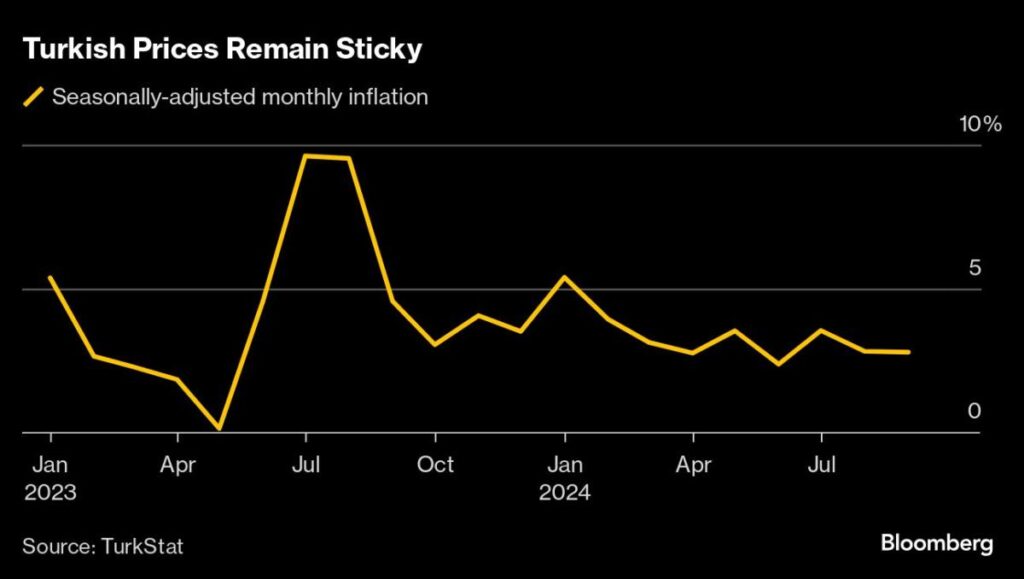

The central bank relies on a specific measure of seasonally adjusted monthly inflation, which has remained stagnant at around 3%. Deputy Governor Cevdet Akcay stated in a recent interview that the bank would maintain a tight monetary policy until a sustainable decrease in the underlying trend of monthly inflation is observed. Bloomberg Economics echoes the expectation that the central bank will keep the one-week repo rate at its peak of 50%, reached in March, while also leveraging alternative tools to control credit growth and liquidity in the market.

President Recep Tayyip Erdogan’s endorsement of a revamped economic policy last year has faced scrutiny from investors. Concerns linger over how long he might maintain high interest rates, considering his historical preference for policies that prioritize growth at any cost. The prevailing economic pressures suggest that the current interest rate level should remain until at least the end of the year.

Despite these pressures, some analysts, including Meyersson, speculate that implicit political pressures may lead to a rate cut before the close of 2024. This speculation is rooted in the uncertainty of economic conditions and Erdogan’s past approach to economic management. The complexity of Turkey’s economic landscape, particularly the interplay between monetary policy and political influences, continues to be a focal point for economists and investors alike.

In conclusion, as Turkey navigates through persistent inflation and economic challenges, the central bank is poised to maintain high interest rates in the short-term. The MPC’s cautious approach reflects a commitment to achieving economic stability while managing potential political pressures. As Turkey’s economic environment evolves, close attention will be paid to future rate decisions and their implications for the country’s financial landscape.