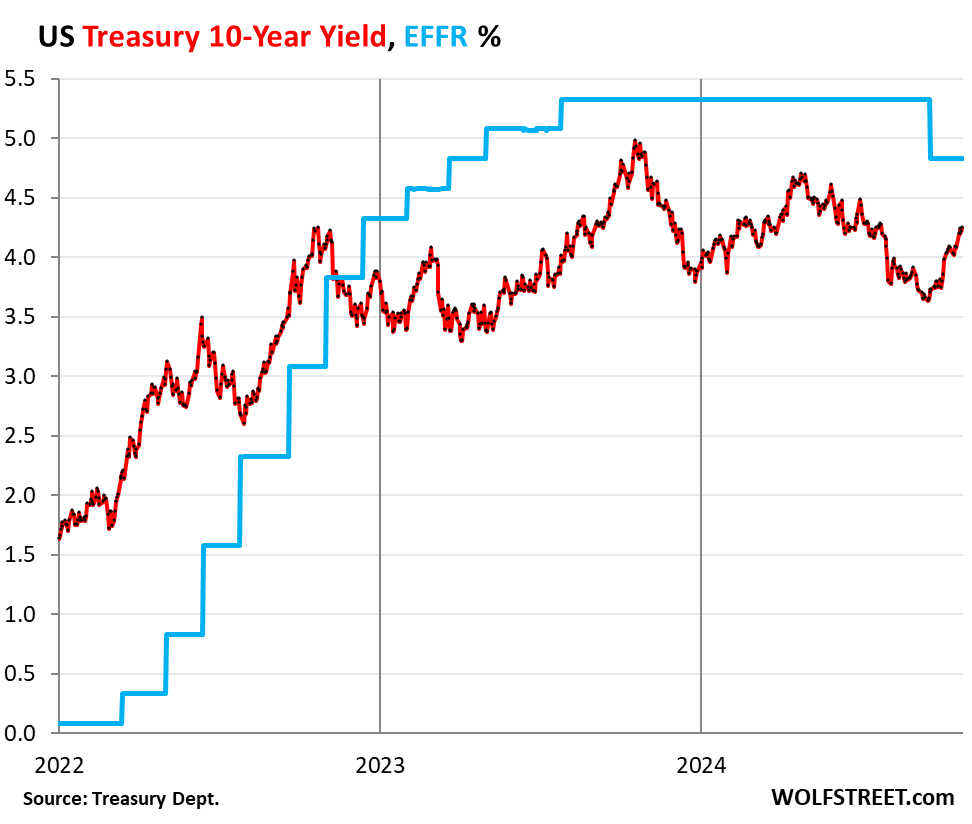

The recent spike in the 10-year Treasury yield, now at 4.25%, has raised concerns and speculations regarding its sustainability. Within a brief span of five weeks, the yield surged by 60 basis points, significantly impacted by the Federal Reserve’s recent rate cut. Prior to this cut, the yield was at approximately 3.65%, and while it dipped on the heels of cooling inflation and a softening labor market, it reversed course post-Fed cut as long-term yields began to climb. This unexpected outcome came as a surprise to many, notably within the home sales sector, as the anticipated decrease in yields did not materialize following the policy adjustment.

Another complex element of the current yield scenario is the contrasting behavior of short-term and long-term yields. While short-term yields have continued their descent, reflecting expectations for at least one more 25-basis-point rate cut this year, longer-term yields are on the rise. This divergence has led to a normalization of the yield curve, which had inverted during the Fed’s aggressive policy tightening in 2022. The yield curve inversion, where short-term yields surpass long-term ones, is now reverting, suggesting a shift back to the traditional state where long-term yields are higher, a sign of renewed investor confidence in economic growth.

From a historical perspective, the current climate of mortgage rates—proportional to the trajectory of the 10-year yield—has undergone notable fluctuations. The 30-year fixed-rate mortgage has spiked from a low of 6.11% prior to the rate cut to about 6.90% currently. This rise has blindsided the real estate sector, leading to discrepancies between market expectations and reality. The industry’s prior optimism suggested that rates would plunge further; however, escalating home prices, particularly those that skyrocketed during the pandemic era, are now hindering sales, resulting in a substantial drop in existing home sales volume.

A deeper analysis reveals that the drivers behind rising long-term yields are primarily rooted in inflation expectations and a projected increase in Treasury securities supply, as the federal deficits loom large. Investor apprehension regarding inflation remains palpable, with fears of holding low-yielding securities in a high-inflation environment pushing yields upward. Furthermore, the increased issuance of new Treasury securities is a pressing issue that underscores the necessity for meaningful discussions about national debt. Meanwhile, the Federal Reserve’s ongoing quantitative tightening (QT) adds another layer of complexity, with the central bank reducing its balance sheet by nearly $2 trillion since 2022, which has contributed to rising longer-term rates.

Amid the current economic landscape, predictions about the future trajectory of the 10-year yield remain uncertain. The immediate outlook suggests that the yield could experience a pause in its upward movement, particularly if forthcoming inflation and labor market data show signs of weakness. Should core inflation unexpectedly rise, however, fueled by strong demand and a resilient labor market, the yield could continue its ascent, potentially pushing mortgage rates back beyond the critical 7% threshold. This dynamic interplay between inflation, labor market performance, and interest rates will heavily influence the financial landscape in the upcoming months.

In summary, the recent fluctuations in the 10-year Treasury yield reflect a complex array of economic signals, including the Fed’s monetary policy decisions, inflation expectations, and supply dynamics seen in the Treasury market. As investors grapple with both the volatility and normalization of the yield curve, the ramifications for the housing market and broader economy become increasingly evident. The interplay of these factors will be pivotal as policymakers and market participants navigate the evolving financial landscape, underscoring the ongoing challenges posed by inflation and the mortgage rate environment in the years to come.