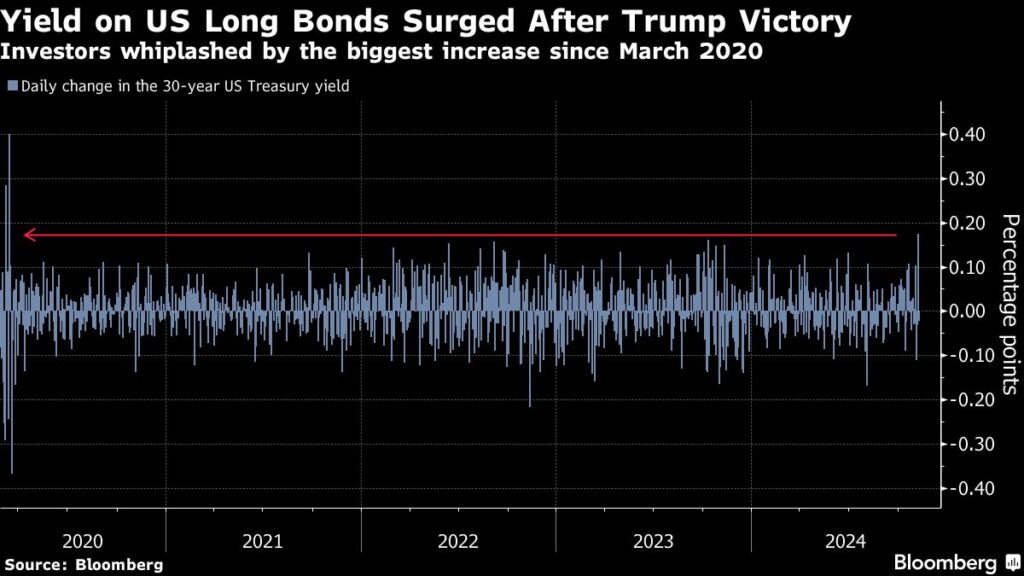

A significant selloff in U.S. Treasuries came to a halt as market focus shifted from Donald Trump’s electoral victory to impending interest rate decisions from major central banks, particularly the Federal Reserve. Following a notable surge in yields, the 30-year U.S. bond yield fell by approximately five basis points to 4.56%. This followed a dramatic 17-basis-point increase earlier in the week, marking the most considerable shift since March 2020. In the UK, government debt rebounded after the Bank of England announced an anticipated rate cut, while euro-area bonds declined amid concerns regarding snap elections in Germany. Investors are particularly attentive to central bank signals on how potential changes in U.S. fiscal policy under Trump might impact global economic growth and inflation.

As market participants awaited a quarter-point interest rate cut from the Federal Reserve, which Chair Jerome Powell was expected to discuss at a subsequent press conference, economic data released in the U.S. revealed mixed results. There was a higher-than-expected growth in unit labor costs during the third quarter, while initial jobless claims remained near their lowest levels seen in recent months. The ten-year Treasury yields dipped by about seven basis points to 4.36%. Additionally, Sweden’s Riksbank made the anticipated move to cut rates by half a point, a stark contrast to Norway, where the central bank opted to keep rates at 4.5% despite a weak krone.

The market had initially rallied for U.S. Treasuries earlier in the week, as anxiety over the elections eased after weekend polls suggested a favorable position for Vice President Kamala Harris. Consequently, a wave of trading activity ensued, reflecting investor adjustments to Trump’s unexpected victory. The president’s campaign promises, which included aggressive tariffs on trading partners and continued tax cuts from the 2017 fiscal plan, could exert upward pressure on inflation. This prospect has led economists at major financial firms such as JPMorgan Chase and Co. to reconsider their expectations of future rate cuts by the Federal Reserve.

In response to these shifting market expectations, money markets had priced in roughly 23 basis points of easing ahead of the Fed’s decision, along with a total of 107 basis points in cuts over the next year. This reflects a decrease from earlier predictions of 115 basis points before the election outcome was clear. Similar adjustments occurred in UK money markets following the announcement of a new fiscal plan that raised concerns over inflation, resulting in gilt yields reaching their highest levels in a year. A strategist at Barclays suggested that the market’s reaction was not only a response to the government’s higher borrowing needs but also to the Office for Budget Responsibility’s assessment of impending inflation risks.

In Germany, financial markets were left unsettled by Chancellor Olaf Scholz’s announcement of potential snap elections, which fueled speculation about increased government spending under a new administration. Following this news, the 30-year yield in Germany surged by as much as 10 basis points to 2.75%, while the 10-year yield surpassed its swap rate correlation for the first time in 16 years. Analysts are closely monitoring whether these political developments might lead to a relaxation of fiscal constraints, as there is growing consensus that additional fiscal stimulus may be necessary for Germany to break free from its current low-growth environment.

Overall, this week has been marked by heightened volatility across bond markets, triggered by a confluence of political developments and economic forecasts. The implications of Trump’s policies on the global financial landscape remain uncertain, and traders continue to seek clarity from central banks regarding their monetary strategies in light of shifting fiscal dynamics. As these conditions unfold, the financial community is poised for fluctuations, setting the stage for a challenging economic environment in the months ahead.