In recent shifts within the U.S. Treasury market, traders are recalibrating their focus from the political turbulence surrounding Donald Trump’s election victory to more immediate economic indicators and comments from Federal Reserve officials. As the market reacts to these developments, Treasury yields have seen slight adjustments, with the yield on the 10-year note dipping for a second consecutive day. Despite this decline, the yield reflects an increase of approximately 12 basis points for the week. The trading landscape suggests that participants are eager for clarity on monetary policy direction as they await crucial retail sales data set to be released.

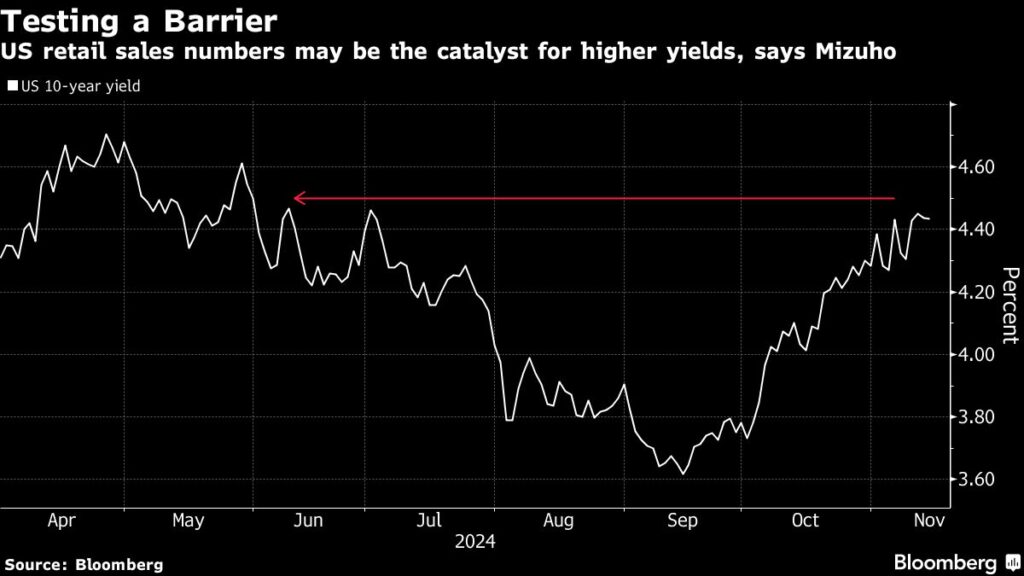

Market participants are carefully monitoring economic metrics such as the upcoming U.S. retail sales figures, which will provide further insight into consumer spending trends and the potential implications for Federal Reserve monetary policy. Economists estimate a growth rate of 0.3%, although some, like Mizuho International strategist Evelyne Gomez-Liechti, anticipate a more robust figure of 0.5%. A stronger retail sales growth could have significant ramifications, propelling Treasury yields higher as traders adjust their expectations regarding future interest rate movements. This upcoming data, therefore, is viewed as pivotal to understanding the Fed’s likely stance.

Amidst these considerations, recent commentary from Fed Chair Jerome Powell has reinforced the perception that the central bank is not inclined to initiate rate cuts in the immediate term. His remarks contributed to a rise in two-year yields, highlighting a cautionary approach as the Fed weighs economic recovery against inflation risks. Such dynamics underscore a shifting narrative where market participants are attempting to disentangle the complexities introduced by the recent election and refocus on foundational economic principles that influence monetary policy.

Barclays’ chair of global research, Ajay Rajadhyaksha, emphasizes the transition back to conventional market drivers after an intense election cycle, indicating that market performance and Treasury valuation can once again be closely tied to economic fundamentals rather than speculative political outcomes. He notes that Treasuries appear to be “fairly priced,” which indicates that while they are stable, they are not necessarily offering value for aggressive buying.

Furthermore, the market is signaling potential shifts in interest rate expectations. Data from the swaps market reveals a 60% probability of a quarter-point interest rate cut by the Federal Reserve in next month’s meeting, a notable decrease from an 80% forecast earlier in the week. This leveling off suggests that while traders are still considering the possibility of easing, there is growing caution amidst recent statements from Fed officials. The evolving landscape signifies that traders are reassessing their positions and expectations as economic indicators and Fed speeches come to the forefront.

As these various factors converge, the Treasury market reflects a broader dialogue about the health of the U.S. economy and the Fed’s policy trajectory. With retail sales data on the horizon and influential Fed voices slated to contribute to the market’s understanding, investors find themselves in a critical period of assessment. The market’s response to upcoming economic data will be decisive in shaping Treasury yields and confirming whether current pricing adequately reflects anticipated Fed actions in light of evolving economic trends.