As Javier Milei embarks on his mission to tackle Argentina’s crippling inflation, his first year in office has proven to be a mixed bag. Despite a gradual decline, the annual inflation rate still exceeds 200%, a staggering figure that underscores the dire economic conditions afflicting the nation. In contrast, investor sentiment remains optimistic, anticipating that inflation will decrease significantly in the coming year. Local bond market trends show traders forecasting a monthly inflation rate dipping to around 1.9%, potentially leading to an annual rate of 25%. This would represent a dramatic decrease and the lowest annual inflation rate in seven years, a welcome departure from the triple-digit increases that Argentines have endured over the past two years. Recent statistics indicate that although the rate has softened—from a peak of nearly 290% in April to an annualized 209% in September—there’s still a long journey ahead for Milei, particularly as citizens demand a resolute commitment to reducing inflation.

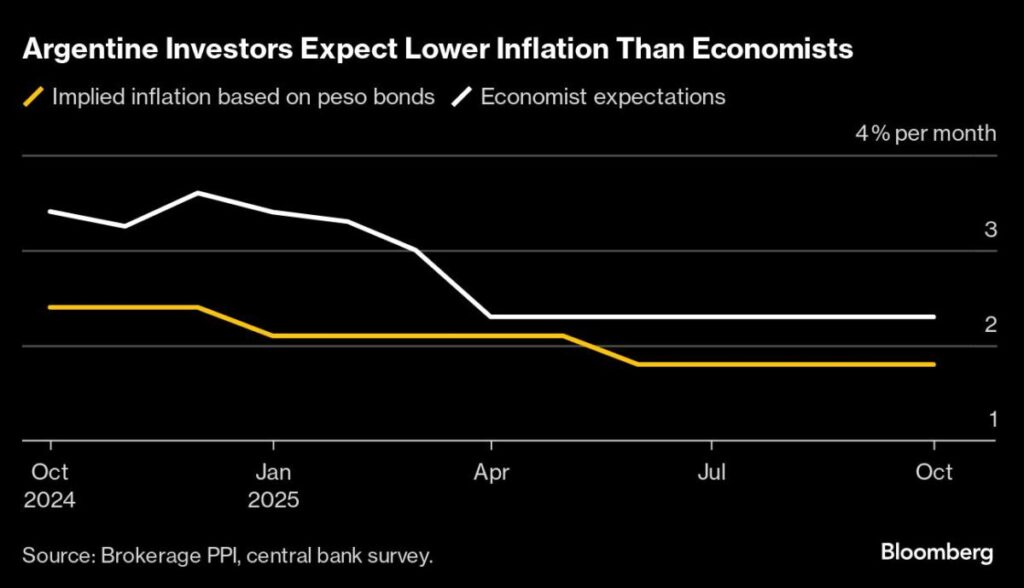

Several private economists are already reporting a promising decline in monthly inflation figures, projecting a drop below 3% for the first time in three years, with estimates from consulting firm Orlando Ferreres & Asociados suggesting it could reach 2.7% in October. The market’s expectations are evidenced by a decline in the break-even measure, which suggests that the anticipated inflation levels from fixed-rate and inflation-linked bonds are more optimistic than the economists’ forecasts. Notably, a recent survey conducted by the central bank reveals that many economists expect an annualized inflation rate around 35% for 2025, while Delta Asset Management is aiming even lower—predicting it could plummet to as low as 20%. Nonetheless, there remains skepticism about this optimistic turnaround, as the haunting echoes of prior economic crises linger in the air, leading to concerns that such projections might be overly optimistic.

The stakes are particularly high for both Milei’s administration and investors banking on significant economic reform. A climate of pronounced optimism has led some analysts to express confidence that the government will successfully implement measures designed to mitigate inflation while simultaneously managing the tumultuous currency situation. Investors are betting on the government’s ability to bolster the official peso while simultaneously supporting the parallel peso market which trades at a 16% disadvantage against its official counterpart. However, lurking beneath this optimism is the potential risk of a stronger Argentine peso affecting Milei’s currency controls, especially given the recent surge of the U.S. dollar. This prevailing situation has prompted analysts to warn of a possible devaluation if the dollar continues its upward trend.

Despite these uncertainties, some market participants are actively re-evaluating their investment strategies amid a market perceived to be overly confident. Emiliano Merenda, president of Pharos Capital, illustrates this tension by relaying his nightly deliberations on whether to maintain his investment positions due to concerns over foreign exchange risks. Earlier in the year, Merenda executed a bold move by leveraging a guaranteed loan to acquire $100,000 in peso notes, resulting in a profit that mitigated the costs of his financing. However, the memory of the 2017 financial crisis, where a similar carry trade resulted in a disastrous 50% devaluation, casts a long shadow over current investment decisions, heightening the anxiety surrounding the sustainability of the peso.

In light of the recent peso appreciation and the ongoing deficit in Argentina’s central bank, many traders are beginning to shift their positions. Carolina Schuartzman, sales and trading director at Columbus Investment Banking, reveals a growing tendency among investors to unwind their fixed-rate peso holdings in favor of inflation-linked bonds. While Schuartzman acknowledges the market’s positivity regarding fixed-rate investments, she expresses caution, noting that a forecasted inflation rate of 25% appears overly ambitious given existing currency restrictions and ongoing price anomalies. Schuartzman outlines her expectation that 2024 might present a different landscape—characterized by stabilized local investor markets and a more manageable fiscal environment—though fears remain that inflationary pressures could persist.

Despite the potential risks highlighted by cautious investors, many still see favorable opportunities in Argentine investments. Max Valores’ Alejo Costa reassures that the landscape is not without hope, stating that the prevailing rates on peso-denominated notes, which vary between 30% and 50%, still offer attractive returns compared to the projected inflation levels. Drawing from the relatively localized nature of the country’s debt and the absence of a fiscal deficit, investors remain optimistic, viewing certain trades as promising. As the economic climate continues to unfold, the coming months may prove crucial for determining the outcomes of Milei’s inflationary strategy and the broader implications for Argentina’s struggling economy.