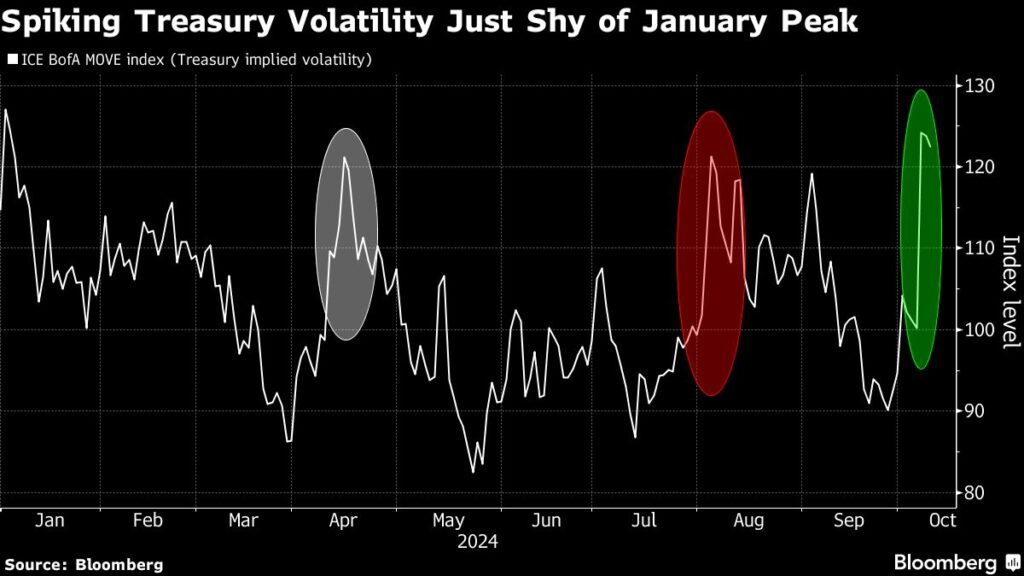

As bond investors navigate an increasingly complex landscape, uncertainty looms over the Federal Reserve’s interest rate trajectory. Recent economic indicators, particularly stubborn inflation coupled with disappointing labor market data, have resulted in a recalibration of market expectations regarding rate cuts in 2024. Traders have moderated their predictions for Fed easing, now factoring in only 45 basis points of potential cuts across the next two meetings, significantly down from previous expectations of a more pronounced reduction. Concurrently, yields have surged to their highest levels since July, reflecting heightened market volatility and unease amongst traders. The ICE BofA Move Index, which tracks anticipated yield fluctuations, has recently peaked, indicating that investors foresee continued turbulence as they reckon with multi-faceted dynamics including fiscal policy implications and possible US election disruptions.

In a strategy to mitigate risks associated with an unpredictable economy, asset managers such as BlackRock, Pacific Investment Management Company (PIMCO), and UBS Global Wealth Management advocate for investments in five-year debt. This recommendation comes amid discussions about the sensitivity of various maturity lengths to economic shocks. Solita Marcelli, chief investment officer for the Americas at UBS, endorses medium-term investments such as Treasuries and investment-grade corporate bonds with around five years to maturity. This maturity window is deemed less susceptible to unexpected fiscal changes and economic pivots, making it appealing for investors seeking stable income streams amid shifting rate cut expectations.

Market reactions to a surprising spike in weekly jobless claims have further complicated the bond landscape. Despite a slight increase in consumer prices suggesting persistent inflationary pressures, the bond market absorbed these mixed signals with fluctuations in trading behaviors. Amidst this volatility, the focus for many traders has shifted to short-term interest rates, leading to cautious speculation about Fed actions in light of evolving economic indicators. Notably, the current sentiment indicates a prevailing inclination towards gradual easing, with a widespread belief that the Fed is likely to soft-pedal its approach to interest rate adjustments moving into 2024.

Investors are particularly attuned to upcoming economic data releases and the Federal Reserve’s November policy decision. Citadel Securities has advised clients to brace for notable volatility as economic conditions develop, predicting one more quarter-point cut from the Fed in 2024. As the US approaches its next election cycle, uncertainty is expected to induce higher implied volatility in bond options and influence positions among fixed-income investors. David Rogal from BlackRock points to the bond market’s volatile nature as elections draw nearer, highlighting the firm’s preference for intermediate-dated Treasuries, anticipating a recalibration of rates aimed at achieving a balance between 3.5% and 4%.

While short-term treasury bonds are viewed favorably, longer-term securities present a mixed picture influenced by the notion of growing fiscal deficits. Anmol Sinha from Capital Group underscores the attractiveness of shorter maturities due to anticipated economic slowdowns or exogenous shocks. Conversely, some observers identify the 10-year yield, now near 4.1%, as entering a “buy zone,” signaling potential opportunities for long-term investors looking to extend their portfolios’ durations in anticipation of a decelerating economy.

For investment firms such as Vanguard, the near-term strategy has involved tactical plays based on current yields while remaining vigilant about economic headwinds. Roger Hallam, global head of rates at Vanguard, notes the company’s interest in exploiting yield levels above 4% as a springboard for lengthening bond portfolios. The firm has seen benefits from maintaining a short position in Treasuries as yields have increased but is simultaneously weighing longer-term options in the face of expected economic contraction next year. As investors gear up for critical economic data releases and the Fed’s ongoing posture towards interest rates, the sentiment remains cautious, with many eyeing strategic opportunities within the current bond market landscape.