ARMOUR Residential REIT has achieved recognition as one of the Top 10 Real Estate Investment Trusts (REITs), as highlighted in the latest “DividendRank” report by Dividend Channel. This ranking is based on a comparison of various REITs, wherein ARMOUR’s shares (ARR) stood out due to their attractive valuation and strong profitability metrics. Specifically, with a recent share price of $19.39, ARMOUR boasts a price-to-book ratio of 0.8 and an impressive annual dividend yield of 14.85%. In contrast, the average REIT within the broader Dividend Channel universe reveals a significantly lower yield of 3.9% and a higher price-to-book ratio of 2.7. These statistics not only emphasize ARMOUR’s favorable valuation but also suggest its potential for solid returns combining both income and capital growth.

The findings of the DividendRank report align with discerning investor strategies that typically focus on identifying strong and profitable companies trading at attractive valuations. ARMOUR Residential REIT, leveraging a proprietary “DividendRank” formula, positions itself well among its peers. This formula effectively ranks various stocks depending on profitability and valuation criteria, which aids investors in uncovering potentially fruitful investment opportunities. The focus on profitability proves essential as investors seek to find a balance between risk and return, particularly in the REIT sector where performance can be sensitive to market fluctuations and macroeconomic conditions.

REITs, being income-focused investments, are uniquely structured to cater to dividend investors since they are mandated to distribute at least 90% of their taxable income as dividends to shareholders. This characteristic typically leads to high dividend yields; however, it simultaneously introduces a level of volatility and unpredictability concerning dividend payments. REIT payouts may significantly fluctuate depending on profit levels—leading to greater distributions during lucrative periods and potential reductions or suspensions during downturns. Thus, while ARMOUR presents a compelling yield, potential investors must consider the inherent risks associated with REIT investments.

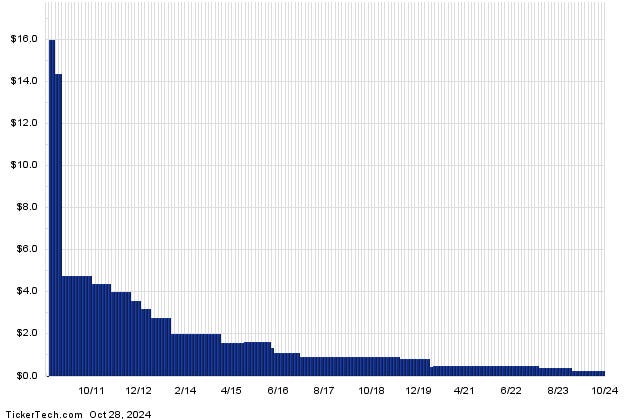

ARMOUR Residential REIT currently maintains an annualized dividend of $2.88 per share, which is distributed monthly. Investors should note that the most recent dividend carries an important ex-date of November 15, 2024. This timing is critical for dividend capture strategies, where investors buy shares before the ex-dividend date to qualify for the upcoming dividend. Consequently, understanding ARMOUR’s long-term dividend history is pivotal; a consistent track record of reliable dividend payments can be a strong indicator of a company’s financial health and its ability to sustain future distributions, making it an attractive option for income-seeking investors.

In assessing ARMOUR’s performance, the report emphasizes the significance of its dividend history as a critical measure. By analyzing this past performance, investors can acquire insights into the company’s management of profits and the sustainability of its payouts. A company with a stable or growing dividend over time is generally viewed as a less risky prospect, as it signifies good operational management and reliable income generation. Furthermore, the report advocates that investors keen on dividends should not only consider current yields but also engage in a comprehensive analysis of a REIT’s overall financials, growth potential, and market conditions.

In summary, ARMOUR Residential REIT’s recognition as a leading high-yield REIT underscores its attractive valuation and profitability ratios in the marketplace. The company’s health is reflected in its impressive dividend yield and strong monthly payment history, making it an enticing prospect for dividend-focused investors. Nevertheless, while the ensuring dividend payouts are important, potential investors must also weigh the associated risks of volatility in REIT investments. Ultimately, thorough due diligence, informed by a detailed scrutiny of ARMOUR’s financial history and outlook, can guide investors toward making sound investment choices within the competitive landscape of real estate investment trusts.