Star Bulk Carriers has recently gained recognition as one of the Top 10 dividend stocks in the latest Dividend Channel “DividendRank” report. The report highlights the strong performance of Star Bulk Carriers (SBLK), focusing on the company’s impressive valuation metrics and profitability levels. With a current share price of $17.32, Star Bulk boasts a price-to-book (P/B) ratio of 0.8 and an attractive annual dividend yield of 13.86%. In contrast, the average company within the same coverage universe yields only 4.1% and shows a higher P/B ratio of 2.8, illustrating Star Bulk’s relative strength in the market. This favorable comparison underscores the company’s robust financial health and commitment to returning value to its shareholders.

The DividendRank report emphasizes that dividend investors looking for value typically prioritize profitable firms with appealing valuations. The proprietary DividendRank formula used by Dividend Channel ranks companies based on various profitability and valuation metrics, thereby spotlighting those that are most worthy of further research. The criteria aim to assist investors in identifying potentially lucrative stock options. Star Bulk Carriers has emerged as a favorable candidate in this context, as it combines strong operational results with a competitive dividend yield that attracts both income-focused and value-oriented investors.

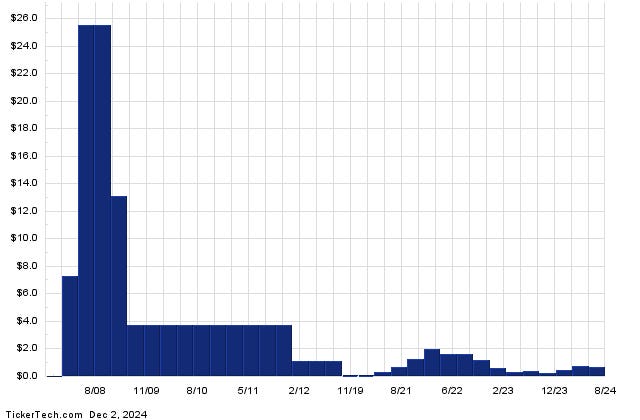

Star Bulk Carriers has established a consistent history of quarterly dividend payments, currently amounting to $2.4 per share annually, distributed in quarterly installments. The company’s latest dividend ex-date was on December 5, 2024. Understanding a firm’s long-term dividend history can play a crucial role in assessing the likelihood that dividend payments will continue in the future. The report encourages investors to analyze this historical data to make informed decisions, further establishing Star Bulk as a potentially reliable source of dividend income.

The consistent quarterly dividends and notable annual yield align with investor expectations in the shipping and logistics sector, where reliable returns can sometimes be challenging to find. Star Bulk’s ability to maintain such strong dividend payments, particularly during periods of market volatility, marks it as an appealing option for those looking to enhance their investment portfolios with dividend-generating assets. As a player in the dry bulk shipping industry, Star Bulk’s dividends are also a testament to its operational efficiency and effective management strategies.

Moreover, the DividendRank report indicates that Star Bulk Carriers is not only performing well in terms of current dividends but is also positioned for favorable long-term growth. The company’s strong performance in key financial metrics suggests a robust operational model that supports sustained profitability. Investors are advised to look beyond just current yields and consider the potential for future growth as part of their investment strategy, reinforcing Star Bulk’s position as a noteworthy investment opportunity.

As investors search for avenues to maximize returns, the insights provided by the DividendRank report can serve as a valuable resource. With its low P/B ratio, high dividend yield, and solid historical performance, Star Bulk Carriers exemplifies a firm that meets the criteria for dividend investors focusing on value. As such, it ranks highly among potential investments, encouraging further exploration into its financial health and growth prospects in the competitive landscape of the shipping industry. This favorable positioning, combined with the company’s ongoing commitment to delivering shareholder value, solidifies Star Bulk’s reputation as an attractive investment choice for dividend seekers.