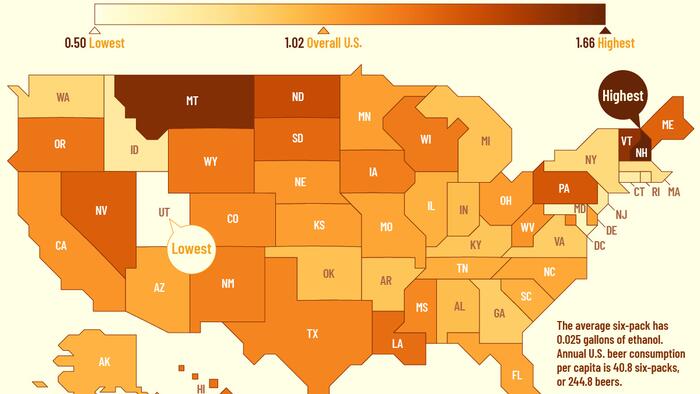

Beer is an integral part of American culture, significantly influencing social gatherings, sporting events, and everyday life. According to data from the World Health Organization (WHO), beer is the preferred alcoholic beverage across the Americas. A visual representation by Kayla Zhu of Visual Capitalist details the annual per capita ethanol consumption of beer in gallons by U.S. state for the year 2022. Data from the National Institute on Alcohol Abuse and Alcoholism (NIAAA) was used to compile consumption statistics, which reflect ethanol volume in alcohol sales. For context, a six-pack of beer contains approximately 0.025 gallons of ethanol. The figures presented only account for residents aged 14 and older and derive from a variety of credible sources, including the Alcohol Epidemiologic Data System (AEDS) and industry reports.

When examining beer consumption across the United States, certain states stand out with remarkably high per capita ethanol consumption rates. New Hampshire ranks first, with an impressive 1.66 gallons consumed annually per person. This figure is closely followed by Montana, Vermont, and North Dakota, each reading above 1.3 gallons. A pattern emerges that shows several Northeastern states leading in beer consumption, which may be influenced by various factors, including alcohol tax laws and availability. Notably, New Hampshire benefits from a lack of state sales tax, leading to lower alcohol prices that attract consumers, especially from neighboring states. This commercial dynamic is supported by the New Hampshire Liquor Commission’s findings that a significant portion of liquor sales derives from out-of-state patrons.

While many U.S. states experience notable beer consumption, a comparison reveals that European countries generally consume beer at much higher rates. This difference emphasizes cultural preferences and the role of beer in daily life outside of the U.S. Despite the apparent popularity of beer in the U.S., the overall beer industry faces challenges. According to recent figures from Beer Marketer’s Insights, U.S. beer shipments have dropped to their lowest levels in 25 years, indicating a concerning trend for major breweries. As a result, the craft brewing industry is also seeing a decline, which includes a 5% decrease in overall beer production and imports in 2023, with craft brewer sales down by 1%.

The data suggest a shift in American consumers’ preferences, potentially driven by changing social habits and an increasing emphasis on healthier living. These trends may lead younger generations to opt for different alcoholic beverages or abstain altogether, which contributes to the downward trajectory of beer consumption. Furthermore, the decline in demand for beer raises questions about the overall sustainability of breweries and craft beer establishments, which had previously experienced growth during the craft beer boom years.

Illustrating the complexity of beer consumption in America, the data highlights regional preferences as well as national trends. States such as New Hampshire and Vermont significantly outpace states like Maryland and Utah, the latter of which sees some of the lowest consumption rates, with Utah averaging just 0.50 gallons per capita. These variations in consumption may reflect differing cultural attitudes toward drinking, state regulations regarding alcohol sales, and even economic factors, such as the price of living. As the industry grapples with these challenges and shifting consumer preferences, it may need to innovate and adapt to ensure that it remains a staple of American social life.

To fully understand beer consumption dynamics, one can also consider the broader global context. The comparison of per capita beer consumption across countries illustrates that while the U.S. remains a significant player in the industry, there are opportunities to learn from international markets. Countries like the Czech Republic and Germany consistently rank among the highest for beer consumption and could serve as models for U.S. breweries looking to rejuvenate their brands. Moreover, the evolving landscape of alcohol consumption continues to challenge traditional norms, indicating that the future of beer consumption in America may require rethinking strategies to engage consumers meaningfully.