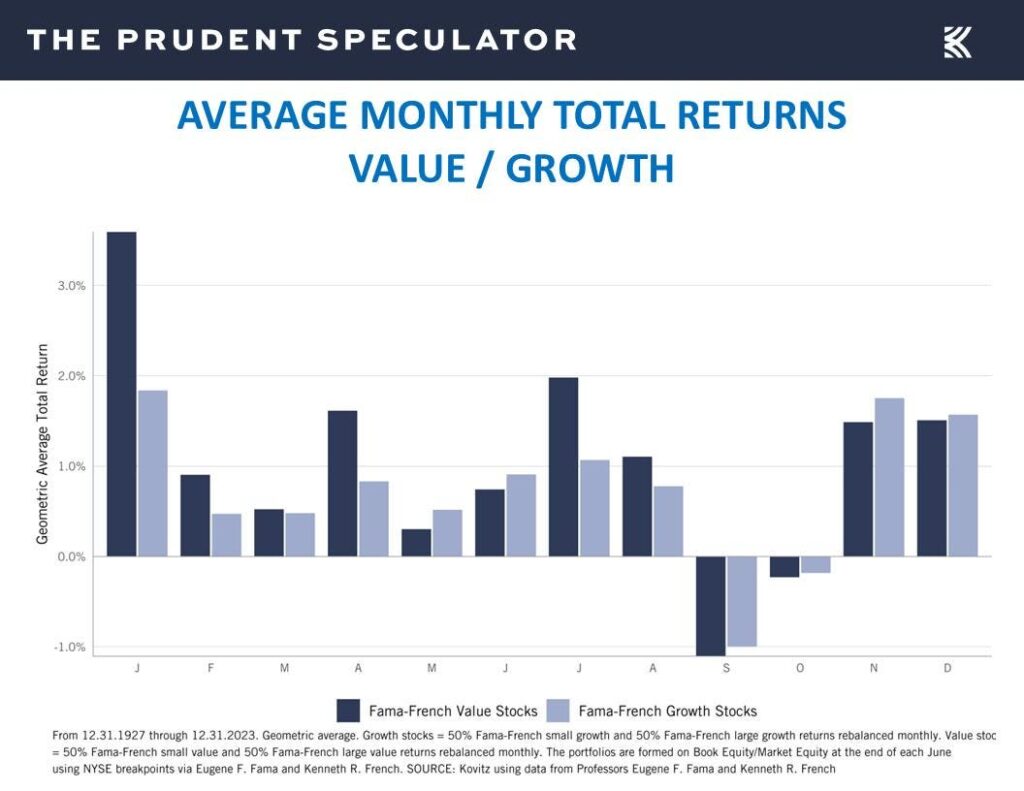

The months of November, December, and January are regarded as the "most wonderful time of the year," particularly in the context of financial markets. Historical data spanning 95 years consistently demonstrates that September and October are typically the weakest months for investments. However, despite their volatility, the last cycle concluded with a slight uptick, offering a sense of optimism as the calendar shifts into the holiday season. This transition marks the beginning of a period traditionally more favorable for investments, with positive trends observed from Halloween through the subsequent months leading into May Day. Notably, value stocks have historically outperformed during this timeframe, even amidst macroeconomic uncertainties such as geopolitical tensions and Federal Reserve adjustments.

In establishing a rationale for investing during this period, the seasonal performance has shown a tendency for positive returns, particularly for the Russell 3000 Value index, which experienced remarkable growth of 18.37% from November through April. While some investors advocate for the adage "Sell in May and Go Away," it’s important to recognize that the summer months, despite being less favorable, have still yielded satisfactory returns on average. The most recent season from April 30 to October 31 saw the Russell 3000 Value index increase by 10.16%. Furthermore, the current trend toward zero trading commissions underscores the advantages of long-term investing over short-term trading strategies, making it prudent to focus on sustainable growth in the current promising six-month period.

As we enter this opportune market phase, our investment newsletter portfolios have proactively identified two strategic positions. The first addition is MetLife (MET), one of the largest life insurance companies in the U.S., which derives substantial earnings from various sectors, including retirement and property and casualty insurance. Recent earnings reports showed a decline in share value due to third-quarter results that fell short of analyst predictions, primarily due to underperformance in the Group Benefits sector and international operations. Despite this dip, the company’s fundamentals remain strong, highlighted by an adjusted return on equity of 14.6% and a competitive stance in the group benefits market. With a price-to-earnings ratio of 8.3 and a yield of 2.8%, we believe there is significant upside potential for MET as the market reassesses its valuation.

The second addition to our portfolio is Regency Centers (REG), a reputable owner, operator, and developer of neighborhood shopping centers, boasting over 50 years in operation. Regency’s strategic focus on grocery-anchored properties in affluent areas contributes to its resilience and growth potential. The company recently reported a solid third-quarter performance, exceeding revenue estimates, with funds from operations (FFO) demonstrating a healthy increase. Notably, occupancy rates remain strong, with particular growth in both anchor store and small shop segments. The management further raised its FFO projections for the year, reflecting confidence in ongoing operations. With conservative financing practices and promising future growth projections—expected FFO growth to $4.83 by 2027 alongside a 3.8% dividend yield—REG presents a compelling prospect within our investment strategy.

While tumultuous months may initially raise concerns about market performance, our findings highlight a clear trend: the period from November to January is typically associated with significant market gains. Investors are urged to remain strategic and focused on long-term objectives, especially given the historical reliability of value stocks during this advantageous six-month stretch. By adding firms like MetLife and Regency Centers to our portfolio, we aim to capitalize on their market positions and growth prospects, leveraging the positive seasonal sentiment prevailing in the investment landscape. The current environment provides an excellent backdrop for potential gains, as value stocks tend to flourish during this timeframe.

Overall, the anticipated market conditions present a robust case for investing through the end of the year, particularly as November leads into the December holiday and January new year. The performance of stocks during this period historically aligns with positive investor sentiment and consumer behavior typical of the season. As demonstrated by the analysis presented, even amidst global uncertainties, the average returns during these months offer reassurance to long-term investors. Focusing on quality, value-oriented investments and ignoring short-term distractions can lead to fruitful opportunities for growth as we move into this promising season in financial markets. For more detailed insights and analyses, readers are encouraged to engage further with The Prudent Speculator, ensuring they are well-prepared to navigate the investment landscape ahead.