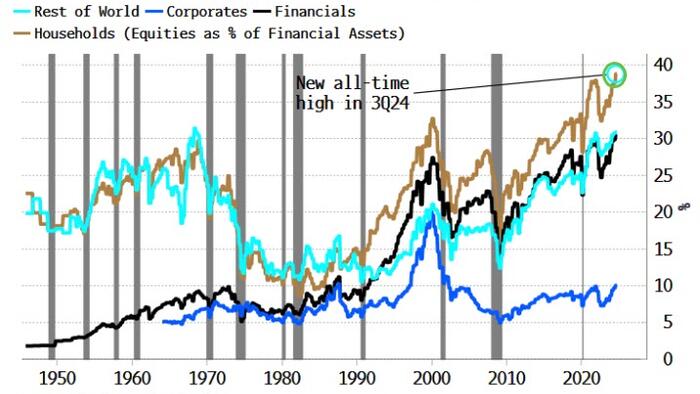

The recent third-quarter release of the Federal Flow of Funds data, authored by Simon White, a macro strategist at Bloomberg, reveals that U.S. households have reached a historical peak in their long positions in equities. With data dating back to the 1940s, this unprecedented level of equity investment highlights a growing enthusiasm for U.S. stock markets. Such an intense focus on equities is often a precursor to market corrections, suggesting that while current sentiment may be bullish, the long-term outlook could be less favorable.

The rise in equity exposure among households could indicate a shift in investment strategies, driven by an overall sense of optimism regarding the economy and corporate performance. However, this overwhelming investment in equities might also signal an overextension in market valuations, which tends to occur at the latter stages of bull markets. Investors must consider the implications of this enthusiasm, as it raises the potential for subpar returns over the long haul once the market adjusts to a more sustainable equilibrium.

Additionally, household net worth tied to equities has likely seen substantial increases, which can intensify the feeling of wealth and encourage more risk-taking behavior among investors. This phenomenon, known as the wealth effect, can lead not only to greater participation in stock markets but also to a lack of diversification as households pour increased capital into equities while neglecting other asset classes. As households grow more confident in their equity investments, they may inadvertently expose themselves to significant downside risks.

Historically, periods of high household equity ownership have often coincided with market peaks or bubbles. Market fundamentals might grow increasingly distorted as investor behavior shifts toward speculative trading rather than value-based investing. The current data suggests that the intensity of equity ownership is at an all-time high, suggesting that seasoned investors should navigate this environment with caution, scrutinizing the fundamentals of individual stocks and the marketplace as a whole.

Moreover, the long-term consequences of such significant equity holdings could entail a more volatile market landscape. Should households begin to reassess their investment strategies or experience heightened economic uncertainty, a rapid unwinding of positions could occur, leading to sharp market corrections. This potential shift emphasizes the necessity for investors to remain vigilant and grounded in their investment strategies and consider how changes in economic conditions may affect equity markets.

In conclusion, while the enthusiasm for U.S. equities is currently at an all-time high among households, historical data suggests that this could foreshadow challenging long-term returns and increased market volatility. Investors must remain aware of these dynamics, as well as the risks associated with concentrated equity exposure, and stay disciplined in their investment approach to mitigate potential pitfalls in their portfolios.