Alibaba’s stock has shown impressive growth over the past six months, increasing by 49% as a result of several key factors, primarily China’s recent economic stimulus efforts. These efforts, which include interest rate cuts and fiscal measures aimed at revitalizing the economy, have helped rejuvenate the broader market, allowing Alibaba to gain momentum after a relatively sluggish performance from 2020 to early 2023. As the company continues to recover towards its pre-pandemic highs, analysts believe there remains significant upside potential for Alibaba stock due to these positive tailwinds.

In the recent past, China’s monetary policy changes, characterized by unexpected interest rate reductions and a supportive economic stance, have contributed to a remarkable upswing in the stock markets. The Governor of the People’s Bank of China announced measures aimed at stabilizing the economy, which have fueled bullish sentiment among investors and analysts alike. The SPDR S&P China ETF is noted for outperforming the S&P 500 for the first time since 2008, highlighting a renewed optimism towards Chinese equities. After years of regulatory scrutiny, a collective sigh of relief from investors has initiated a rally for Alibaba and its tech counterparts, backed by reforms aimed at reviving the struggling property market and improving economic conditions.

Alibaba’s competitive edge is bolstered by its advancements in artificial intelligence (AI) and cloud services, with its Qwen AI model positioning the company favorably within the global tech scene. The partnerships with industry leaders like Nvidia and Mastercard showcase Alibaba’s prowess in AI application, particularly in fields such as autonomous driving. By integrating its AI initiatives with its popular platforms such as Taobao and DingTalk, which collectively host over 600 million active users, Alibaba is not only enhancing its operational capabilities but is also strategically setting itself up for long-term growth.

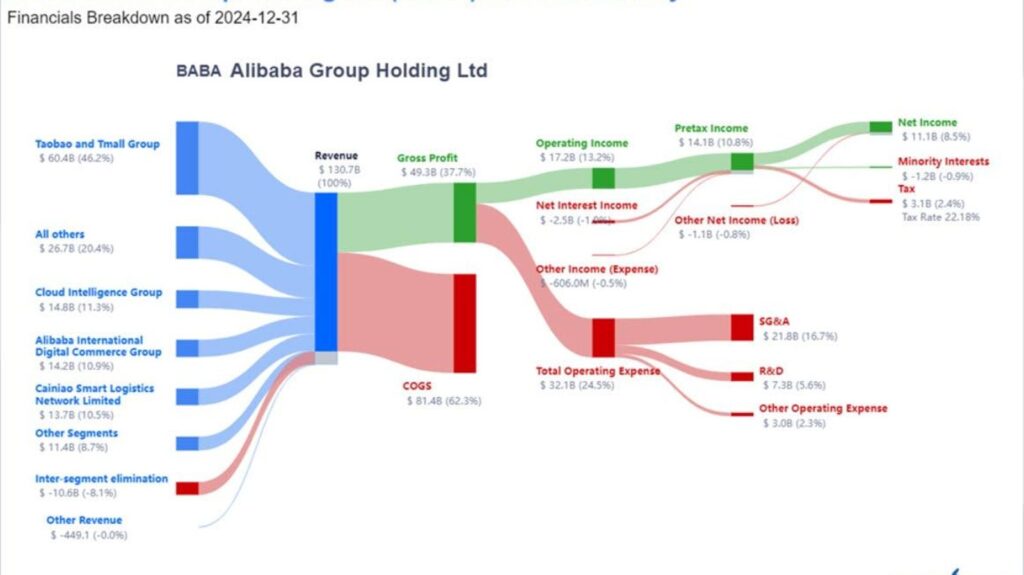

Despite facing headwinds in revenue growth due to market conditions, Alibaba has continued to demonstrate solid profitability metrics, with impressive gross and operating margins that underscore its financial health. The company’s gross margin is at an impressive 37.9%, indicating strong profit retention relative to sales, while its operating margin holds at 12.12%. Additionally, Alibaba’s cloud segment has evolved into a critical growth engine, contributing to a rebound in overall profitability even amidst a challenging retail environment. The impressive growth trajectory of Alibaba Cloud, particularly in AI-driven products, promises continued revenue generation for the company, as indicated by its reported 6% year-on-year growth in Q2 2024.

Looking forward, Alibaba’s stock retains considerable growth potential, as recent performance has shown substantial gains over multiple timeframes. Analysts have set a consensus price target of approximately $108.40, with projections varying significantly between a high estimate of $146 and a low of $79.70. A discounted cash flow (DCF) analysis further suggests that Alibaba stock could reflect a fair value of $146.07, presenting a sizable margin of safety for investors and indicating that the current stock price does not fully account for the future cash flow potential of the company.

In conclusion, the outlook for Alibaba appears increasingly positive despite its recent stock surge. The recovery in Chinese equities driven largely by economic stimulus, in conjunction with Alibaba’s advancements in AI and cloud infrastructure, positions the company for ongoing success. Key financial metrics indicate solid operational health, while growth projections suggest substantial upside remains in the stock. The DCF analysis reinforces the notion that Alibaba’s stock is an attractive value investment, with the possibility of significant capital appreciation in the near future.