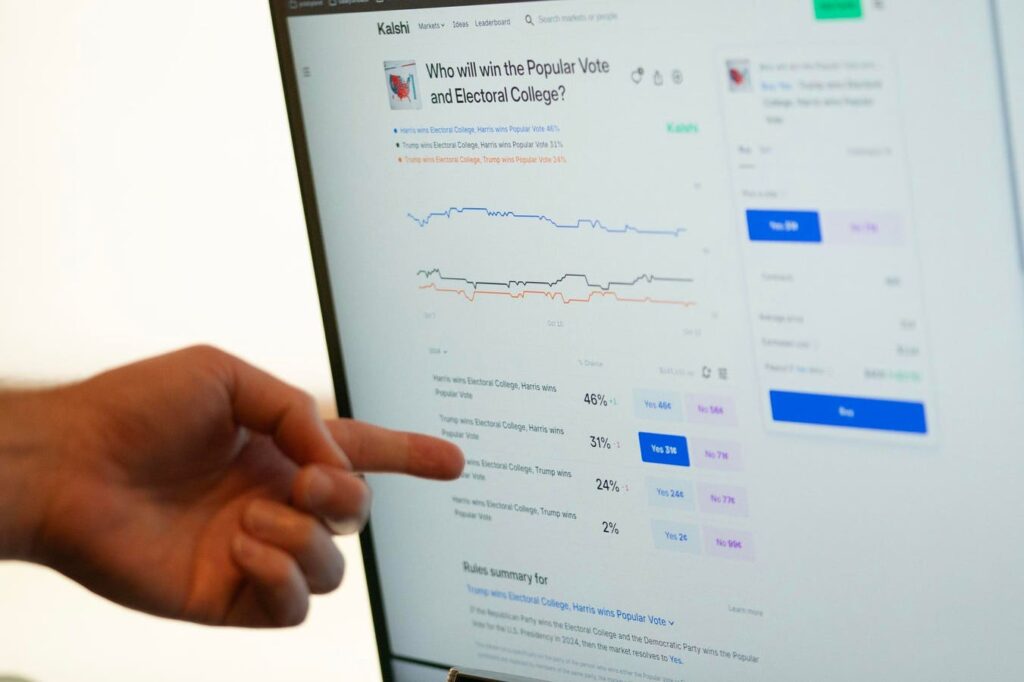

In the wake of the 2024 presidential election, much has been discussed regarding President Trump’s unprecedented resumption of office. However, another equally compelling narrative has emerged surrounding the inconsistent performance of prediction markets, particularly in forecasting the electoral duel between Trump and Kamala Harris. These prediction markets, such as Kalshi, enable participants to financially back various future events, including electoral outcomes, under the premise that collective betting leads to more accurate forecasting than traditional polls or expert analysis. Ideally, the market prices should reflect the probability of certain outcomes, serving as a valuable tool for discerning election dynamics. Yet, this election cycle revealed significant shortcomings in these betting platforms, raising questions about their reliability and efficacy.

The regulatory landscape for prediction markets in the U.S. underwent a notable transformation when the Commodity Futures Trading Commission (CFTC) permitted Kalshi to host political betting markets. Following a legal ruling, Americans gained the ability to engage in election outcome betting through this legitimate platform, alongside established offshore competitors like Polymarket and PredictIt. While these platforms aimed to clarify electoral predictions, they quickly became the source of considerable confusion. Diverging probabilities for the same electoral outcomes were common across betting markets; for instance, Kalshi might favor Kamala Harris while Polymarket leaned toward Trump. This divergence, contrary to the expectations of efficient markets, should not occur in well-functioning prediction environments, where any discrepancy would typically invite arbitrage — the practice of exploiting price differences across markets for guaranteed profits.

Despite minor variations potentially explained by transaction costs, the persistent and large discrepancies between markets suggested deeper underlying issues. A notable instance involved a trader known as “Freddi9999,” who reportedly made substantial bets on Polymarket favoring Trump, leading to significant shifts in that marketplace’s odds. This situation hinted at potential manipulation, as supporters of Harris seemed to respond by elevating her probabilities on Kalshi, ultimately transforming these predictive platforms into tools for partisan advocacy. This echoes the critique by economist Robert Lucas about the paradox of target metrics losing their reliability once they become policy objectives; when prediction markets are utilized as indicators of public sentiment, they become susceptible to distortive influences.

As the electoral contest neared its conclusion, disparities among prediction markets persisted, with platforms like PredictIt and Polymarket maintaining conflicting probabilities even days before Election Day. While some defenders claimed that betting markets swiftly projected Trump’s victory on election night ahead of major networks, this observation lacks significance. Other media forecasting tools, like the New York Times election needle, also promptly detected Trump’s advantage. In essence, these markets were likely responding to the same available data that informed media analyses, lacking unique predictive capabilities. This underlines a critical flaw: prediction markets are sometimes only as good as the data on which they are based and the intent behind the bets placed.

Despite the demonstrated limitations of prediction markets in the 2024 election, it is essential to acknowledge that they can still offer valuable insights when structured correctly and when participants manage their trades based on authentic information. The election cycle, however, underscored how high-stakes political environments present fertile ground for efforts to manipulate outcomes, undermining the integrity of these markets. The key takeaway from this electoral episode is that prediction markets should not be viewed as standalone indicators; their imperfections necessitate their interpretation as one of many forecasting tools. Therefore, maintaining a healthy skepticism towards their predictive power is vital.

As the political landscape continues to evolve and future elections loom on the horizon, it is crucial to bear in mind that no single forecasting mechanism is infallible. Although betting markets can provide intriguing perspectives at times, their role in society—particularly regarding policymaking—remains limited. The experience from the 2024 election emphasizes that the greatest contribution prediction markets may offer is highlighting the inherent limitations in our forecasting methods. As we endeavor to understand and predict electoral outcomes more robustly, integrating diverse tools and perspectives will yield more reliable insights while reinforcing the need for cautious interpretation of any singular method’s indications.