Sysco Corporation has gained recognition as a Top Socially Responsible Dividend Stock by Dividend Channel, reflecting its strong performance in terms of “DividendRank” statistics. This accolade highlights Sysco’s competitive 2.7% dividend yield, positioning it as an attractive option for investors seeking income through dividends. The designation as a socially responsible investment underscores the company’s commitment to environmental and social governance (ESG) criteria, which are increasingly important to contemporary investors. These criteria assess the company’s practices and their broader impact, considering both environmental sustainability and social responsibility in corporate governance.

The environmental criteria that Sysco meets involve an analysis of the ecological impacts arising from its products and services. This includes evaluating energy consumption, resource utilization, and waste management modalities. Equally important, the social criteria consider aspects such as human rights protections, the absence of exploitative child labor practices, and a commitment to corporate diversity. Investors are particularly invested in understanding how a company’s ventures relate to sensitive industries such as weapons, gambling, tobacco, and alcohol, which may present reputational risks. In adhering to these criteria, Sysco not only solidifies its market standing but also attracts socially conscious investors.

In the broader context of investment opportunities, Sysco is included in the iShares USA ESG Select ETF (SUSA), according to data from the ETF Finder at ETF Channel. This inclusion illustrates Sysco’s ongoing commitment to sustainable practices and responsible investment strategies. The firm constitutes approximately 0.13% of the underlying holdings in this fund, which represents a substantial $6,618,557 worth of Sysco shares within the ETF portfolio. By being part of such a fund, Sysco aligns itself with other socially responsible firms, enhancing its visibility and credibility in the market.

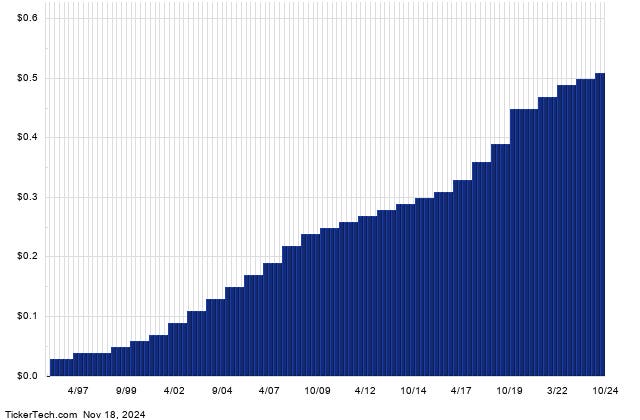

Sysco boasts an annualized dividend payout of $2.04 per share, distributed quarterly to its investors. The latest ex-dividend date was on January 3, 2025, indicating the company’s continued practice of maintaining regular dividend disbursements. Investors often look to a company’s historical dividend chart when assessing its reliability as a dividend stock; long-term consistency can signify stability and a strong operating foundation. Such scrutiny provides potential investors with insights into whether the company is likely to maintain its dividends in the future.

Furthermore, Sysco operates primarily within the Grocery & Drug Stores sector, where it competes alongside notable companies such as US Foods Holding and Casey’s General Stores. This sector is critical, particularly as consumer behavior increasingly favors companies with sustainable and ethical practices. Sysco’s emphasis on both responsible investment and solid dividend returns positions it well within this competitive landscape, allowing it to stand out among peers by promoting its dedication to ESG principles.

In summary, Sysco’s recognition as a Top Socially Responsible Dividend Stock and its inclusion in the iShares USA ESG Select ETF reinforce its reputation as a strong player in the socially responsible investment space. The firm’s robust dividend yield, coupled with its commitment to environmental and social governance, makes it an attractive choice for investors. As the focus on sustainability continues to grow, Sysco’s proactive measures in adhering to responsible practices ensure that it remains relevant and appealing to both income-focused and socially conscious investors in the marketplace.