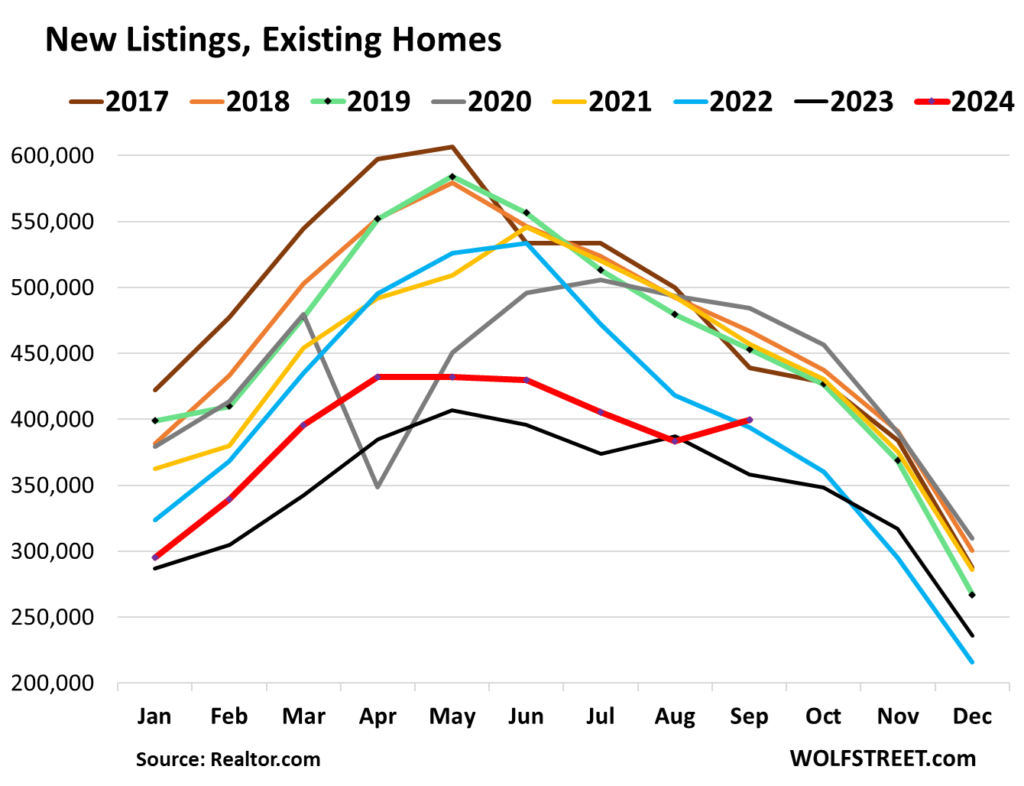

In September 2024, the real estate market across several major metropolitan areas in the U.S. witnessed an unprecedented spike in new listings despite expectations for a drop during the month. This surprising trend was particularly evident in San Diego, where active listings surged by 77% year-over-year. Such a significant increase in listings is noteworthy, especially considering that, historically, new listings have typically declined during this period. The Seattle area recorded the highest year-over-year increase in new listings at 42%, followed closely by regions in Silicon Valley and Washington D.C. Additionally, 26 out of the top 50 metropolitan statistical areas (MSAs) experienced double-digit growth in new listings, contrasting sharply with the current lackluster demand for homes.

As inventory levels surged, total active listings rose by 34% compared to the previous year, reaching nearly one million listings—the highest number observed since April 2020. Sellers appeared to be responding to stagnant sales, with many choosing to list homes that had been vacant for some time. This trend suggests that former homeowners are now taking advantage of a market that previously restricted potential inventory—pushing these homes onto the market to capitalize on rising prices. For those not actively living in the homes, this represents a significant shift as they had previously chosen to wait out the price spikes instead of selling; now they are compelled to sell given the inflation in home values is slowing or reversing.

Key metros that recorded the most dramatic increases in active listings include San Diego (77%), Tampa, Orlando, and Seattle, each experiencing over 60% growth. Concurrent with this increase in inventory, the demand for homes has decreased considerably, as many buyers are now resistant to high prices. The combination of an increased number of active listings and declining buyer demand indicates a potential over-saturation in the market. Many buyers accepted the high costs as unsustainable, causing them to pivot towards new homes, with builders providing better incentives, thereby altering the landscape of home sales. This transition comes at a time when mortgage applications for purchasing homes remain historically low.

The current climate around mortgage rates is also impacting buyer sentiment. Following a period of low rates earlier in the year, mortgage rates surprisingly rose when the Federal Reserve implemented a policy rate cut in September 2024. This rise has added to buyers’ hesitance, as many found themselves facing mortgage rates hovering around 6.26%. Consequently, the median listing price in September fell for the third consecutive month after peaking in June. Year-on-year, the median has dipped by 1.1%, reflecting previous expectations by sellers and the inflated housing prices witnessed during the pandemic years. Many homeowners who were looking to realize profits from their current equity appear to be reevaluating their strategies amidst these changes.

As supply starts to climb and sellers become more motivated to sell, the dynamics are likely to shift in favor of buyers. With several metropolitan areas experiencing sudden drops in median listing prices, including Miami and San Francisco—down 12% and 9%, respectively—buyers may find an opportunity to negotiate better deals. The price reductions are clear indicators of a market responding to increased inventory and subdued demand. Sellers, seeing the need to close deals, are likely to reconsider their asking prices in an effort to attract buyers, especially given that the current average days on the market increased to 55 days—the longest duration in four years.

The heightened activity in price reductions suggests a market adjusting to the new normal. A significant portion, around 34.5% of active listings, experienced price cuts—marking one of the highest recorded rates within recent years. This adjustment is critical, as buyers remain indifferent, continuing to weigh their options favorably against construction opportunities offered by homebuilders that are lowering prices and providing incentives. Ultimately, the market appears to be at a crossroads, where increasing inventory and softened expectations could redefine buying conditions in the near future, potentially benefiting buyers who have exercised patience and strategic foresight in navigating this complex housing market landscape.