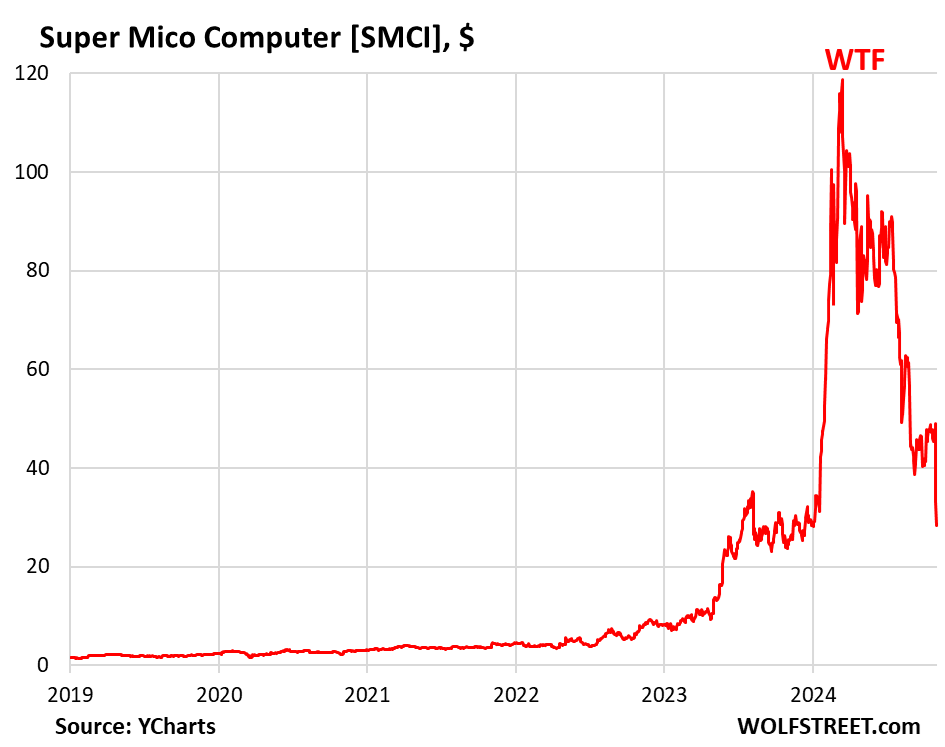

In recent weeks, the stock of Super Micro Computer, a significant player in the artificial intelligence (AI) hardware market, has experienced a dramatic decline. After witnessing explosive growth, with shares skyrocketing 1,500% since January 2023 and peaking at an all-time high of $118.81 in March 2024, the company’s stock plummeted by 42.5% over two days, leaving investors reeling. This fall is indicative of a broader trend of market volatility tied to AI-mania, as many companies that had previously enjoyed meteoric rises are starting to falter. Super Micro’s precipitous drop not only shines a light on the inherent risks woven into the AI stock frenzy but also underscores the critical importance of due diligence in the often speculative world of tech investments.

The downfall of Super Micro began in earnest following the resignation of its auditing firm, Ernst & Young (EY), which was announced on October 24. This abrupt resignation was triggered by concerns that led the auditing firm to question the reliability of management’s representations and assert that they could no longer associate themselves with the financial statements produced by the company. This resignation came in the wake of allegations from the short-seller Hindenburg Research, which highlighted potential accounting malfeasance and manipulative practices within the organization. The implications of EY’s departure, especially considering the serious allegations from Hindenburg, raised red flags for investors and signaled deeper issues within Super Micro.

Market sentiment quickly soured following these revelations. The company’s ongoing struggle to finalize its audit, initially begun in March 2023, along with the absence of the expected annual report due in August, further compounded investor anxiety. As Super Micro disclosed that additional time was needed to assess its internal financial controls, the stock faced further declines. The turbulence began in April, when the company failed to report preliminary results, indicating potential disarray within its management and financial reporting. This pattern of missed deadlines and financial ambiguities has led to increasing skepticism about the company’s financial health.

The fallout continued as the Department of Justice reportedly opened an investigation into Super Micro, further shaking investor confidence. The implications of accounting irregularities can be significant, as they undermine the integrity of reported revenue and profit figures, casting doubt on the company’s previously stellar market performance. It is this uncertainty that has not only caused investors to flee but has marked Super Micro as the first significant casualty of the AI-mania bubble—a stark reminder of how quickly fortunes can shift within the tech landscape. As scrutiny intensifies, the corporate and financial future of Super Micro appears increasingly precarious.

Amidst this chaos, it becomes evident that the frenetic rise during AI-mania may have clouded judgment for many investors and analysts alike. The euphoric stock price increases, propelled by hype and speculation, often overshadowed fundamental analysis and risk assessment practices that should guide prudent investment decisions. This nostalgic reflection emphasizes the importance of critical evaluations of companies and vigilance against the allure of soaring stock prices fueled by speculative euphoria, particularly in volatile sectors such as technology and AI. Super Micro’s journey serves as a cautionary tale about the fragility of speculative investments.

In summary, Super Micro Computer’s swift ascent and subsequent collapse encapsulate the tumultuous nature of the AI stock surge. With significant losses now marked alongside the failure to meet auditing standards and regulatory scrutiny, the company stands at a critical crossroads. Investors drawn to the rising stars of technology are reminded of the necessity of careful analysis and due diligence, particularly when confronting the hype that often surrounds transformative innovations like AI. The story of Super Micro is not just about one company’s fate; it symbolizes the inherent risks of investing in fast-paced, speculative markets, where rapid gains can quickly lead to startling declines.