Goldman Sachs has released a new report titled “2025 Outlook: The Year of the Alpha Bet,” presented by Peter Oppenheimer, the firm’s Chief Global Strategist. This outlook comes in the context of the bank’s ongoing assessments of market trends and macroeconomic factors, highlighting the evolving landscape for investors. Oppenheimer forecasts that 2025 will mark a divergence in market performance, favoring stock pickers over broad market strategies. This shift is primarily due to expectations that the current levels of valuation expansion observed in global equities may not persist into the coming year.

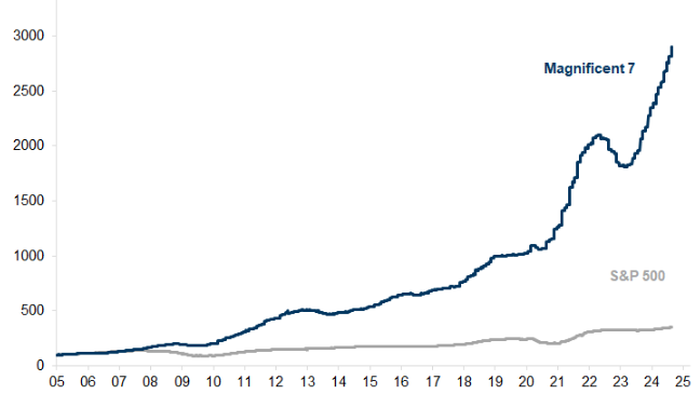

In analyzing the recent performance, it is notable that global equities have surged by 65% since October 2022. The Nasdaq index has experienced an impressive increase of over 80%, driven largely by high-profile technology stocks, with Nvidia’s remarkable climb of more than 1,100% capturing attention. These substantial gains highlight a significant recovery in the market that followed a bearish sentiment from prominent analysts, such as Marko Kolanovic, who publicly shifted to a bearish stance just as the market was bottoming out in late 2022.

Looking ahead, Oppenheimer suggests that relying solely on market-wide trends will yield diminishing returns as the market transitions into what he describes as a stock-pickers’ environment. Investors will need to focus on selecting specific stocks that can outperform the market rather than benefiting from broad market rallies. This necessitates a more rigorous analysis of individual companies and sectors, as the overall buoyancy in stock prices may not be sustained across the board. Oppenheimer’s insights call for a reevaluation of strategies that have worked well in a bull market over the past year.

As the macroeconomic landscape evolves, factors such as inflation, interest rates, and geopolitical risks will play crucial roles in determining market dynamics. Oppenheimer addresses these variables and their potential impact on equity valuations moving forward. He emphasizes the importance of adapting investment strategies to not only identify growth opportunities but also manage risks associated with changing economic conditions. This adaptability will be essential for capitalizing on stock-specific potentials in a more challenging market environment.

Furthermore, Oppenheimer also draws attention to the technological advancements driving the current market trends, particularly in sectors such as artificial intelligence and renewable energy. These areas are expected to present significant investment opportunities as companies continue to innovate and adapt to emerging consumer demands. There is a growing recognition among investors that sector-specific growth narratives will be crucial in the coming year, thereby reinforcing the need for diligent research and analysis.

In conclusion, Goldman’s 2025 outlook presents a nuanced perspective on future market conditions, emphasizing the transition from broad market reliance to a focus on individual stock performance. This shift reflects the complexities of the current economic climate, where specific sectors and companies will likely outperform others. As investors gear up for the challenges and opportunities that lie ahead, the message is clear: success in 2025 will hinge on informed stock selection and a deeper understanding of market trends and economic forces.