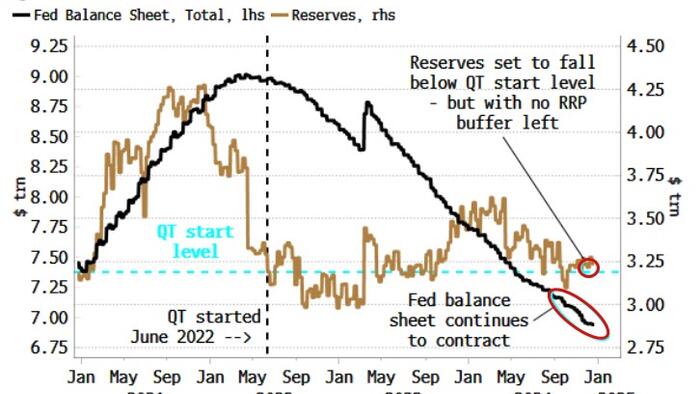

In the current economic landscape, the Federal Reserve’s balance-sheet management faces significant challenges as reserves approach levels seen at the onset of its balance-sheet reduction policy in June 2022. This development occurs amid renewed fears of a government shutdown, compounding the multitude of risks that pose threats to the stock market. The interplay of these dynamics raises pressing questions about market stability and the Fed’s ability to navigate its dual mandate of controlling inflation and supporting economic growth.

Historically, the Fed has demonstrated a remarkable capacity to manage seemingly contradictory policies simultaneously, akin to the Red Queen’s race in “Alice in Wonderland.” By reducing the size of its balance sheet while maintaining overall reserve levels, the Fed aimed to promote market liquidity during a period of financial tightening. However, as reserves decline and the specter of a government shutdown looms, the efficacy of this strategy comes under scrutiny. Investors are increasingly wary of how these developments may impact long-term economic prospects and financial stability.

The prospect of dwindling reserves raises concerns about market liquidity, which is crucial for the smooth functioning of financial markets. A reduction in liquidity could lead to increased volatility and pressure on asset prices, affecting both institutional and retail investors. Additionally, these changes may necessitate a reevaluation of risk management strategies across various sectors and could catalyze a shift in how investors allocate their capital in response to a less predictable market environment.

Moreover, the interplay of fiscal policy uncertainties, such as potential government shutdowns, adds an extra layer of complexity to the situation. A shutdown could stymie economic growth, heighten anxiety among consumers and businesses, and complicate the Fed’s decision-making process regarding interest rates and liquidity measures. The combination of a reducing balance sheet and fiscal policy disarray could potentially derail the recovery that the central bank has worked diligently to foster over the past few years.

In light of these factors, market participants must grapple with the implications for monetary policy and overall economic health. The Fed’s ongoing adjustments to its balance sheet will likely remain a focal point for analysts and investors alike as they seek to understand the potential ripple effects across various asset classes. Should reserves continue on their downward trajectory, the Fed may be forced to reconsider its approach to monetary policy, implementing measures to ensure adequate liquidity levels in the financial system.

Ultimately, the current predicament underscores the delicate balancing act the Federal Reserve must navigate as it responds to evolving economic conditions while striving to maintain market confidence. With reserves nearing critical thresholds and external risks resurfacing, the Fed’s ability to adapt to these emerging challenges will be pivotal in shaping the outlook for both the stock market and broader economic recovery. Investors will be closely monitoring these developments, as they will likely influence market sentiment and investment strategies in the months ahead.