The global economy is approaching the end of the year with some unexpected positive dynamics thanks to easing inflation, which may signal an unlikely soft landing for many economies. Despite this optimistic economic outlook, several political challenges lie ahead, particularly the contentious U.S. presidential election that suggests significantly different economic futures. Concurrently, high levels of government debt, ongoing conflicts in the Middle East and Ukraine, along with rising tensions in the Taiwan Strait, present a precarious scenario. The annual meeting of finance ministers and central bank leaders in Washington, held under the auspices of the International Monetary Fund and World Bank, is occurring against this complex backdrop, raising concerns among policymakers regarding the sustainability of recent economic gains amidst geopolitical uncertainty.

The latest assessments show that unemployment rates in advanced economies have remained stable, consistent with levels recorded in 2022, the same year central banks initiated aggressive rate hikes in response to inflation. Forecasts from Bloomberg Economics indicate that global GDP growth for the year will be around 3%, slightly lower than the previous year’s 3.3%, but markedly better than dire predictions made earlier this year. American consumers appear resilient, continuing to spend, while companies maintain their hiring momentum. In Europe, although demand is tapering, some growth is still expected to persist. In China, policymakers are consistently implementing stimulus measures aimed at stabilizing the struggling property sector, which should help reach the nation’s annual growth goal of approximately 5%.

As the economic landscape shows signs of resilience, it also faces significant testing, particularly with the political landscape in the United States. Vice President Kamala Harris represents continuity in President Biden’s economic policies, while former President Donald Trump, her electoral opponent, has laid out aggressive tariff proposals that could radically alter global trade dynamics. Trump’s plan threatens to impose tariffs of at least 10% on all imported goods and potentially upwards of 60% on goods from China, which could incite severe disruptions in international business, according to experts. Trump believes that these tariffs would incentivize companies to relocate their manufacturing to the U.S. to avoid such charges. However, this perspective starkly contrasts with broader economic projections that indicate potential negative repercussions for the U.S. economy if retaliatory measures are taken by China.

Economic studies suggest that if tariffs proposed by Trump were enacted, the U.S. could see a GDP contraction of 0.8% by the 2028 elections, a less severe impact on China, and even smaller effects on the European Union and Japan. Should Chinese goods bypass the U.S. tariffs and enter Europe, the latter could face additional strain, compounding existing issues of sluggish demand and stagnant investment levels since the pandemic. The European Central Bank (ECB) has cut rates for the third time since June and is optimistic that inflation can return to its target quicker than anticipated, although ECB President Christine Lagarde cautions that new trade conflicts could undermine a potential soft landing for the regional economy.

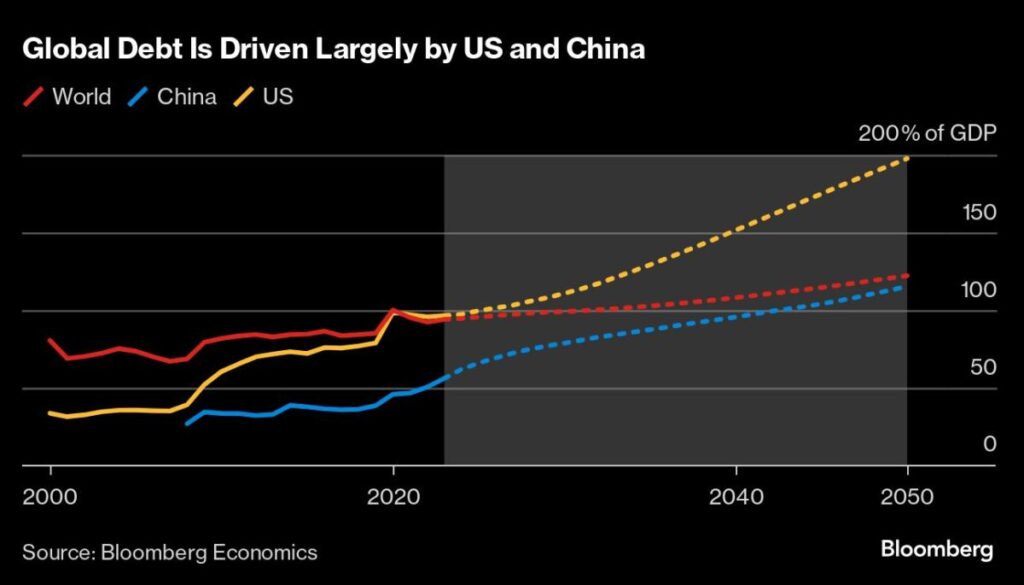

The potential emergence of a trade war is overshadowed by ongoing military conflicts, notably in Ukraine and the Middle East, where any escalation could have global ramifications. For instance, analysts anticipate that a surge in oil prices to $100 per barrel, coupled with heightened financial market caution, could reduce global growth by half a percentage point over the coming year while also raising inflation rates. Furthermore, the increasing global public debt is a critical concern. The IMF has reported that public debt is on course to reach $100 trillion, equating to 93% of the global GDP by year-end, which could limit governmental fiscal responses during inevitable slowdowns.

As global policymakers congregate in Washington, they are grappling with the realities of constricted fiscal capacity and rising geopolitical tensions. Experts are voicing that achieving a soft landing in such a tumultuous global environment may be increasingly implausible. The combined effects of war, heavy debt burdens, and political uncertainty create a volatile economic landscape, with concerns about insufficient fiscal space to manage future shocks and the possibility of making suboptimal decisions regarding economic interventions. Overall, the confluence of these challenges and the uncertain economic trajectory paint a complex picture as nations strive to navigate their way through potential upheaval in the coming months and years.