The U.S. housing market is experiencing significant shifts, marked by an increase in active listings across major metropolitan areas and a decline in home prices in many regions. As of mid-September, sellers have been faced with an unexpected situation where inventory levels are rising while buyer demand remains subdued. Despite a reduction in mortgage rates over recent months, potential buyers are not responding positively due to persistently high home prices. In fact, recent data indicate that in September, the prices of single-family homes, condos, and co-ops dropped in 26 of the 28 large metropolitan statistical areas (MSAs), showcasing a general trend of price deflation in the market.

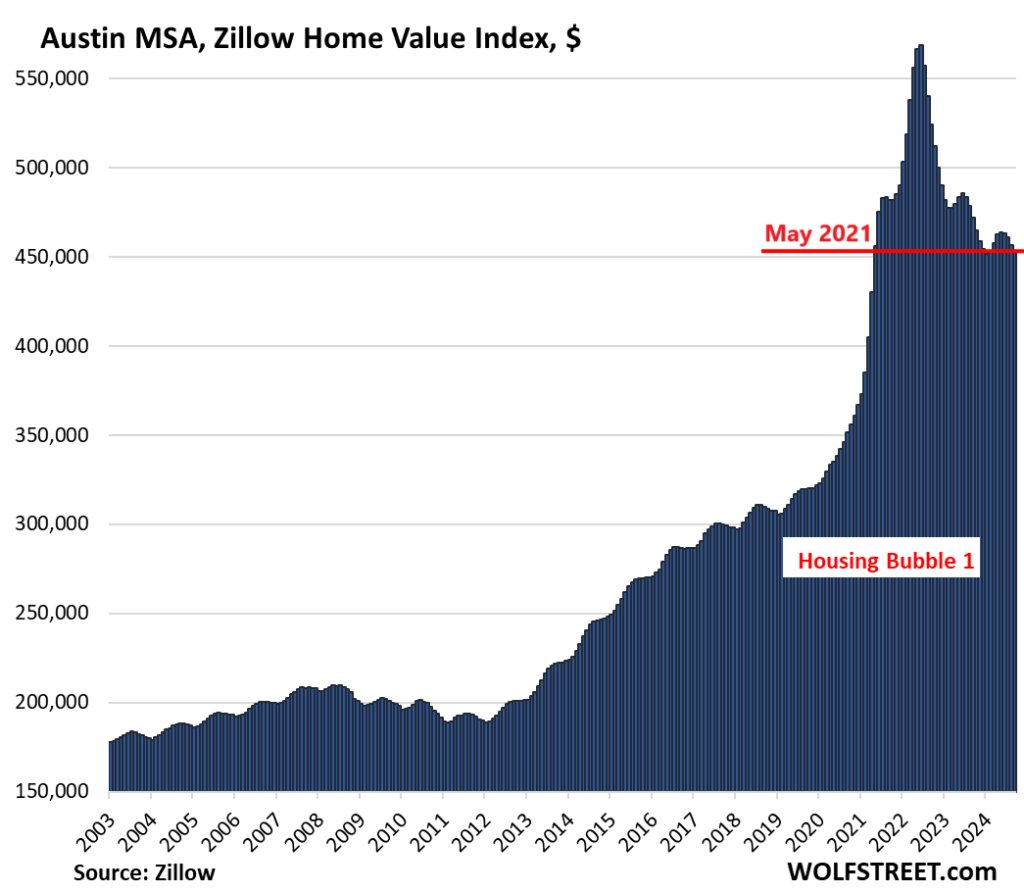

Among the markets analyzed, notable month-to-month price declines were recorded in cities like San Francisco (-1.1%), San Jose (-0.9%), and Austin (-0.8%). While the majority of these metro areas are seeing price declines, New York City stands out as an exception, reaching a new price high and satisfying the demand with stable pricing in Baltimore. The ongoing trend points to a broader sliding of home values from their 2022 peaks, with 19 of the 28 MSAs reporting declines. For instance, Austin alone has seen a staggering 20.4% decrease, indicating the drastic shifts occurring in once-hot housing markets.

Breaking down the prices reveals the extent of the downtrend—San Francisco and San Jose’s home prices have seen declines of 9.4% and 8.0%, respectively, while Denver and Salt Lake City also exhibit significant decreases. This downward pressure has emerged in response to shifts in the economic landscape influenced by Federal Reserve policies, compared to years of interest rate repression. The analysis of home prices reveals a stark contrast from previous surges driven by monetary policies, indicating a fundamental restructuring in the dynamics of buying and selling homes.

The methodology for assessing these home prices utilizes the Zillow Home Value Index (ZHVI), which incorporates a broader dataset, including public records and sales-pair data to provide a more comprehensive view of home values. This proactive approach in using raw data is crucial to understanding the current state of the housing market, particularly for large MSAs with property values over $300,000. However, the persistence of elevated prices amidst increasing inventory remains a point of contention in these markets, particularly in areas where demand has waned.

Despite some growth in specific markets, like New York City, the overall sentiment among buyers appears to be cautious, as they remain hesitant to dive back into the market. These hesitations lead to ongoing decreases in the sales momentum, forcing sellers to reconsider price expectations in order to attract buyers. In some major metropolitan areas, this could mean a recalibration of market strategies and potentially more aggressive pricing strategies moving forward, especially as the seasonal dynamics shift.

In conclusion, the current trajectory of the U.S. housing market reflects complexities marked by rising inventory levels, declining prices, and changing buyer behavior. While some cities like New York maintain upward trends, the overall condition remains indicative of a market in flux, responding to economic realities and recalibrating from past inflationary pressures seen in 2022. The significance of these changes is not only felt in housing but also extends to the broader economy, as shifts in real estate value can have ripple effects on consumer confidence and spending patterns. As we navigate these changes, the evolving dynamics of the housing market will continue to warrant attention from buyers, sellers, and policymakers alike.