In September, retail sales experienced a significant rise, exceeding expectations and putting scrutiny on the Federal Reserve’s recent decision to reduce its benchmark interest rate by half a percentage point. Overall, sales at retail stores and online platforms climbed by 0.4% during the month, despite notable declines in gas station sales and stagnation in auto sales. When isolating the performance of auto dealers and gas stations, otherwise known as the core measure, retail sales exhibited a stronger increase of 0.7%. This unexpected growth signals an underlying momentum in consumer spending, which may have further implications for monetary policy.

Economists had predicted a modest overall increase of 0.3% for both total retail sales and the core measure excluding gas and auto sales. Year-over-year comparisons reveal that total retail sales have risen by 1.7%, but this figure masks the stronger sales activity occurring in other categories. When stripping away gas stations and auto sales—often influenced heavily by fluctuating gasoline prices—retail sales show an even more robust growth of 3.7% compared to the same month one year prior. This indicates that, while the overall sales figures might seem underwhelming, there is a more promising trend in consumer expenditure outside these volatile sectors.

In examining the sales data for the year-to-date period from January through September, the figures correspond to a 2.6% increase in retail sales compared to the first nine months of the previous year. When discounting auto dealers and gas stations, the growth rate becomes remarkably stronger at 3.6%. However, not every category showed positive trends; furniture stores and electronics and appliance stores registered monthly declines in sales. Conversely, most other retail segments experienced an uptick in consumer spending, highlighting a mixed yet generally positive sales landscape.

Category-specific data reveals encouraging trends in various segments: grocery stores saw a noteworthy 1% increase in sales, general merchandise stores grew by 0.5%, and online sales experienced a rise of 0.4%. Moreover, clothing stores enjoyed a 1.5% surge, while health and beauty establishments reported a 1.1% increase. Dining and bar sales also increased by 1%, underscoring the resilience and robustness of consumer attitudes despite some downturns in specific areas. It’s essential to note that these figures are seasonally adjusted, although they do not account for price fluctuations.

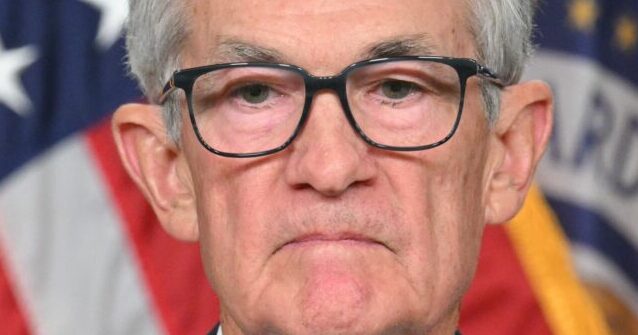

The unexpectedly strong sales figures challenge the narrative surrounding the Federal Reserve’s monetary policy decisions, suggesting that the recent interest rate cut may have been premature. In conjunction with a stronger-than-forecast jobs report for September and inflation data that also exceeded expectations, the data raises questions about the rationale behind aggressive monetary easing. Critics of the Fed’s approach argue that the timing of the interest rate cut, coming just before a presidential election and exceeding market expectations, potentially gives off the impression that the central bank is letting politics influence its monetary policy decisions.

As the economic landscape continues to evolve, the ideal balance between fostering growth and managing inflation becomes increasingly complex. The better-than-anticipated retail sales figures could prompt the Federal Reserve to reconsider its strategy going forward, particularly in light of the economic indicators that suggest a stronger-than-expected consumer market. This could translate into future policy adjustments aimed at addressing inflationary pressures while ensuring sustaining momentum in consumer spending, which remains a vital pillar of the U.S. economy. The next steps taken by the Federal Reserve will be pivotal in shaping the economic framework, and careful consideration of these retail sales metrics will undoubtedly play a significant role in their decision-making process.