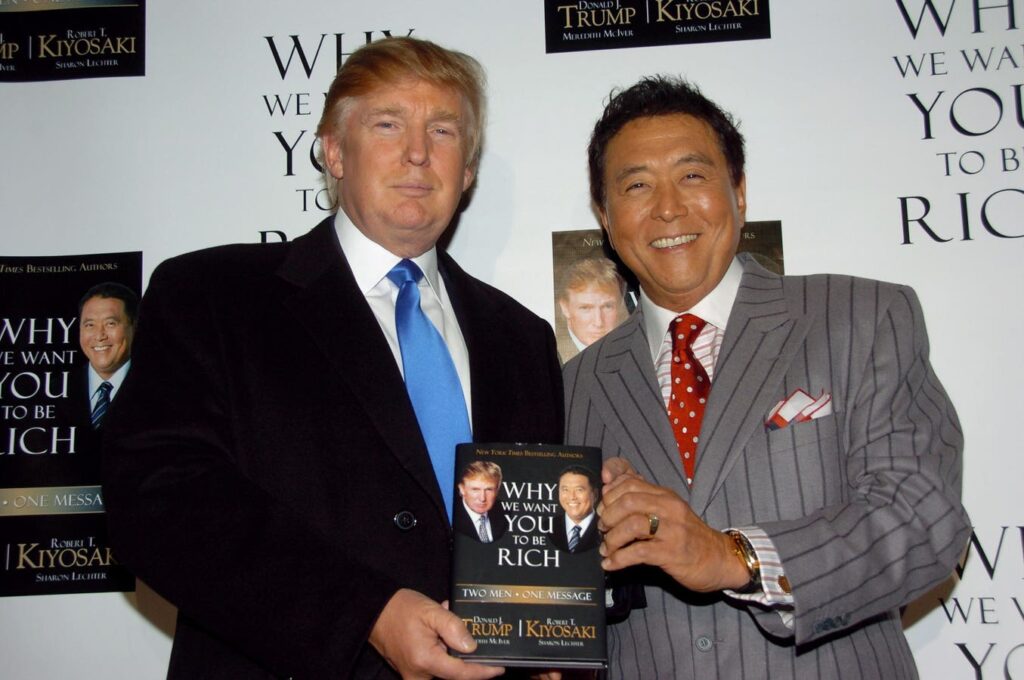

The cryptocurrency market continues to be a hotbed of speculation, particularly exemplified by the bold predictions made by Robert Kiyosaki, the author of “Rich Dad Poor Dad.” In a surprising post shared on November 25, Kiyosaki projected that the price of Bitcoin could soar to an astonishing $500,000 by the year 2025, attributing this significant leap to insights from artificial intelligence. Kiyosaki posed the rhetorical question, “What is the price of Bitcoin in 2025?” followed by an emphatic confirmation of this high figure. This is not an isolated prediction; it represents Kiyosaki’s ongoing enthusiasm for cryptocurrency and underscores his belief in its long-term financial viability.

Kiyosaki’s previous forecasts display a mixture of optimism and audacity. Earlier in 2023, he had claimed that Bitcoin could potentially reach $350,000 by August 2024. Furthermore, he has entertained even more ambitious projections, suggesting at one point that Bitcoin might skyrocket to $10 million, though he has not provided a timeline for this estimate. His consistent advocacy for Bitcoin as a safeguard against the instability of fiat currencies has garnered him both followers and skeptics. However, critics often point out the dramatic nature of Kiyosaki’s predictions, questioning their feasibility given market realities.

Historically, Kiyosaki has suggested that Bitcoin might hit $1 million by the year 2030, driven by the transformative impact of AI. He described these anticipated changes as “frightening,” indicating a profound shift in how money is conceptualized in modern society. Although his ideas resonate with a section of the crypto-community, his earlier forecasts, such as the projection of Bitcoin exceeding $350,000 by August 2022, did not materialize, casting doubt on the credibility of his predictions. Despite these challenges, Kiyosaki’s bullish stance reflects a larger trend within the cryptocurrency space, where other influential figures have similarly conjured optimistic future valuations.

In alignment with Kiyosaki, Arthur Hayes, co-founder of the cryptocurrency exchange BitMEX, has also hinted at a potential $1 million valuation for Bitcoin, largely based on the projected long-term impacts of inflation. Furthermore, Cathie Wood, CEO of ARK Invest, has elevated her own forecasts, claiming that Bitcoin could reach $1.5 million by 2030 in a favorable scenario, up from her previous estimate of $1 million. These figures are grounded in the broader narrative of growing institutional interest and macroeconomic themes that could influence Bitcoin’s price positively over the coming years.

The sentiment around Bitcoin on Wall Street appears to be gaining traction, especially as Bernstein Research, a prominent investment firm, chimed in with its estimates. They project that Bitcoin could reach as high as $200,000 by 2025, citing factors such as increased institutional adoption, regulatory clarity, and movements within the political arena, including support from figures like Donald Trump. Analysts Gautam Chhugani and Mahika Sapra of Bernstein noted that Bitcoin could potentially exceed $500,000 by 2029 and even touch $1 million by 2033. Their forecasts rest on the pivotal role that regulated Bitcoin exchange-traded funds (ETFs) could play in attracting traditional investment into the crypto space, marking a significant moment for the integration of Bitcoin in traditional financial portfolios.

In essence, the prevailing forecasts and market analysis encapsulate a complex interplay between hope and reality within the cryptocurrency landscape. The possibility of Bitcoin attaining unprecedented valuations hinges on an array of factors, including regulatory advancements, institutional adoption, and macroeconomic conditions. While Kiyosaki and others voice their exuberant optimism, it is essential to approach these predictions with a critical lens, recognizing both their aspirational nature and the unpredictable dynamics of the market. The journey of Bitcoin is likely to be as tumultuous as it is transformative over the coming years, and the dialogue surrounding its potential continues to be a significant focal point for investors and crypto enthusiasts alike.