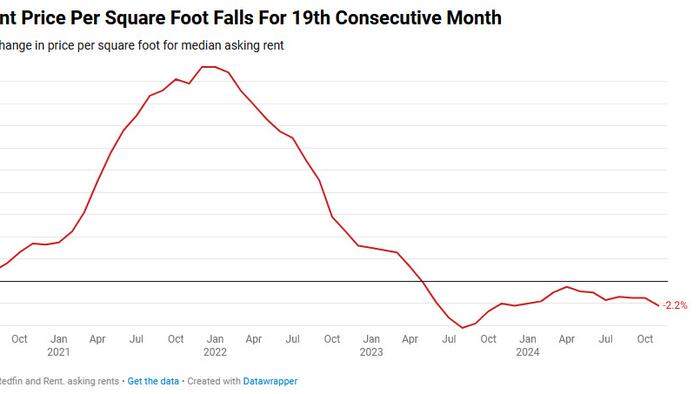

In November, the median asking rent in the U.S. decreased by 0.7% year over year, settling at $1,595, which marks the lowest level since March 2022. A month-over-month comparison reveals a more significant decline of 1.1%. This figure represents a notable decrease of 6.2% from the all-time high of $1,700 reached in August 2022. A pivotal element in this trend is the persistent decline in the median rent price per square foot (PPSF), which has now fallen for 19 consecutive months, dipping 2.2% to $1.79. This represents the first time the PPSF has fallen below $1.80 since November 2021. Such developments indicate a gradual easing of rental affordability in the U.S. market, contrasting the high rents observed in previous years.

The rental market has largely remained static over the last two years; however, recent months have shown a slight downward trend in rental prices, largely attributed to a historically high number of new apartment completions. Notably, there was a robust increase of 22.6% in apartment completions year over year during the second quarter, the highest recorded in over a decade. Consequently, the vacancy rate in buildings with five or more units climbed to 8% in the third quarter, marking the highest rate since early 2021. In light of these developments, Redfin Senior Economist Sheharyar Bokhari emphasizes that renters in markets characterized by rapid construction are experiencing improved affordability as rents decrease while wages rise, creating a more favorable environment for tenants.

The surge in housing supply has also led to a consistent decline in asking rents across all types of apartments for five consecutive months. Median rents for 0-1 bedroom apartments fell by 1.7% year over year, settling at $1,450—this is the lowest level seen since November 2021. Additionally, rents for larger apartments also experienced declines, with 2-bedroom apartments down 1.1% to $1,671 and 3+ bedroom units showing a decrease of 2.3% to $1,955. This downward trajectory in rental prices is echoed in the price per square foot, where 0-1 bedroom units observed the steepest drop of 2.5%, followed closely by 3+ bedroom apartments at a decline of 2.4%, and a less pronounced 1.2% decrease for 2-bedroom units.

A notable trend within the rental market has been the significant drops in rent prices in various Sun Belt metropolitan areas. Austin, TX, leads the way with rents plummeting by 12.4%, followed by Tampa, FL at 11.3%, Raleigh, NC at 8.4%, Jacksonville, FL at 7.5%, and Nashville, TN seeing a 7% decline. This regional trend highlights the marked disparity in rent changes across major U.S. metros. Conversely, some Midwest and East Coast cities exhibited rental price increases, which can be attributed to lower levels of new construction in these regions compared to their Sun Belt counterparts.

Cleveland stands out as the city with the most substantial rent increase, advancing by 10.6%, followed by Louisville, KY at 10.2%, and Baltimore, Washington D.C., and Providence, RI, all experiencing increases of around 9.4% or more. The persistence of rising rents in these cities underscores the diverging trends between regions of significant new construction and those with less supply growth. The geographical disparities in rent fluctuations illustrate the complexities of the rental market, where local economic conditions, construction activities, and demographic movements interplay to shape rent prices.

Looking ahead, the dynamics of the rental market suggest an impending shift towards a renter’s market by 2025, especially if construction activities begin to slow down. Economists expect that the widening gap between buying and renting could affect future rental affordability. Those currently renting in areas benefiting from new construction may enjoy favorable conditions for a while, but as the pace of new developments slackens, upward pressure on rents could resurface. Therefore, while the present landscape is more favorable for renters, shifts in economic conditions, supply, and demand dynamics suggest that vigilance will be needed in navigating the changing tides of the housing market.