Chancellor of the Exchequer Rachel Reeves is contemplating a significant overhaul of the UK’s business taxation, particularly targeting major online retailers like Amazon. The proposed changes aim to create a more equitable tax structure that benefits traditional high street stores, which have been adversely affected in recent years by the rise of e-commerce. The current system of business rates, which taxes firms based on the value of their physical premises, is seen as detrimental to brick-and-mortar retailers. Reeves is expected to discuss her plans in an upcoming budget announcement on October 30, 2023. While details remain tentative, the rationale behind these changes is to generate additional revenue and support local economies.

Reeves is addressing the financial imbalances exacerbated by the previous Conservative government, which she claims has left the Labour Party facing a challenging budgetary situation. Aiming to raise approximately £40 billion ($52 billion), her strategy combines tax increases and restrained short-term spending with an emphasis on long-term investment in public services. This dual approach seeks to rectify the fiscal shortfalls while underscoring the Labour Party’s commitment to supporting sustainable economic growth. Public consultation is anticipated to follow the budget announcement, paving the way for broader reforms in the business rates system next year.

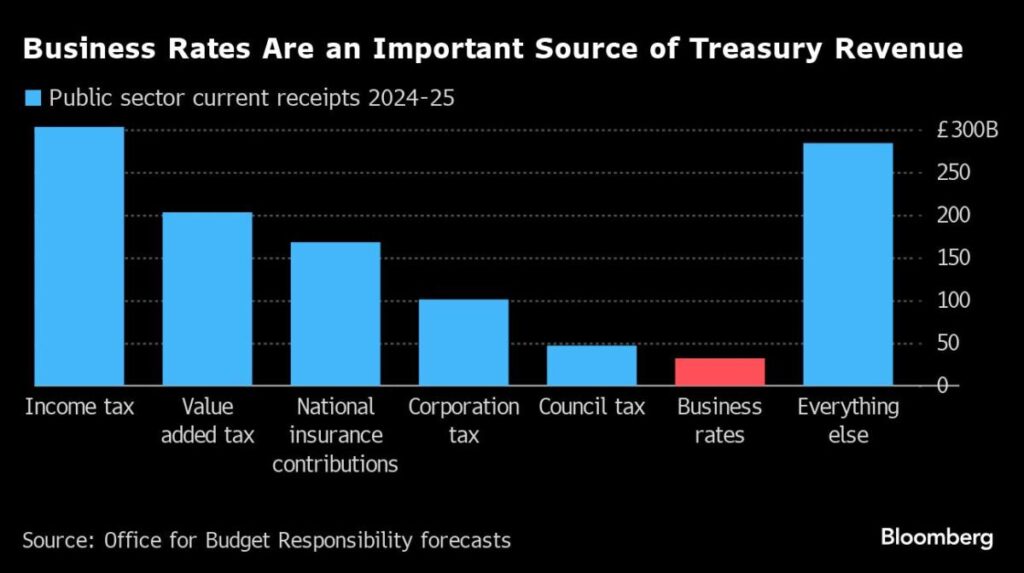

The significance of adjusting the business rates structure cannot be understated, as there has been growing pressure from various industry sectors, particularly retailers. Traditionally, high street businesses have borne a disproportionate share of the business rates burden compared to their online counterparts, primarily due to the disparity in property values. As the Labour Party works on reforming the business rates, it aims to align taxation practices more closely with the current retail landscape that increasingly favors digital platforms over physical retail spaces. Although generating revenue through business taxes is important, the reform must also ensure that local authorities’ funding is preserved.

The urgency for these reforms has intensified with the impending expiration in April of a substantial business rates relief that was initiated during the pandemic. Many businesses, particularly in the hospitality sector, are facing looming financial challenges as they prepare for potentially steep increases in their tax liabilities. High-profile industry leaders from various sectors have recently rallied to advocate for a reformation of the business rates system, emphasizing that immediate action is necessary to prevent detrimental impacts on the high street. The central theme of their appeal hinges on the promise of delivering on Labour’s manifesto commitments to ease the tax burden for local businesses.

The proposal does not appear to include the introduction of a new online sales tax, a measure that had been previously considered by the prior Conservative government. Reeves has emphasized the need for a balanced approach, proposing to alleviate the financial strain on traditional businesses without imposing excessive new taxes on e-commerce platforms. In her criticism of the current tax landscape, she has argued that businesses like Amazon should contribute more to the national revenue, particularly as their profits continue to soar while conventional retailers struggle. The Treasury is also exploring various options to adjust the multipliers used in calculating business rates and reevaluating property valuations to ensure taxes are fairly aligned with businesses’ economic realities.

In summary, Chancellor Rachel Reeves is poised to introduce reforms that aim to level the playing field between traditional retail and e-commerce giants. As part of the Labour Party’s first spending plan in over a decade, these proposed changes reflect a broader strategy to address economic disparities and stimulate investment in high street businesses. The upcoming budget will be a critical juncture that could set the stage for a new era in UK business taxation, potentially benefiting countless local stores and invigorating communities across the country. Through careful consultation and strategic fiscal planning, Reeves aims to ensure that the traditional retail sector can thrive despite ongoing competition from online giants.