Australia’s central bank is closely monitoring the potential economic repercussions of China’s recent stimulus measures as it prepares for the upcoming Reserve Bank of Australia (RBA) board meeting. According to Assistant Governor Sarah Hunter, the RBA is currently assessing how these measures may influence domestic growth, especially given that China remains Australia’s largest trading partner. During an interview, Hunter noted the significance of China’s economic trajectory for Australia, particularly in regard to forecasting for the year 2025. As the RBA’s chief economic adviser, Hunter plays a crucial role in communicating insights and analyzing trends that affect the bank’s monetary policy decisions.

In recent weeks, Chinese authorities have made substantial efforts to address the challenges posed by their economic slowdown, unveiling a series of stimulus initiatives ranging from monetary easing to regulatory adjustments. Hunter highlighted the importance of these developments in understanding how Australia’s economy may respond, acknowledging the enduring economic linkages between the two countries. She emphasized that while the Australian government has sought to diversify its trade relations, China’s impact on the Australian economy remains profound and warrants significant attention from the RBA.

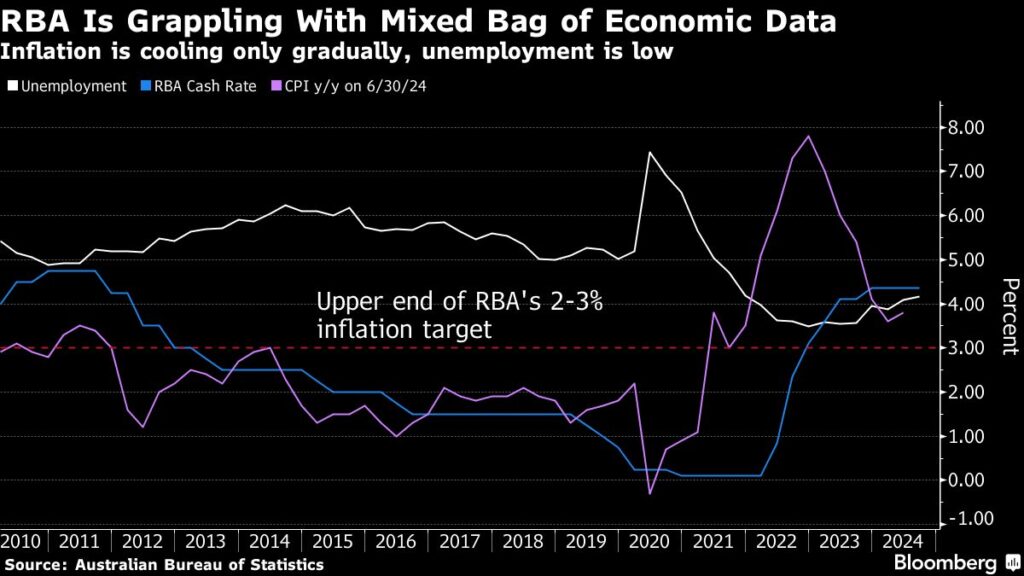

In a separate speech at a Citigroup conference, Hunter addressed concerns surrounding inflation expectations in Australia amid persistent price pressures. She stated that the RBA is vigilant about avoiding a scenario where inflation expectations become unanchored, which could lead to increased volatility in actual inflation outcomes. Hunter expressed confidence that, at present, inflation expectations remain within the RBA’s target range of 2-3%. However, she acknowledged the challenges posed by inflation’s current elevated levels and the need for ongoing monitoring of how expectations evolve among households and labor unions.

Hunter’s remarks about inflation come as the RBA maintains its key interest rate at a 12-year high of 4.35%. The bank’s strategy is to hold rates steady until they see sustainable progress in bringing inflation back within target levels. This approach contrasts with many other developed economies that have begun to loosen monetary policy in response to varying economic conditions. Hunter indicated that while there is speculation in financial markets regarding potential rate cuts early next year, the RBA will remain focused on its inflation targets before considering any adjustments.

The RBA’s commitment to its inflation containment strategy is underscored by its cautious approach to interest rates, reflecting broader trends within Australia’s economic landscape. The central bank is balancing immediate concerns about inflation with the economic interconnectedness it shares with key trading partners like China. Hunter’s role in offering economic forecasts and her active engagement in analyzing inflation dynamics are crucial in shaping the RBA’s responses to both domestic and international economic developments.

Overall, as the RBA prepares for its upcoming policy decisions, the interplay between China’s stimulus measures and Australia’s own economic indicators will be critical in guiding the bank’s strategies moving forward. The assistant governor’s emphasis on monitoring inflation expectations and the bank’s resolve to retain high interest rates until clear signs of economic stability arise encapsulate the complexities facing Australia’s monetary policy in an increasingly interdependent global economy.