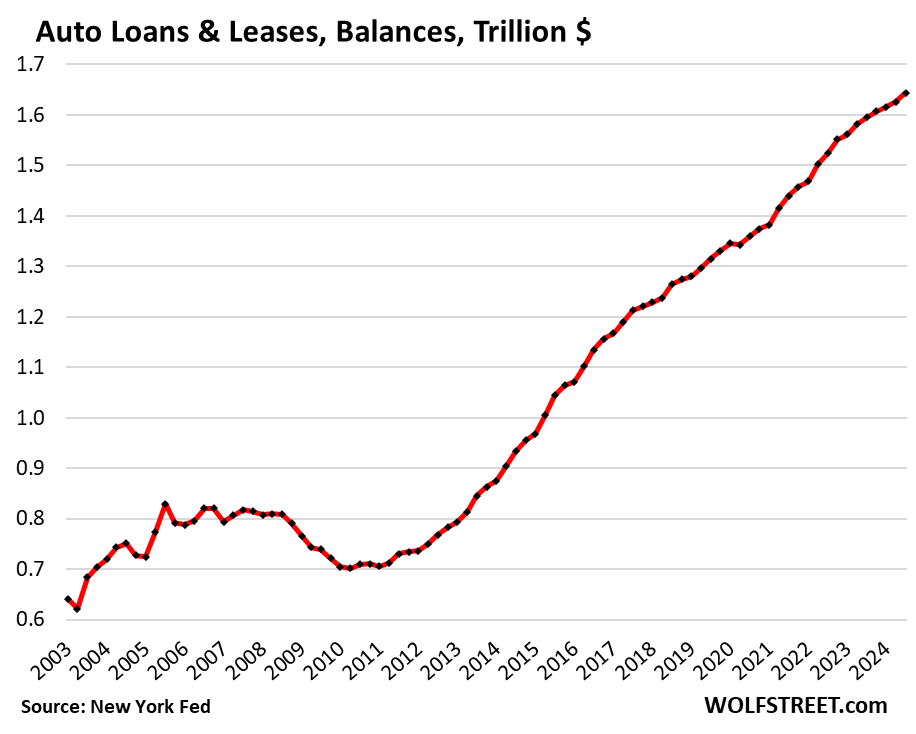

The auto loan landscape appears decidedly mixed, with significant shifts arising from prior lending behaviors and current economic realities. Data released by the New York Fed indicates a modest growth in auto loans, with balances rising 1.1% quarter-over-quarter and 3.1% year-over-year, bringing the total to a staggering $1.64 trillion. Notably, this annual growth rate is among the lowest recorded since early 2021, suggesting that the market is impacted by elevated interest rates and a growing inclination amongst consumers to purchase vehicles with cash. The percentage of cash purchases for new vehicles increased to 20%, while the used vehicle market saw cash purchases leap to 64%. This behavioral shift among buyers is indicative of a climate where higher financing costs are pushing consumers toward less debt-heavy purchasing options.

Historically, auto loan balances have ballooned over the past 20 years, driven less by higher unit sales and more by soaring vehicle prices. Despite flat new vehicle sales, the expansive pricing and the tendency of manufacturers to upscale their models have inflated financing amounts. The dramatic price spikes experienced in the past few years—exacerbated by supply shortages—resulted in ballooning amounts financed, which put upward pressure on loan balances throughout 2020. However, the slight price declines observed in new vehicles during 2023 have curbed the financing amounts, bringing some relief to growth rates of auto loan balances.

The burden of auto loans can be contextualized against household disposable income, which encompasses after-tax wages and other income streams. Traditionally, rising auto loan balances would have escalated the debt-to-disposable income ratio; however, despite rising prices, this metric has remained surprisingly stable over the past two decades. Since prices began declining mid-2022, and with disposable income witnessing an uptick, the overall auto loan burden on households has started to lessen—bringing the debt-to-disposable income ratio down to around 7.5% in Q1 2024.

In stark contrast to the prime lending sector, subprime lending continues to face challenges. Much of the subprime lending is funneled into older used cars, predominantly through specialized lenders. The share of subprime loans constituted 16.9% of all auto loans in Q3—a significant decline from the historic range of 19% to 25%. The past few years of aggressive lending, low credit standards, and soaring used car prices have now led to a risky environment rife with delinquency, reflected in the bankruptcy phenomena of several subprime dealer chains in 2023. Notably, more substantial firms like America’s Car-Mart have encountered significant difficulties, with their shares plunging and entering the realm of ‘imploded stocks.’

Delinquency rates among borrowers reveal a stark contrast between subprime and prime borrowers. According to Equifax, the overall 60-plus day delinquency rate hit 1.55% in September, marking a troubling trend, particularly among subprime borrowers, where the delinquency rate stood at 6.1%, unchanged since August. The overall delinquency rate has shown an upward trajectory since early 2023, driven primarily by spikes within the subprime sector. In contrast, prime-rated auto loan delinquencies remained consistently low, between 0.28% and 0.35%, signifying significant stability in that segment. Such disparity underscores the systemic issues within subprime lending pathways, as these loans increasingly attract riskier financial behaviors from borrowers.

Looking ahead, the auto loan market contends with a complex mix of factors, encapsulating consumer behavior, economic pressures, and the historical backdrop of subprime lending practices. As car buyers adapt to higher rates and shifting market dynamics by leaning towards cash purchases, the landscape of auto financing might evolve considerably. Diverging trends in delinquency—highlighting the fragility of subprime lending—will continue to present challenges as this segment witnesses further scrutiny and readjustment. Overall, these developments signify important transitional phases for the auto lending sector, with long-lasting implications for both lenders and consumers alike.