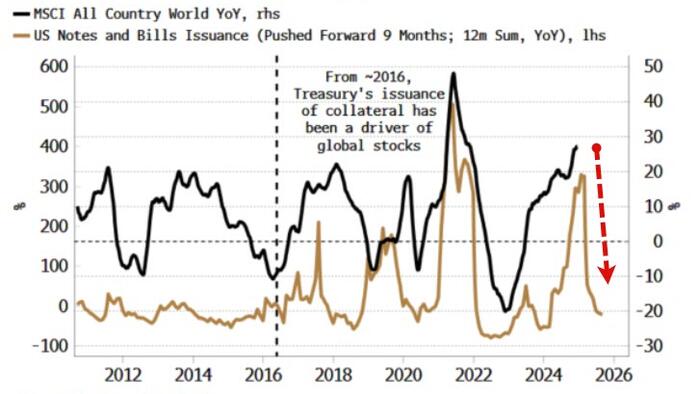

In the current economic landscape, macro strategist Simon White from Bloomberg highlights that net Treasury bill (T-bill) issuance is anticipated to decline further with the likely appointment of Treasury Secretary nominee Scott Bessent. This change in fiscal policy leadership may lead to a shift in how the government manages its borrowing and funding strategies. As the Treasury Department pivots, the implications for capital markets, particularly the stock market, are significant.

The reduction in T-bill issuance will prompt the U.S. Treasury to rely more heavily on liquidity-draining bonds to finance the budget deficit. This transition could exacerbate challenges for equity markets, as the reduced availability of short-term government securities may tighten liquidity conditions in the broader financial system. Investors often seek safer assets like T-bills during times of uncertainty; hence, diminished issuance may lead to increased volatility and risk perceptions in the stock market.

Additionally, White warns that this mounting pressure on liquidity may set the stage for increased downside risks in equities next year. Lower T-bill supply means that institutional investors might become more constrained in their ability to manage cash positions, influencing their investment choices favorably toward bonds over stocks. Consequently, this could pressure stock valuations, especially if investors begin to reassess risk exposures amid anticipated economic uncertainties.

Moreover, the relationship between interest rates and stock prices becomes ever more critical as T-bill issuance dwindles. With reduced short-term debt available, the upward movement in interest rates might accelerate, leading to higher borrowing costs. This may deter companies from making new investments, potentially slowing economic growth and amplifying the negative feedback loop affecting stock performance.

As we look ahead, the implications of these financial shifts extend beyond just the immediate travails of the equity markets. Policymakers and investors alike must grapple with the intricate dynamics of fiscal policy and its effects on liquidity. With greater reliance on less liquid instruments to manage deficits, a recalibration of investment strategies across asset classes might be essential to navigate these changes effectively.

In summary, Simon White’s analysis presents a consequential outlook for financial markets in the wake of anticipated declines in T-bill issuance. The transition toward liquidity-draining bonds could elevate risks for stocks, suggesting that investors may need to exercise caution. As the economic environment evolves with new leadership in treasury policy, strategic adjustments in investment portfolios will be key for navigating the challenges ahead.