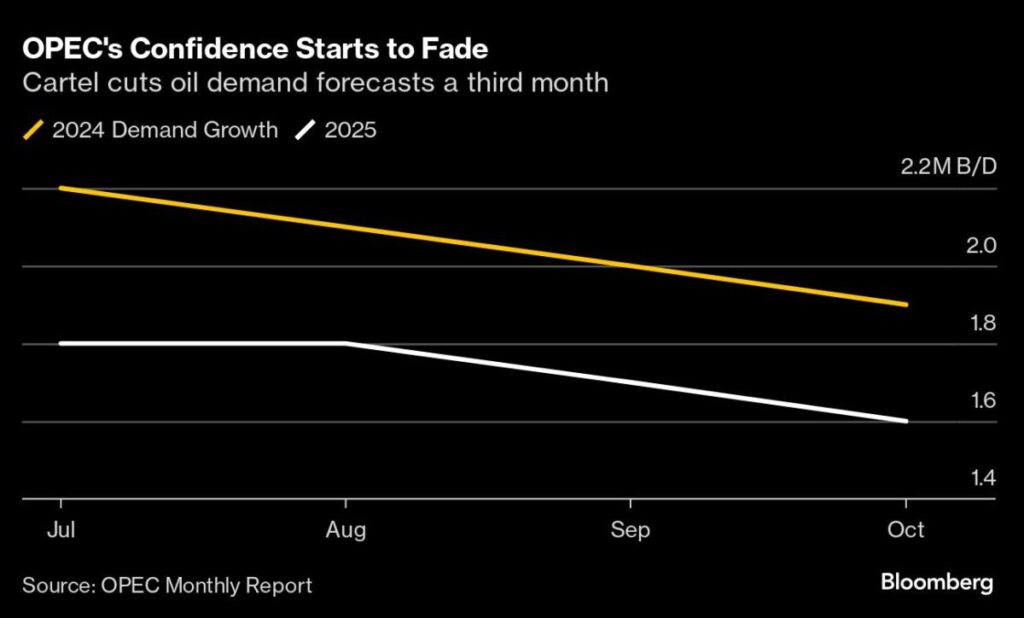

OPEC has recently revised its oil demand growth projections for 2023 and 2024, marking the third consecutive month of downgrades as the organization finally acknowledges a deceleration in global fuel usage. According to OPEC’s latest report, global oil consumption is expected to rise by 1.9 million barrels per day, approximately a 2% increase in 2024. This figure represents a reduction of 106,000 barrels per day from prior estimates, attributed to a combination of newly acquired data and lowered expectations for specific regions. The revisions point to a noticeable shift from OPEC’s previously optimistic outlook on demand, which had characterized the organization’s forecasts earlier in the year. Despite these cuts, the revised demand estimates remain higher than those projected by major Wall Street banks and trading entities, and even exceed the expectations set forth by Saudi Aramco, the national oil company.

This series of downward adjustments in forecasts suggests a dwindling confidence within OPEC regarding future oil demand. The uncertainties regarding global energy consumption are compounded by hesitations among member nations to boost production as previously planned, underscoring a disparity between OPEC’s projected supply deficits and the actions of its member states. For instance, under Saudi leadership, OPEC and its allies are preparing to progressively reinstate 2.2 million barrels per day from December, however, this resumption has been delayed by two months from its original schedule. Analysis from firms like JPMorgan and Citigroup indicates skepticism towards this planned increase, especially considering the pulling back of growth from crucial consumer markets such as China and a notable influx of supply from North and South America.

While geopolitical tensions, particularly in the Middle East, have momentarily supported crude prices, they remain inadequate for fulfilling the fiscal needs of several OPEC nations. Currently, crude oil hovers around $77 per barrel, which doesn’t meet the financial expectations of members dependent on higher prices. Efforts to stabilize oil prices through constrained production have not been effectively realized, with several nations, particularly Iraq, Kazakhstan, and Russia, failing to adhere to the agreed-upon cuts. As a critical case, Iraq has shown some improvement in meeting its output cut obligations, curtailing its production by 155,000 barrels a day to 4.112 million, although it still exceeds its target production level and shows no substantial progress in making compensatory cuts for previous overproduction.

Kazakhstan’s situation presents a contrasting picture; it has actually increased its production by 75,000 barrels per day, directly violating its pledges to comply with OPEC’s output regulations. Although Russia’s production reduced by a modest 28,000 barrels per day, it similarly remained above its assigned limit, producing about 9 million barrels daily. This inconsistency among member countries in adhering to agreed production cuts raises concerns about OPEC’s ability to effectively control and adjust outputs in response to shifting global demands. As discussions around scheduled output hikes progress, it remains to be seen how OPEC+ will strategize, particularly during their upcoming meeting set for December 1, when policies for 2025 will be deliberated.

Looking ahead, the prospects for oil demand are becoming increasingly uncertain, particularly as major economies confront various economic challenges. Slower growth in China, a major consumer of crude oil, compounded by the rising output from American producers, complicates OPEC’s ability to manage both supply and expectations in fostering higher prices. The adjustments to demand forecasts and member nations’ inconsistencies further highlight the growing disjoint between OPEC’s leadership and the operational realities faced by its members. Potential disruptions from geopolitical tensions or shifts in consumption trends could exacerbate the situation, making it crucial for OPEC to navigate these complexities while striving to align production levels with actual market conditions.

In the face of these challenges, OPEC must grapple with balancing the economic needs of its member states against the backdrop of shifting global oil dynamics. With prices falling short of many countries’ required levels for economic stability, the group is caught in a dilemma of either enforcing stringent output cuts or risking market oversupply, which could lead to deeper price declines. The organization’s management of this precarious situation will be critical as they move towards deciding on their output policies for the coming year. As global consumption patterns weigh heavily on these discussions, OPEC’s actions in the upcoming months will serve as a significant indicator of both the group’s confidence in recovering demand and their strategy for navigating a fluctuating and uncertain market landscape.