Reza Dilmaghani, a Phoenix-based day trader, typically focuses on equities but has recently shifted his attention to the oil market due to a significant rally in crude prices, marking the largest increase in nearly two years. Since oil prices reached $67, Dilmaghani has been actively trading, praising the market’s orderly rise. His experience is reflective of a broader trend, as many retail investors are also drawn to oil-linked products amidst the escalating geopolitical tensions following Iran’s attacks on Israel, which have played a pivotal role in driving oil prices upward. The surge in prices, exceeding $6 per barrel within a week, has enticed various so-called “oil tourists” to capitalize on the potential for profit in this volatile environment.

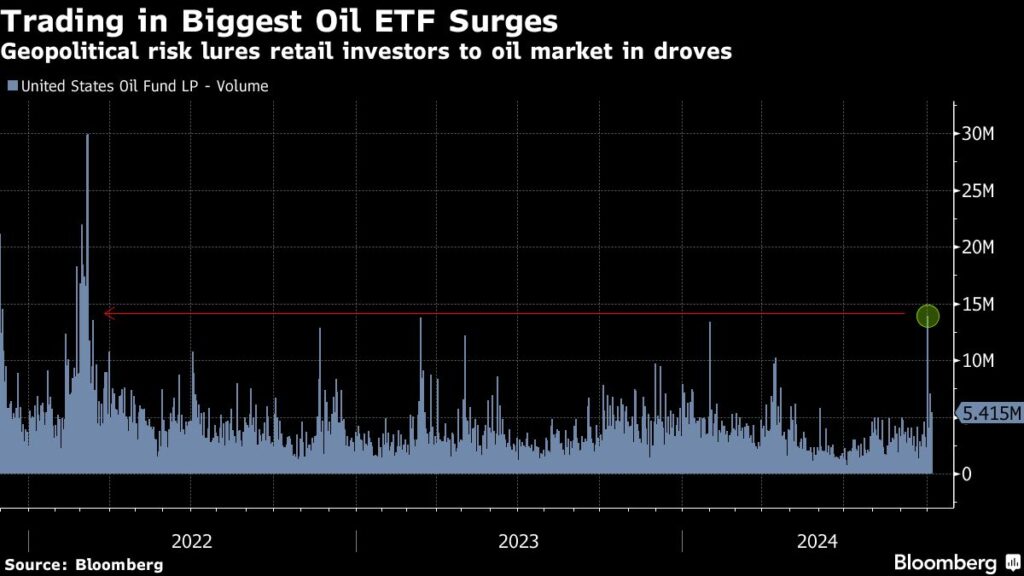

This influx of retail investors has marked a notable increase in trading volumes for oil-related exchange-traded products (ETPs). The United States Oil Fund (USO), the largest ETP that tracks oil prices, saw its trading volumes soar, reaching levels not experienced since the onset of the Russia-Ukraine conflict in 2022. Additionally, the CME Group reported significant activity in Micro WTI futures, particularly on retail trading platforms, which experienced the highest daily volumes since January. Concurrently, weekly options used to mitigate short-term price fluctuations observed a record increase in open interest, indicating a growing presence of retail traders in the oil market, which is seen as bringing in much-needed liquidity.

However, this surge in trading activity raises concerns about increased volatility within the futures market. Retail investors, often described as opportunistic traders, have been known to influence oil prices significantly during global events. The volatility that has unfolded in the market echoes back to 2020 when a flood of retail investment contributed to a historic decline in US oil prices, even turning them negative briefly. The recent spike in USO trading volumes has coincided with notable fluctuations in crude oil prices, indicating a correlation between the surge in retail participation and heightened market volatility.

That said, the impact of these retail investors is viewed differently by more traditional market players. Analysts caution that while retail investors are driving prices higher, the increases may not be fundamentally justified, especially if the geopolitical tensions in the Middle East do not materially disrupt oil supplies. Some market experts warn that should the underlying conditions remain stable, there could be a significant correction in oil prices, driven by the disconnect between trader sentiment and actual supply-demand fundamentals.

Despite the potential risks, Dilmaghani remains unconcerned about holding positions overnight. He operates under a trading strategy that emphasizes short-term moves, allowing him to avoid significant exposure to market swings that might occur from prolonged geopolitical developments. This approach highlights a distinct separation between his trading philosophy and that of more conventional traders who might monitor longer-term trends and factors influencing market stability.

In summary, the dynamics within the oil market have shifted significantly with the arrival of a new wave of retail investors, driven by urgency in response to international conflict. The resulting trading activity has brought about notable spikes in volumes and volatility, creating challenges for traditional market players. While the rapid influx of retail interest introduces liquidity, it also poses risks of market instability, underscoring the delicate balance between speculative trading and fundamental market drivers in the current oil landscape.