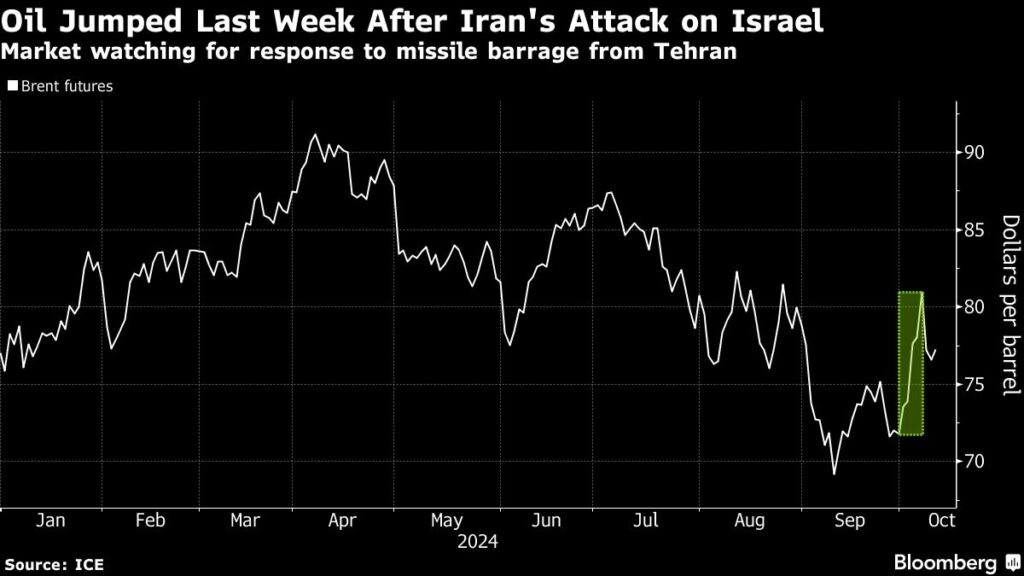

Oil prices experienced a slight uptick following a two-day decrease, primarily influenced by geopolitical tensions stemming from an Iranian missile attack last week. This precarious situation has engendered anxiety within the market, particularly regarding Israel’s potential military response to Iran. As traders remain vigilant, Brent crude climbed above $77 a barrel, while West Texas Intermediate approached $74. The ongoing conflict in the Middle East is driving oil market volatility, prompting hedge funds to increase their net-long positions, despite President Joe Biden’s recent remarks discouraging strikes on Iranian oil infrastructure. The geopolitical landscape is further complicated by an escalating warning from Iran, which has indicated it is prepared to launch thousands of missiles if provoked.

Market analysts, including Arne Lohmann Rasmussen from A/S Global Risk Management, stress that the unfolding situation in the Middle East remains the primary focus of oil traders. The uncertainty surrounding Israel’s military intentions after the recent missile offensive by Iran has generated heightened tensions, which could have far-reaching implications for global oil supply and prices. As traders navigate this complex environment, the volatility and risk associated with Middle Eastern conflicts are prompting a cautious approach, coupled with strategic positioning in the market.

Amidst the geopolitical turmoil, concerns over the economic landscape in China persist. This week, a lack of significant stimulus measures from Beijing contributed to a broader market selloff, affecting various sectors, including oil. While traders await updates on fiscal policy, which will be discussed in an upcoming government briefing, the overall economic health of China remains a critical determinant for oil demand. Slowing growth in the world’s second-largest economy poses risks to global energy consumption patterns, particularly in the face of rising oil prices.

In the United States, domestic crude stockpiles have seen a significant surge, rising by 5.8 million barrels last week—marking the largest increase since April. This uptick in inventories reflects a contrast to the volatility in international markets, as U.S. oil production continues to ramp up. Interestingly, gasoline stocks decreased during this period, indicating a potential shift in consumption patterns. As traders analyze these shifts, they must consider the implications of rising stockpiles against a backdrop of geopolitical risks and fluctuating demand.

The overall outlook for oil markets remains uncertain as multiple external factors are at play. Geopolitical tensions in the Middle East continue to overshadow price stability, while economic uncertainties in China pose ongoing concerns for global demand. With traders remaining attuned to developments in both regions, oil market participants are likely to see continued fluctuations as they balance risks and potential gains. The interplay between rising U.S. inventories and international conflicts will shape trading strategies and market behavior in the coming weeks.

In conclusion, while oil prices show signs of recovery following a decline, the market remains sensitive to geopolitical developments and economic indicators. The potential for an Israeli response to Iranian aggression looms large, driving volatility and positioning among traders. Simultaneously, the health of the Chinese economy remains a critical factor influencing global oil demand. With rising U.S. crude stockpiles creating additional dynamics, the oil market is set for continued fluctuation as it navigates complex geopolitical and economic landscapes. As traders brace for upcoming fiscal policy announcements from China and further developments in the Middle East, the balance between supply concerns and demand potential will largely dictate price movements in the near term.