A week ago, the U.S. government implemented additional sanctions on Iran’s oil trade, leading to a notable decrease in crude oil prices, which dropped over $5 a barrel. This decline can be attributed to the perception that Israel is likely to refrain from targeting Iran’s oil infrastructure, which has previously raised concerns amongst traders. Despite the sanctions, market reactions suggest that traders remain skeptical about the effectiveness of U.S. actions against major oil producers like Iran and Russia affecting pricing significantly, especially considering the upcoming November 5 election. Traders seem to be unconvinced that sanctions targeted at these nations will lead to an increase in oil prices, as the U.S. aims to maintain manageable fuel costs while also navigating complex relationships with significant buyers such as China, which continues to import Iranian oil.

The most recent sanctions allow the U.S. to target virtually any component of Iran’s oil trade and impose penalties on anyone engaging with it. U.S. Deputy Treasury Secretary Wally Adeyemo emphasized that if Iran continues its destabilizing behaviors, including attacks against Israel, the U.S. will be prepared to escalate its actions. However, U.S. officials privately express caution about directly targeting large Chinese oil buyers and intermediaries in the United Arab Emirates (UAE) that have helped boost Iran’s oil exports significantly since 2019. While the U.S. has the capacity to inflict damage on Iran’s oil sector, they are hesitant to utilize the most severe strategies. Such measures could introduce instability not only to oil markets but also jeopardize broader foreign policy objectives tied to relations with other countries.

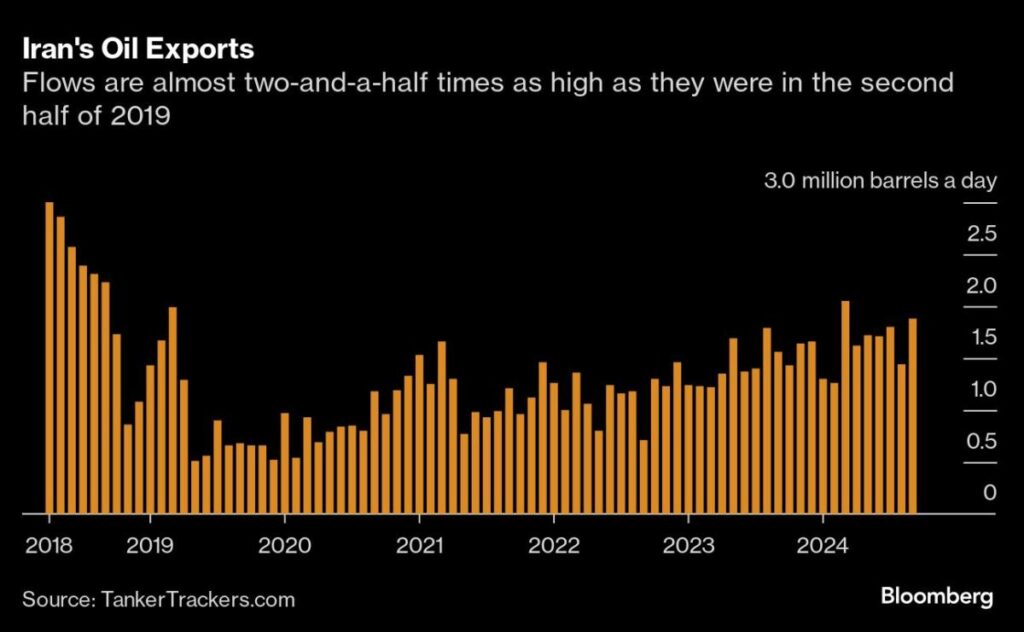

In a move to counter Iranian oil revenue, Treasury Secretary Janet Yellen asserted that the U.S. has consistently put sanctions in place and recently intensified these efforts. She described the October 11 sanctions as a potential precursor to further actions aimed at drastically limiting Iran’s ability to generate revenue from its oil exports. Iran’s oil exports had reportedly averaged 1.7 million barrels per day in the third quarter of this year, reflecting a significant recovery compared to the second half of 2019. This increase persisted despite fears of potential Israeli strikes against Iranian oil facilities, indicating that U.S. officials have opted for strategies designed to complicate Iran’s supply chain rather than impose outright restrictions on exports.

The geopolitical context surrounding Iran’s oil trade is further complicated by several foreign jurisdictions that play critical roles in global oil commerce. The UAE is home to many intermediary firms involved in oil trade, while China remains the destination for approximately 80% of Iranian oil exports, with many transactions conducted in yuan. This dynamic mirrors the situation concerning Russia, where the U.S. has also sought to balance the need for oil supply against efforts to diminish the Kremlin’s revenue streams. This approach resulted in a price-cap scheme restricting the use of Western ships and services for cargoes sold above a specific price point, leading to the emergence of a clandestine fleet of vessels in Russia that operate outside the influence of Western suppliers.

As the U.S. approaches the presidential election, there is speculation that the recent sanctions against Iran could provide the next administration with enhanced authority to enforce stricter limits on Iranian oil exports. This scenario recalls the “maximum pressure” campaign instigated by former President Donald Trump, which aimed to cut Iran’s oil flow to a minimum after the U.S. withdrew from the 2015 nuclear agreement and revoked waivers allowing certain countries to continue purchasing Iranian oil. The outcome of the upcoming election could significantly reshape U.S. foreign policy towards Iran, potentially leading to renewed or revised approaches to sanctions that may have an even more profound impact on both Iranian oil exports and global oil markets.

In summary, the U.S. sanctions on Iran’s oil trade present a complex interplay of geopolitical interests, market reactions, and the balancing of foreign relations. While the Iranian oil sector seems resilient in light of recent measures, the involvement of significant players like China and the UAE complicates U.S. efforts to restrict oil exports effectively. The response of the market indicates skepticism towards the potential of sanctions to lead to dramatic price increases, particularly in an environment where U.S. officials remain cautious about actions that could destabilize the oil market further. Upcoming political changes may ultimately determine the direction of U.S. policy and its effectiveness in altering Iran’s oil trade dynamics, with implications that extend far beyond the Middle East and into global energy markets.