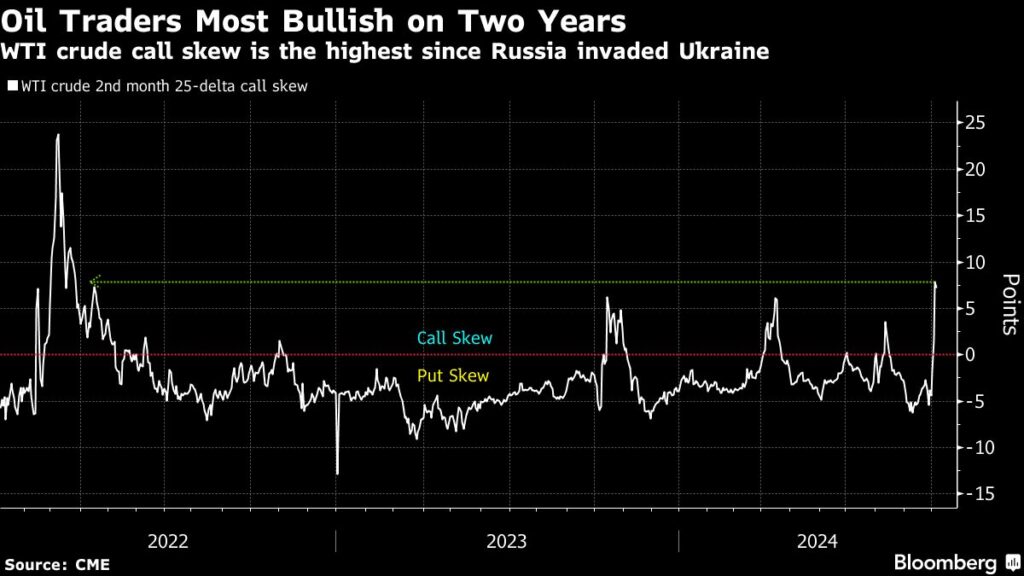

Oil futures experienced their most significant increase in over a year last week, reflecting heightened concerns surrounding potential price surges due to escalating geopolitical tensions in the Middle East. The oil options market saw an extraordinary response, marked by a dramatic rise in call skew for second-month West Texas Intermediate (WTI) futures. This shift in market sentiment draws parallels to March 2022, when the invasion of Ukraine led to widespread apprehensions about oil supply disruption, particularly from Russia. Traders, previously troubled by the potential impacts of sluggish economic growth in major economies like China, quickly adjusted their positions following recent developments, indicating a stark change in outlook.

In mid-September, many traders had adopted bearish stances on crude oil, driven by expectations of decreased demand amid concerns for economic slowdown, alongside anticipated increased supply from OPEC+. Nonetheless, the unexpected deterioration in Middle Eastern stability has shifted the focus from supply concerns to potential price volatility. With the new dynamics in play, many traders are pivoting towards purchasing call options to hedge against possible price increases, with some even reversing bearish positions. Notable spikes in implied volatility signal that market participants are hedging against a potential rally that could stem from geopolitical tensions.

Traders notably ramped up the purchase of December call options on Brent crude, betting on the possibility of oil prices hitting $100 a barrel or more. This surge in trading activity resulted in a record-high volume of call options on September 27, with WTI futures achieving an 11% rise amid fears of potential Israeli strikes on Iranian oil facilities. These geopolitical worries slightly eased later in the week following US President Joe Biden’s intervention aimed at de-escalating tensions. The data indicates a substantial increase in money managers’ net long positions in Brent crude, reflecting a reversal of sentiment in response to global economic developments and OPEC+’s production strategies.

Traders also displayed increased enthusiasm for various speculative bets on the futures curve, with a notable uptick in transactions wagering on the nearest Brent spread hitting $3 per barrel—a significant increase from its previous rate of 62 cents. The uptick in market activity revealed that traders are now heavily focused on shorter-dated contracts, and the demand for bullish options has surged. With implied volatility for December calls rising steeply, the current market environment illustrates a stark contrast to the relatively subdued expectations that characterized earlier months, indicating an unanticipated shift towards bullish sentiment among oil traders.

Meanwhile, enthusiasm for oil and its associated derivatives is outpacing that of oil producers themselves. This heightens interest in short covering as commodity trading advisors move from short positions to neutral stances, motivated by fears of potential supply disruptions rather than Wells Fargo forecasted production increases. Fundamental investors, despite possessing reservations about future oil prices beyond 2025, are utilizing call options as a means to secure upside exposure amidst the volatility and uncertainty dominating the current oil market.

Ultimately, the recent developments have created a complex landscape for oil futures and options trading, characterized by a quick pivot from pessimism to optimism in response to geopolitical crises. The reactions in the market reflect broader concerns regarding the stability of oil supplies and long-term demand forecasts, illustrating how external factors can dramatically influence trading behaviors and sentiment. As the volatility persists in the market, the trading community finds itself navigating a rapidly evolving environment, influenced both by imminent geopolitical events and underlying economic conditions.