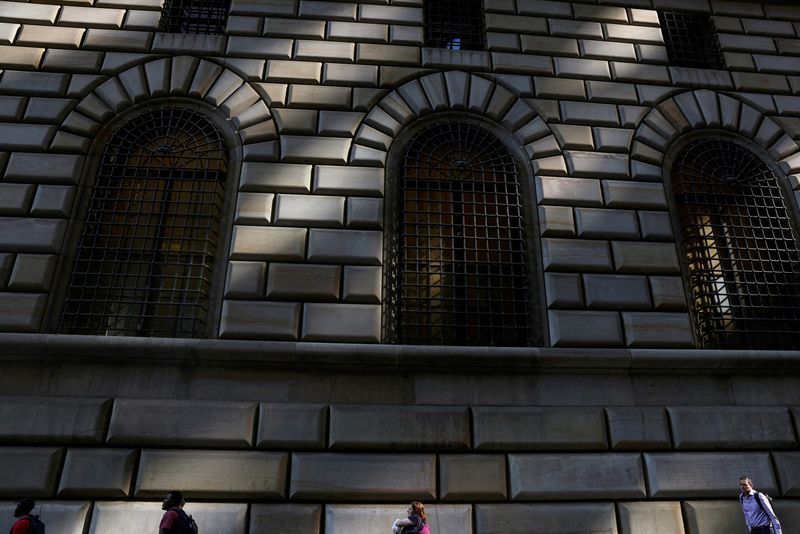

A recent paper from the Federal Reserve Bank of New York reveals that banks are adjusting the terms of commercial real estate (CRE) mortgages to obscure losses in a move termed as “extend-and-pretend.” This strategy allows banks to delay recognizing the negative impact of the pandemic and its subsequent consequences on the CRE sector. With the rise of remote work and lockdowns leading to a reduced demand for office spaces, the CRE market has not shown signs of recovery. In the context of aggressive interest rate hikes by the Federal Reserve between spring 2022 and July 2023, banks are increasingly operating in a financial environment with heightened risks, not just for themselves, but for the wider financial system as well.

The report indicates that banks have largely avoided writing off capital related to their impaired CRE mortgages, thus misallocating credit and heightening financial fragility. Federal Reserve officials have been prepared for manageable difficulties among banks engaging in CRE lending, expecting that any issues will be minor, especially for smaller banks that have a higher exposure to this troubled sector. Despite substantial pressure on the CRE market, there are currently no widespread financial dislocations, as metrics such as nonperforming loans and net charge-offs remain low, especially for banks with weaker capital positions.

Indeed, the majority of CRE loans—over 50% of the $5.8 trillion market as of late 2023—are concentrated within banks, which are viewed as having a primary role in the issuing and holding of these loans. The report highlights that banks with lower capital levels, resulting from securities losses, are chiefly responsible for extending the terms of CRE mortgages. This strategy effectively masks the severity of financial distress in the sector, creating an illusion of stability to prevent further capital depletion. However, the extended maturities could result in challenges for issuing new loans while simultaneously increasing the likelihood of imminent crises as the maturity of existing loans approaches.

Further complicating the scenario is the emergence of a “maturity wall” concerning CRE mortgages, as the practice of extending loan maturities raises concerns about a sudden surge in losses. Banks with weaker capitalized positions show a 0.2 percentage point greater likelihood of extending loan terms compared to their better-capitalized counterparts. This trend poses significant risks, as the potential for rapid loss realization looms when these loans finally come due, with the specter of financial distress hovering over the commercial real estate landscape.

Despite the challenges facing the CRE market, there are indicators that recent Federal Reserve rate cuts initiated in September could provide some respite. These cuts are anticipated to stabilize asset quality, potentially enhancing CRE lending conditions. Recent movements from financial institutions, like Moody’s upgrade of the banking sector’s outlook to stable due to improved asset quality as a result of rate cuts, suggest that the situation might not be as dire as previously feared. Additionally, a Goldman Sachs report indicated that, while lending growth in the CRE sector is slowed, there is a lack of evidence showing a credit crunch is impacting the market significantly.

In conclusion, while the Federal Reserve Bank of New York’s study highlights significant risks associated with the practices of extending and deferring recognition of troubled CRE mortgages, the potential stabilization initiated by recent rate cuts offers a glimmer of hope. The current landscape is marked by banks’ efforts to adapt to changing demands and financial pressures, but the focus remains on how these adjustments might lead to future challenges in the commercial real estate sector and the broader financial system. As the maturity wall looms and lending practices evolve, stakeholders must navigate a precarious balance between obscuring current losses and ensuring long-term stability within the market.