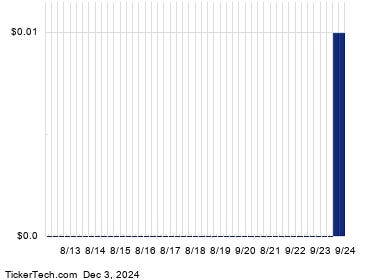

On December 5, 2024, three major companies in the technology and semiconductor sectors—NVIDIA, Qualcomm, and NXP Semiconductors—will go ex-dividend, signaling critical dates for investors interested in receiving dividends. NVIDIA has declared a quarterly dividend of $0.01, which is scheduled for payment on December 27, 2024. Qualcomm is set to pay a larger quarterly dividend of $0.85 on December 19, 2024, while NXP Semiconductors will pay a quarterly dividend of $1.014 on January 8, 2025. These upcoming payouts are important events for shareholders, influencing how the stocks may trade in response to the dividend announcements.

As dividends are a key metric for many investors to gauge the attractiveness of a stock, it is relevant to examine how these payments will impact the prices of the respective stocks when they go ex-dividend. With NVIDIA’s recent stock price at $138.63, the upcoming dividend of $0.01 translates to a yield of only approximately 0.01%. Thus, shares of NVIDIA are expected to open about 0.01% lower on December 5, 2024, assuming all other market conditions remain consistent. In contrast, Qualcomm’s larger dividend of $0.85 represents a yield of about 2.09%, leading to an expected price drop of approximately 0.52%, while NXP Semiconductors, with its dividend of $1.014, will see an anticipated opening drop of around 0.43%.

To better understand these dividends, one can assess the historical trends associated with the dividend practices of these companies. Each of these stocks has varied dividend histories, which reflect their profitability and financial health over time. Analyzing historical dividends helps to form expectations regarding future yields, providing insights into whether the recently declared dividends are sustainable. While dividends can fluctuate based on company performance, reviewing past performance offers crucial context for evaluating the reliability of these payments moving forward.

For current investors, monitoring dividend history can provide a clearer picture of the stability and growth potential within these companies. Stability in dividend payments is often viewed as a sign of a company’s health and performance. For instance, NVIDIA’s low yield might concern some investors, while Qualcomm’s higher yield indicates a more substantial return on investment. NXP Semiconductors falls in between these two, with a moderate yield that also suggests a consistent return relative to its stock price. Overall, the current estimated yields annualized are 0.03% for NVIDIA, 2.09% for Qualcomm, and 1.74% for NXP Semiconductors, highlighting a diverse range of investment returns across these firms.

In the trading session leading up to the ex-dividend date, market performance has shown a positive trend for all three tech giants. NVIDIA shares have risen about 0.3%, while Qualcomm and NXP Semiconductors have experienced more significant increases, with respective rises of 2.8% and 1.9%. These fluctuations could reflect broader market sentiment or investor anticipation regarding future company performance and dividend stability. Ultimately, a company’s ability to maintain or grow dividends is an important indicator of financial viability, making it essential for shareholders to track these developments actively.

In conclusion, as NVIDIA, Qualcomm, and NXP Semiconductors approach their ex-dividend date, investors are encouraged to consider the implications of these dividend payments on stock prices and overall returns. By analyzing dividend histories alongside current stock performance, investors can better assess the potential for ongoing dividends and the stability of their investments. As each company has different yield levels and historical trends, understanding these perspectives can inform investment decisions in the tech sector, particularly in relation to dividends as a critical component of total shareholder return.