In a recent statement, Federal Reserve Chairman Jay Powell emphasized the Fed’s commitment to supporting the labor market amidst signs of economic resilience that exceeded previous expectations. Powell highlighted that the economy is currently stronger than anticipated, with a noticeable decrease in downside risks associated with the labor market. He pointed out that economic growth appears to be more robust than initial forecasts, and while inflation rates are slightly rising, this creates an opportunity for caution in monetary policy as the Fed seeks to find a neutral stance. This nuanced approach indicates that while the economy shows positive signs, the Fed remains vigilant about potential risks that could impact the labor market.

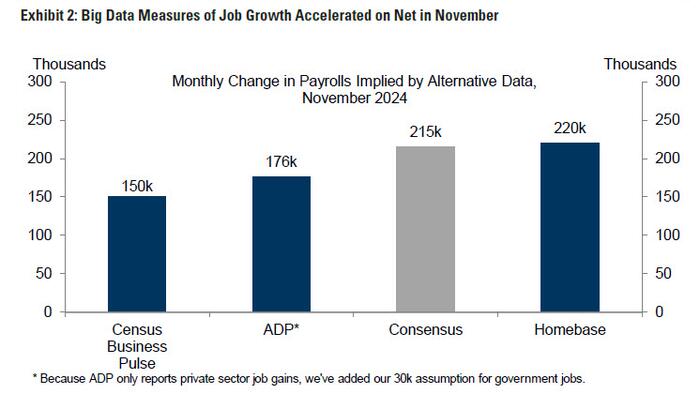

As the year draws to a close, the December jobs report emerges as a critical economic indicator with the potential to influence the Federal Reserve’s decision regarding interest rates. Analysts anticipate that the report will reveal the addition of approximately 220,000 jobs in November, marking a significant recovery from October’s disappointing figure of just 12,000 newly created jobs. The October figure was heavily affected by external factors such as hurricanes and strikes, primarily at Boeing, which distorted the job numbers. Consequently, many of these jobs are expected to be restored in the November report, with estimates suggesting that the base figure could be around 109,000, setting a context for a potentially stronger labor market than previously depicted.

Expectations for the upcoming jobs report vary among analysts, with projections ranging from 150,000 to 284,000 new jobs. Meanwhile, the unemployment rate is projected to hold steady at 4.1%, which remains significantly lower than the Fed’s September median dot plot projection of 4.4%. This stability in the unemployment rate is particularly noteworthy since it is derived from the household survey, unaffected by the prior month’s weather-related disruptions or strikes. Additional focus is placed on wage growth, with expectations of a 0.3% increase in the monthly wage index, a slight moderation from the previous month’s 0.4%. Year-over-year wage growth is anticipated to ease to 3.9%, down from 4.0%. Interestingly, minutes from the latest Fed meeting revealed that certain members believe wage growth is not likely to exert inflationary pressures in the near term, suggesting a more tempered outlook on wage impacts.

The jobs data will play a pivotal role in shaping expectations for the Federal Open Market Committee (FOMC) meeting scheduled for December 18. A majority of analysts forecast a 25 basis points rate cut at this meeting, reflecting the perception that the labor market’s performance and inflation dynamics will dictate the Fed’s approach. Current money market pricing indicates a 73% probability of such a cut. Federal Reserve Governor Waller has signaled his support for leaning towards this cut, although he cautions that any significant shifts in inflation data might alter his stance. This illustrates the Fed’s responsiveness to economic conditions, demonstrating a commitment to adapting policy based on the latest data insights.

As the December FOMC meeting approaches, the Federal Reserve is attentive to forthcoming economic data that could influence its decision-making process. Following the release of the non-farm payroll report, the upcoming Consumer Price Index (CPI) and Producer Price Index (PPI) reports will provide additional context on inflationary pressures and economic trends ahead of the Fed’s meeting. The expectation is that a careful assessment of these data points, along with the broader array of economic indicators, will allow Federal Reserve officials to gauge the most appropriate course of action regarding interest rates.

In summary, the Federal Reserve’s position remains one of cautious optimism as it navigates the complexities of a robust economy facing potential inflationary pressures. The December jobs report is set to be a critical factor influencing the Fed’s interest rate policies, with signs of increased job growth and stable unemployment contributing to the narrative of strength in the labor market. However, the Fed’s commitment to data-driven decision-making underscores its readiness to adapt to changing economic conditions, ultimately reflecting a strategic approach to sustaining economic stability amid evolving uncertainties.