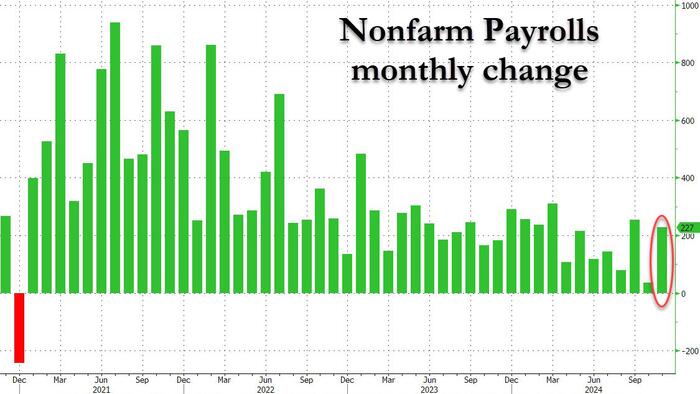

In the wake of a disappointing jobs report last month, which posted a meager payroll growth of just 12,000 jobs due to the dual impact of a hurricane and a Boeing strike, economists anticipated a robust rebound in the November labor market. Their expectations were confirmed when the Bureau of Labor Statistics (BLS) reported a significant increase in payrolls, with a jump of 227,000 jobs, marking the second-highest growth figure since March of the same year. This surge was bolstered by previously revised figures that showed both September and October’s numbers had been adjusted upwards—September’s by 32,000 jobs to 255,000 and October’s by 24,000 jobs, facilitating a total increase of 56,000 jobs for the combined two-month period. This recovery suggests an adjustment to the distortions caused by earlier extreme weather events and labor strikes, contributing to more stable growth patterns moving forward.

The uptick in payrolls was largely driven by sectors such as health care, social assistance, leisure and hospitality, and government jobs, which saw the most substantial hiring activity. Notably, the end of the Boeing strike played a direct role in revitalizing the transportation manufacturing sector, as employment in that category rose by 32,000 positions. Despite these promising signs, other facets of the report exhibited a mixed picture of the labor market. The unemployment rate edged up from 4.1% to 4.2%, exceeding expectations, with various demographics—including Black Americans, adult men and women, teenagers, and minorities—showing minimal shifts in their jobless rates. Curiously, the labor market’s resilience on the payroll front was contrasted by a notable downturn indicated in the household employment survey, which depicted a stark decline of 355,000 employed individuals.

In deeper analysis, the job market exhibited concerning trends beyond the top-line payroll growth figures. The number of long-term unemployed persons (those out of work for 27 weeks or more) held steady at 1.7 million, although that figure reflects an increase compared to the previous year’s numbers. Moreover, the labor force participation rate remained stagnated at 62.5%, trapped in a narrow range for almost a year, indicating a potential ceiling on economic recovery. While the number of people seeking part-time work for economic reasons slightly rose from previous months, the overall employment landscape hinted at underlying weaknesses in workforce sustainability and health.

Job acquisition trends across various sectors further revealed nuances in labor market dynamics. Health care remained a consistently strong sector, adding 54,000 jobs, with growth primarily seen in home health care services and hospitals. Leisure and hospitality also experienced growth, contributing 53,000 positions, following a month of little change. Meanwhile, government employment noted a steady increase, albeit with federal employee numbers experiencing the most significant drop-off seen in two years. Conversely, the retail industry, often anticipated to bolster employment during the holiday season, suffered significant job losses totaling 28,000, with general merchandise retailers particularly hard-hit.

As the economy navigates the complexities of these contrasting labor trends, there are growing concerns regarding wage pressures. The report showed an encouraging increase in hourly earnings, which rose by 0.4% month-over-month in November, surpassing consensus estimates of 0.3%. The stability in wage growth figures, however, amidst mixed employment signals, suggests that the latent wage inflation may prompt considerations from the Federal Reserve. This comes at a critical juncture as traders and policymakers alike weigh the implications for monetary policy and Federal Reserve strategies, determining whether the central bank should continue easing or halt its quantitative measures in the upcoming meetings.

Lastly, the broader economic implications were underscored by the ongoing changes in workforce demographics, particularly the shrinking pool of illegal immigrant workers in the labor market. This shift could catalyze significant wage inflation pressures as employers increasingly turn to the domestic labor force which is typically less flexible in wage negotiations compared to their foreign counterparts. Such dynamics could lead to a fundamental restructuring of hiring practices and wage standards moving forward, directly affecting economic growth and consumer spending in the broader economy. As the labor market evolves, it will be essential for analysts and policymakers to closely monitor these indicators to gauge the future trajectory of economic recovery and workforce stability.