In a significant policy shift towards the inclusion of cash payments, Norway’s government and central bank have taken steps to counteract the nation’s increasing reliance on cashless transactions. With a mere 3% of individuals using cash for recent purchases, the introduction of amendments to Norway’s Financial Contracts Act aims to reinforce citizens’ rights to transact in cash within retail environments. Effective October 1, this legislation will render businesses that reject cash payments subject to penalties. Clarity around cash’s legal tender status, stipulated by Norges Bank, is set to eliminate the common “we only accept cards” signage seen across shops in Norway. This marks a crucial development in a country known for its advanced digital payment systems.

One of the primary motives behind this legislative change is to ensure financial inclusion for around 600,000 Norwegians who confront difficulties using digital payment methods, equating to roughly 10% of the population. The Minister of Justice emphasized the importance of cash in emergency preparedness and the need to provide people with confidence when making purchases. Many elderly citizens, who often feel vulnerable navigating online payments, have expressed relief and enthusiasm regarding the new cash payment provisions. However, there is dissent among certain retailers, particularly those who argue that cash transactions not only incur higher handling costs but also support illicit black-market operations. These conflicting perspectives highlight the ongoing tension between consumer rights and the operational challenges faced by many businesses in adapting to this legislative change.

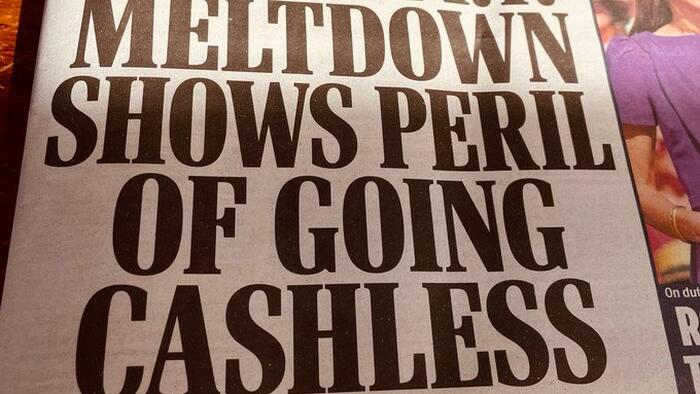

Another crucial objective of the new law is to enhance financial resilience in the economy. Cash serves as a reliable payment option in scenarios where digital systems fail due to power outages or cyber attacks. Norwegian authorities have recognized the necessity of maintaining cash availability as a safeguard against disruptions that have been increasingly prevalent in cashless environments. This echoes concerns raised earlier by officials in neighboring Finland, emphasizing the essential role cash plays as a backup payment method amid growing reliance on digital infrastructures that may not be as robust as perceived.

The discourse around cash’s diminishing role continued with central banks in both Norway and Sweden underscoring the vulnerabilities of cashless economies. Sweden’s Riksbank has similarly cautioned against the fragility of a system overly dependent on digital payments, especially in light of ongoing geopolitical tensions and the risks posed by potential cyber threats. Events such as significant digital payment outages worldwide have illustrated how cash transactions remain unaffected by power or internet failures, making a compelling argument for the maintenance of cash systems.

Across Europe, there is a palpable trend towards bolstering the rights of citizens to utilize cash. Several nations, including Switzerland and Austria, are enacting or have developed legislation to protect the right to cash payments. There is momentum for implementing similar amendments in Sweden as its central bank has called for urgent measures to fortify the role of cash. Both countries’ central banks are now facing the daunting task of reversing trends that have seen a substantial decline in cash use, largely stemming from measures taken by financial institutions in prior years that suppressed cash access.

Ultimately, while Norway represents a noteworthy case study in re-establishing cash’s significance, the success of such initiatives remains uncertain amidst a predominantly cashless populace. Central banks must balance the convenience and speed of digital transactions with the inherent security and reliability of cash payments. As Norway and Sweden forge ahead with their legislative efforts, they recognize the larger implications for cash. Without swift and effective action, there is a risk that society may retreat into a digital-only framework, which could lead to genuine financial exclusion for many and caution against leaving the economy vulnerable to potential disruptions inherent in a fully cashless future. Efforts to safeguard cash utilize a blend of traditional values in currency with modern financial imperatives, highlighting a critical juncture in the evolution of payment systems worldwide.