Nike Inc., a global leader in athletic apparel and footwear, is set to report its next earnings on December 19, following the market’s close. Analysts project the company will post an earnings per share (EPS) of $0.83, generating approximately $12.47 billion in revenue for the quarter. This forecast is important for investors and analysts as it reflects Nike’s ability to sustain and grow its operations in a competitive market, while also providing insight into consumer spending habits, global retail trends, and the brand’s resilience against economic fluctuations.

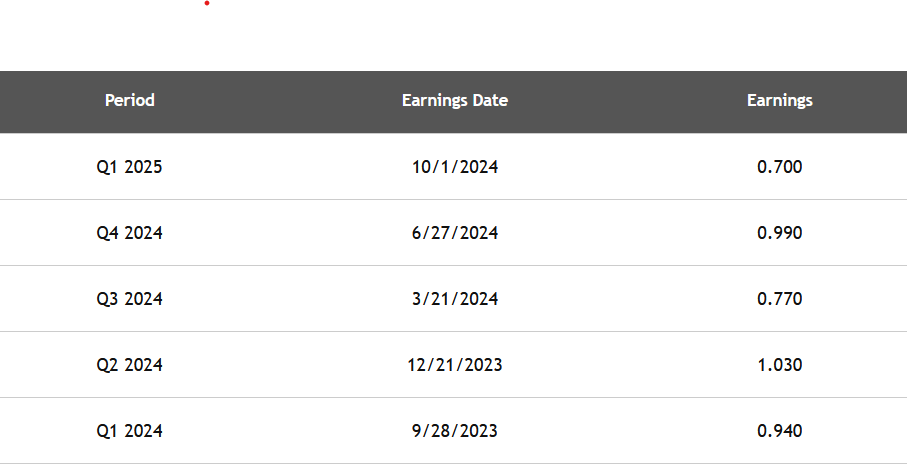

Looking at Nike’s recent earnings history reveals a consistent upward trend in both earnings and revenue growth over the long term. Historical data indicates that while the company has faced various external challenges, it has managed to deliver solid financial performance, which has been a hallmark of Nike’s strategy. Such a record instills confidence among investors, as strong earnings and revenue figures are essential indicators of the company’s operational health and market strength.

However, earnings reports can trigger significant volatility in stock prices, as investors react to new information about the company’s performance or forecasts. This uncertainty can lead to sharp price movements in either direction, presenting opportunities for investors, particularly those engaged in stock options trading. For those interested in these strategies, Nike has options available that will expire on December 20, which may allow traders to leverage potential short-term price fluctuations following the earnings release.

The volatility surrounding earnings reports often attracts traders looking to capitalize on market movements. Investors can explore Nike’s options chain listed on StockOptionsChannel.com, where they can find various strategies involving both call and put options. These strategies can be particularly appealing to those who are adept at predicting market trends and willing to take on the associated risks, as price swings can generate considerable profits if timed correctly.

In addition to its stock performance, Nike also offers a dividend yield of 2.06%, making it an attractive option for income-focused investors. The company has a well-documented dividend history, reflecting its commitment to returning value to shareholders through regular dividends. This aspect of Nike’s business model is important for dividend investors who typically seek stable income streams, especially in uncertain economic environments where traditional revenue may fluctuate.

Overall, Nike’s consistent earnings growth, attractive dividend yield, and upcoming earnings report present a complex landscape for investors. Whether one is interested in long-term investment possibilities or short-term trading strategies, keeping an eye on Nike’s performance and market reactions after its earnings release will be essential. As the company continues to navigate the dynamic retail landscape, its financial metrics and investor engagement will remain crucial in shaping its future trajectory in the market.