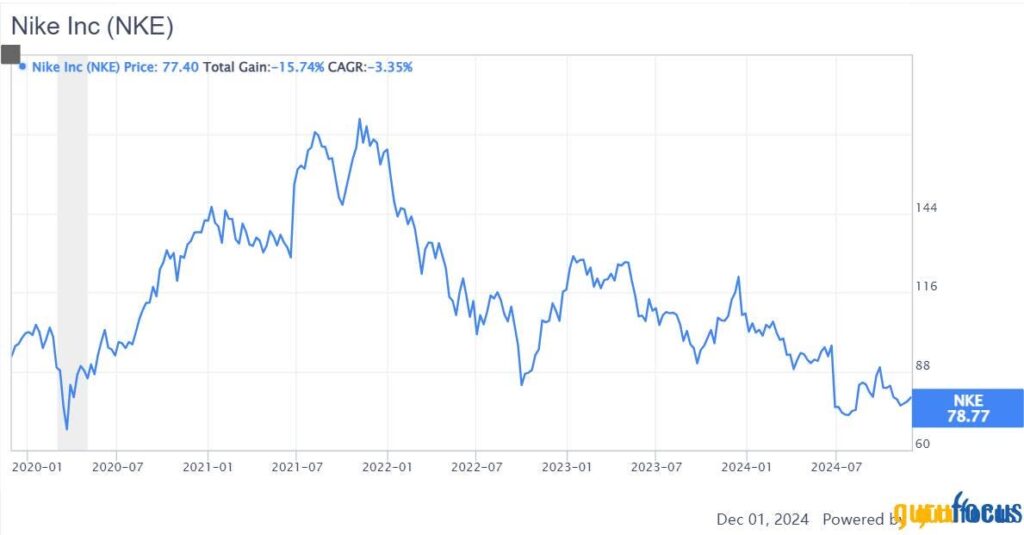

Nike, the globally recognized athletic footwear and apparel leader, has encountered significant challenges that have adversely affected its stock performance in recent years. Over the past three to five years, Nike’s underperformance is notably disheartening for long-term shareholders, as the company has grappled with myriad issues. Following a peak in valuation in 2021, disappointing fundamental growth has led to a steady decline in its stock price, affected by problems in its distribution model, shifts in product design strategy, and a backlash in the crucial Chinese market during the COVID pandemic. This article scrutinizes these hurdles and assesses Nike’s valuation amid a challenging operational landscape.

A key issue for Nike has been the transformation of its distribution model. The company made a strategic pivot in 2017, favoring a Direct-to-Consumer (DTC) approach over traditional wholesale channels. While this strategy has improved margins by eliminating third-party costs and enhancing pricing control, it has also resulted in lost connections with local communities where wholesale partners, such as Dick’s Sporting Goods and Foot Locker, traditionally served as vital links to consumers. Consequently, Nike’s withdrawal from these key retailers has allowed competitors like Asics, Hoka, and New Balance to capture market share, necessitating Nike’s current efforts to rebuild partnerships with these retailers to regain footing in certain markets.

Furthermore, changes in Nike’s product design strategy under former CEO John Donahoe have contributed to its struggles. The shift from a category-led approach focused on performance to a gender-led strategy prioritizing lifestyle trends has led to the brand losing its competitive edge in the running category. As popular lifestyle products surged during the pandemic, Nike inadvertently left an opening for aggressive competitors, such as Hoka and On Running, as well as legacy brands that quickly adapted to evolving consumer preferences. This realignment of focus has significantly impacted Nike’s market share, posing a challenge for the company to reclaim its previous dominance in performance-oriented segments.

In addition to internal changes, Nike’s relationship with consumers in China has markedly deteriorated. Prior to COVID-19, Nike was a leader in the Chinese sportswear market; however, its public stance on issues such as Xinjiang cotton has alienated many Chinese consumers. This backlash has driven former customers towards domestic brands like Li Ning and Anta, which have been successful in resonating with local culture and optimizing their digital marketing strategies to cater effectively to Chinese consumers. As these competitors gain ground, Nike faces the daunting task of re-establishing connection and trust with a critical customer base.

Amidst these operational challenges, Nike appointed Elliott Hill as CEO in hopes of stabilizing the company. Although Hill’s return briefly bolstered investor sentiment, concerns about the ongoing transitional difficulties continued to weigh heavily on the stock. Analysts have expressed trepidation regarding Nike’s ability to navigate these market challenges and restore growth, especially following the withdrawal of fiscal guidance for FY25 earlier in the year. Investors remain cautious as the company endeavors to adapt to a rapidly changing retail environment while under scrutiny for its performance.

From a valuation standpoint, Nike’s stock currently appears to be undervalued, reflecting considerable market pessimism regarding its future. The Schiller P/E ratio is near a 15-year low, indicating that investors have baked significant uncertainty into the price. Additionally, the company’s dividend yield is hovering near a 15-year high at almost 2%, suggesting that it offers an attractive return for income-focused investors. Nike has also increased its share repurchase program, which could serve to shore up its stock price. These factors lead to a perception that Nike shares, although facing immediate challenges, may hold long-term value for patient investors willing to weather the current market volatility.

In conclusion, Nike is embroiled in a transformative phase that presents both significant hurdles and potential opportunities. While the company grapples with distribution revamps, shifts in product focus, and adverse impacts from market dynamics, its valuation metrics point toward a possible recovery. The return of an experienced CEO like Elliott Hill could signal a strategic pivot back to growth if effective measures are implemented. Given Nike’s healthy dividend yield and increased share buybacks, the company’s stock may represent a bargain prospect for investors prepared to anticipate a resurgence in the brand’s long-term prospects amidst the current tumult.