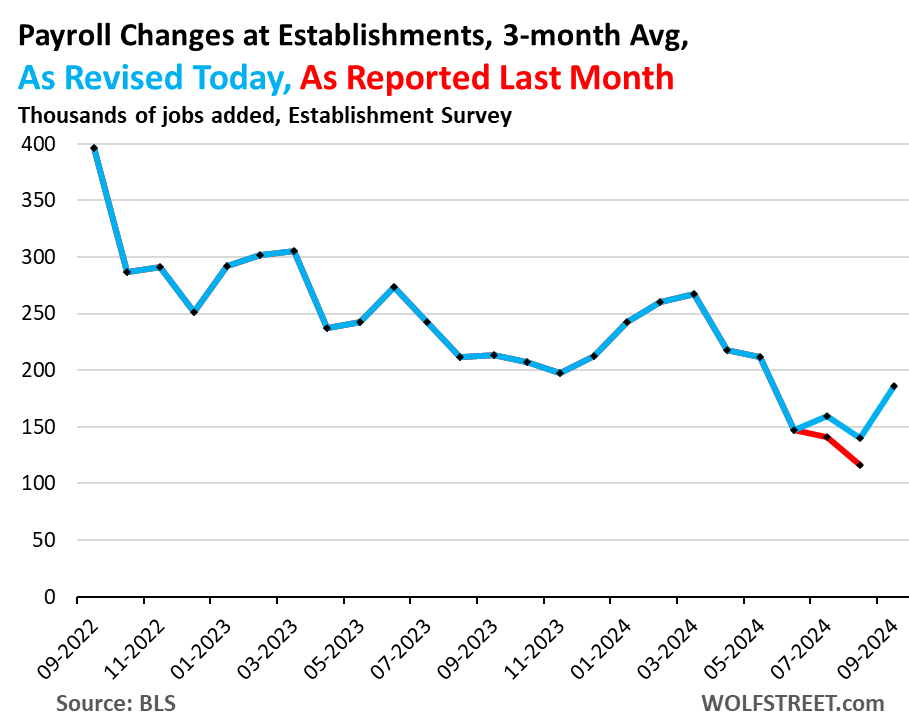

The labor market is showing signs of resilience and strength as recent payroll data indicates a positive trend in job creation. In September, employers added 254,000 jobs, with upward revisions for previous months contributing to a three-month average of 186,000 jobs created. The prior month’s negative assessments were corrected, revealing a labor market that is functioning effectively, despite concerns about slowdowns. The unemployment rate has decreased for the last two months, reflecting a healthier job environment. Moreover, there is a growing concern regarding inflation as wages continue to rise. Although the Federal Reserve might consider further rate cuts in response to economic pressures, the improving job market complicates such a decision.

Wage growth has shown significant acceleration recently, with average hourly earnings rising by an annualized rate of 5.6% in August and an additional 4.5% in September. This development lends itself to debates surrounding inflation, as rising wages contribute to overall price pressures. The 12-month increase in average hourly earnings reached 4.0% in September, signaling the fastest growth since March 2022. The implications of increasing wages are particularly relevant to the Federal Reserve, which has been monitoring inflationary trends closely. The overall robustness of the labor market and wage advancements highlight a complex economic landscape where growth and inflation are intertwined.

The unemployment rate, which fell to a historically low 4.1%, offers insights into both the current job market dynamics and the impacts of recent immigration trends. A notable influx of approximately 6 million migrants into the labor force during the past two years has contributed to this statistic, affecting the overall labor supply. The distinction between an unemployment rate rise due to growing labor supply compared to that caused by job cuts is crucial. In this context, it suggests an ongoing labor demand amidst a larger pool of job seekers, showcasing a unique phase of economic adjustment.

Despite fluctuations in the labor market and revisions to initial reports, the report highlights a consistent trend of low layoffs and discharges, indicating that companies continue to retain employees while also seeking to add to their workforce. This steady job creation demonstrates a productive phase for most sectors, as evidenced by the decrease in the number of unemployed individuals actively looking for work. Such labor market stability pairs with broader economic indicators to present an overall positive outlook, though the increase in wage growth raises additional concerns about future inflation.

In response to the revised labor market data, the bond market experienced a notable shift, leading to a rise in treasury yields. As the labor market’s robustness becomes clearer and the potential need for aggressive rate cuts diminishes, the bond market’s reaction underscores investor sentiment about future monetary policy and inflation trends. As the yield on 10-year Treasury bonds increased 12 basis points to 3.97%, it became evident that the market is adjusting to the new economic reality, balancing growth prospects with concerns over inflationary pressures stemming from wage increases.

Ultimately, the recent labor statistics suggest a deepening economic complexity influenced by multiple factors, including job creation rates, wage growth, and immigration patterns. While immediate concerns about recession may have waned, longer-term inflation expectations remain a critical focal point for both policymakers and market participants. The intersection of these dynamics will play a pivotal role in shaping monetary policy and overall economic performance in the months to come, as stakeholders navigate the implications of a changing labor landscape and its broader economic ramifications.