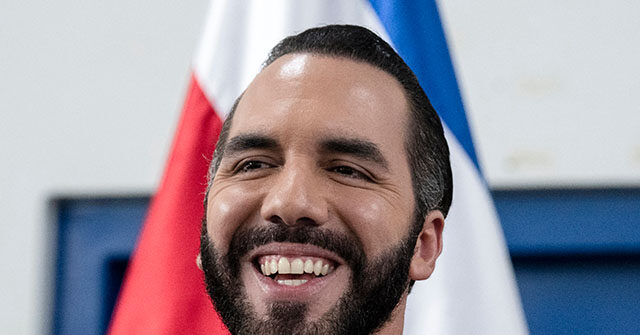

President Nayib Bukele of El Salvador recently revealed the country’s cryptocurrency portfolio, showcasing that it currently holds over $573 million worth of Bitcoin, reflecting a remarkable profit of 113.84%. This financial boost comes in the wake of an unprecedented surge in Bitcoin’s value, which was recorded at over $98,000 for the first time following the recent U.S. presidential election where President-elect Donald Trump triumphed over Vice President Kamala Harris. With Bitcoin’s price soaring, El Salvador has seen significant unrealized gains, with an increase of $305 million compared to the initial investment.

El Salvador’s engagement with Bitcoin began in 2021 when it became the first nation to adopt the cryptocurrency as legal tender alongside the U.S. dollar. This policy decision underscores the government’s commitment to modernizing the economy while tackling issues such as violent crime. Bukele’s government had made significant investments when Bitcoin was priced around $52,600, making timely acquisitions that have now paid off, as indicated by the impressive profits reported in Bukele’s social media updates. On social media, Bukele shared the country’s holdings and the financial results with a humorous touch by using a popular meme.

In a quirky turn of events, Bukele’s post featuring the “Chill Guy” meme led to a spike in the value of a cryptocurrency also branded with that imagery, which saw a dramatic increase of 65% within just 90 minutes. The artist Phillip Banks, creator of the original meme, has since threatened legal action against those using the image for financial gain without permission. Meanwhile, the Bitcoin portfolio tracking service estimated El Salvador’s total Bitcoin holdings slightly lower at around $556 million, illustrating the fluctuating nature of the cryptocurrency market.

To protect its Bitcoin investments, Bukele disclosed that a substantial portion—approximately $400 million—has been securely stored in a “cold wallet” kept in a physical vault within the country. Cold wallets provide enhanced security by remaining offline, thus minimizing the risk of hacking or unauthorized access. This strategy not only safeguards the cryptocurrencies but also highlights a deliberate effort by the Bukele administration to mitigate the volatility associated with digital assets.

International response to El Salvador’s Bitcoin policy has been mixed, with critics such as the International Monetary Fund (IMF) warning that the adoption of Bitcoin could destabilize the nation’s economy. The IMF’s call in 2022 for El Salvador to revoke its legal tender status for Bitcoin reflects significant concern from global financial institutions regarding the potential implications of such a bold economic experiment. Despite criticism, Bukele remains steadfast in his approach, even touting the country’s success by sharing his reaction as the unrealized Bitcoin profit crossed the $100 million mark.

The backdrop of these developments coincides with broader discussions around cryptocurrency policy under the upcoming Trump administration, which promises to be more favorable towards Bitcoin and similar assets. As the situation evolves, Bukele’s cryptocurrency policies and El Salvador’s bold venture into the world of digital currencies continue to attract both attention and criticism, exemplifying the complex dynamics of navigating modern financial ecosystems while pursuing national reform.