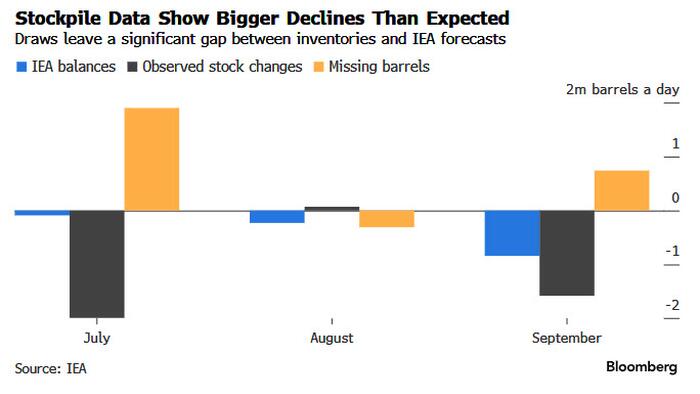

The oil market currently faces skepticism stemming from the prevailing belief that a significant oversupply, projected at about one million barrels per day (bpd) in 2025, will hinder price growth and discourage OPEC+ from ramping up production. This forecast largely mirrors the narrative propagated by the International Energy Agency (IEA), an entity notorious for politicizing its assessments and, more often than not, missing the mark. However, while many traders align with the IEA’s pessimistic outlook regarding inventory surpluses, there are emerging indicators that suggest the anticipated stockpile increase could be substantially less than predicted—potentially even negligible. Recent data indicates a notable decline in global oil inventories, by approximately 1.16 million bpd, which starkly contrasts with the IEA’s reduced estimate of 380,000 bpd. This discrepancy raises significant questions about market dynamics moving into the next year.

In analyzing this situation, the stark difference between the IEA’s projections and the actual data presents a critical insight for traders and analysts alike. The gap of nearly 800,000 bpd equates to the daily oil demand of a mid-sized country like Poland. Over a quarter, this discrepancy totals around 70 million barrels, suggesting a markedly tighter market than the IEA forecasts. Oil proponents believe that the IEA will likely need to adjust its future balance sheets to reflect these higher-than-expected stock draws, thereby diminishing the anticipated oversupply scenario for the upcoming year. Importantly, this isn’t a one-time anomaly; the oil market has a historical tendency to recalibrate its outlook based on actual inventory changes, which often contradicts initial bearish sentiment.

However, this phenomenon of “missing barrels” has traditionally presented a challenge in accurately forecasting oil markets. Acknowledging the historical challenges of oil forecasting, analysts like Giovanni Staunovo from UBS Group AG emphasize the potential for demand projections to be revised upward based on new data confronting the IEA’s previous forecasts. The pattern of underestimating demand while highlighting surpluses reflects a recurring trend in the sector—one that has continued to shape investor sentiment and market strategies. Analysts predict that as the market grapples with these missing barrels, the IEA will increasingly find itself under pressure to revise its stance, which may ultimately lead to less bearish projections.

The IEA has suggested that the discrepancies seen in inventory data could be attributed to reporting issues from certain countries where data availability is poor. In an attempt to provide clarity, the agency previously adjusted its second-quarter balance, revising demand downwards and supply upwards, and aligning its projections with a surge in unreported stockpiles. Such revisions are integral to maintaining credibility in market assessments, but they often reveal a pattern of historical inconsistencies. Earlier adjustments, including a reduction of 70,000 bpd in the oil demand estimate for 2022, serve to underline the evolving nature of energy market analytics.

Developments in U.S. governance may further influence the IEA’s forecasting model and methodologies. The anticipation of new leadership in the United States raises questions as to how this shift in administration will affect the IEA’s operations and its potentially politicized viewpoints, particularly towards green energy initiatives. With a perceived change in presidential priorities, commentators speculate that there will be a realignment in the IEA’s reporting framework, positioning it to either mitigate or amplify the message of rising oil demands and tighter markets. Given the IEA’s historical relations with past U.S. administrations, these dynamics could foster a new direction in energy policy analysis.

In conclusion, as we approach 2025, the prevailing expectations of an oversupply in the oil market must be critically assessed against dynamic real-world data illustrating the complexities of oil inventory management. The historical context of “missing barrels” will continue to shape forecasts, but current trends suggest that inventory adjustments may lead to a less bearish outlook than the IEA currently proposes. The oil market’s tendency to adapt to unexpected inventory changes can serve to confound initial forecasts and should advise caution among traders and policymakers. Moving forward, a reevaluation of inventory metrics, demand predictions, and the influence of U.S. political shifts will be essential in navigating the future landscape of global oil trade and pricing strategies.