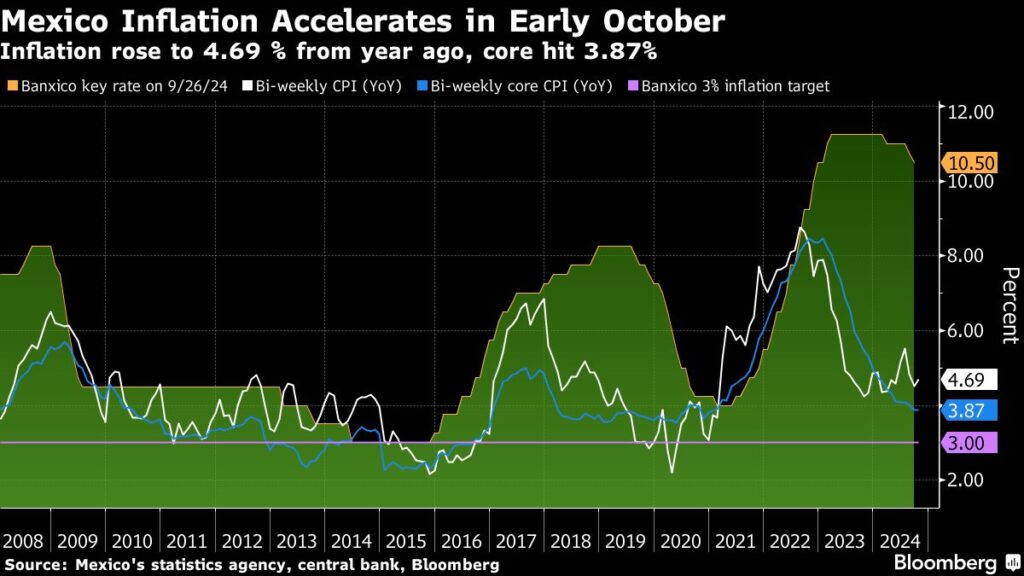

In early October 2023, Mexico experienced an unexpected rise in inflation, complicating the central bank’s strategy of reducing its benchmark interest rate in the upcoming month. Official figures revealed that consumer prices surged by 4.69% in the first two weeks of October compared to the same period in 2022, exceeding the median analysts’ forecast of 4.66%. This inflation report drew attention, particularly the core inflation metric that, while slightly decreasing from 3.88% to 3.87%, also surpassed the anticipated estimate of 3.82%. The Bank of Mexico, known as Banxico, aims for an inflation target of 3% with a permissible deviation of 1 percentage point, allowing for a certain degree of fluctuation in economic conditions.

In response to easing inflation trends, Banxico voted to lower its benchmark interest rate by a quarter-point to 10.5% during its September 26 meeting. The bank’s meeting minutes indicated optimism among policymakers regarding external conditions; the slowdown in inflation and economic activity in the U.S. and the sluggish performance of Mexico’s economy were seen as factors that could support further rate cuts during the forthcoming meeting scheduled for November 14. Notably, this decision wasn’t unanimous, with Deputy Governor Jonathan Heath opposing the cut, advocating instead for a tighter monetary policy because of persistent high prices in the services sector.

The slowdown in economic performance within Mexico, the second-largest economy in Latin America, has led analysts and investors to speculate on the likelihood of additional interest rate cuts. Banxico has revised its growth forecast for the year down to 1.5% from an earlier estimate of 2.4%. Additionally, the bank adjusted its growth projection for 2025 to 1.2%, a decrease from its previous estimate of 1.5%. These revisions reflect broader trends of economic sluggishness that have prompted a reevaluation of forecasts regarding both inflation and growth.

Further contributing to this economic assessment, economists recently conducted a Citi survey that revealed a downward adjustment in inflation predictions. The forecast for inflation in 2024 was lowered from 4.44% to 4.40%, while the estimate for 2025 was also adjusted downwards from 3.81% to 3.80%. These changes in inflation estimates align with Banxico’s own growth forecast of 1.5% for 2024, but economists also revised their projected growth for the subsequent year downward to 1% from 1.2%. Such adjustments highlight the uncertain economic landscape and potential difficulties that lie ahead for the central bank.

The situation presents a delicate balancing act for Banxico as it attempts to respond to rising inflation without stifling growth. The increase in consumer prices could undermine the central bank’s credibility and complicate its efforts to stimulate the economy through lower interest rates. The decision-making process within Banxico reflects a similar theme of caution. The divided votes during policy meetings, particularly the dissent from Deputy Governor Heath, reveal the differing views on how best to approach current economic challenges. The need for a proactive strategy in managing rising prices while encouraging economic growth will be imperative in the months to come.

As the central bank prepares for its important meeting in November, these economic indicators—rising inflation, a decelerating economy, and clamoring for interest rate adjustments—paint a complex picture for Mexico’s financial landscape. Banxico must weigh these factors carefully to avoid undermining efforts for sustained economic recovery while still addressing the inflationary pressures that could jeopardize consumer purchasing power and overall economic stability. The upcoming months will be crucial in determining the trajectory of monetary policy in Mexico, with the potential for significant implications for both domestic and international markets.