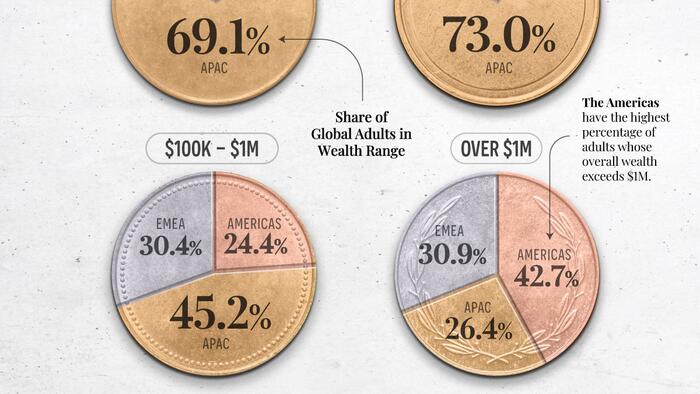

Wealth distribution globally reflects stark economic disparities shaped by development levels, resource availability, and access to financial services. The 2024 UBS Global Wealth Report provides a comprehensive overview of wealth distribution across different regions, covering 56 markets that represent approximately 92.2% of total global wealth. However, it’s crucial to note that the report excludes many African countries, so the data may not fully represent global wealth trends. The report categorizes adults into four wealth bands based on their financial status in USD: those with less than $10,000, those with $10,000 to $100,000, those with $100,000 to $1 million, and those with more than $1 million.

In terms of wealth bands, the lowest tier (under $10K) is predominantly populated by individuals from the Asia-Pacific (APAC) region, where nearly 70% of adults in this wealth category reside. This substantial majority indicates that economic challenges and limited financial access are particularly pronounced in this area. Meanwhile, the higher wealth bands showcase a contrasting picture, with the Americas leading in the proportion of adults who possess wealth exceeding $1 million. This region, which encompasses both North and South America, is home to 42.7% of global adults in the wealthiest category, underscoring significant economic concentration within this demographic.

The United States stands out prominently within the Americas, hosting nearly 22 million individuals with a net worth over $1 million—the highest number of millionaires of any country globally. This remarkable statistic signifies that the U.S. houses approximately 38% of the world’s millionaires. This concentration of high-net-worth individuals highlights the substantial economic divide that exists, not only between different regions but also within countries themselves. The wealth accumulation patterns in the U.S. may be reflective of favorable investment environments, innovation, and entrepreneurial opportunities, contributing to its status as a hub for wealth creation.

Following the U.S., mainland China ranks second in terms of millionaire population, boasting just over 6 million individuals who fall into the ultra-wealthy category. This number is noteworthy, as it is nearly double that of the third-ranked nation, the United Kingdom. The rapid economic growth and expansion of the Chinese economy have facilitated this increase in wealthy individuals, contrasting with the persistent challenges faced by its lower-income demographic. In this context, understanding the factors that contribute to wealth generation in these regions becomes essential.

While examining the distribution of wealth, the report also highlights the prevalence of ultra-wealthy individuals, defined as those with a net worth of $30 million or more. This select group, consisting of approximately 626,619 individuals worldwide, is concentrated in regions such as North America and Western Europe. This clear delineation underscores the idea that wealth not only correlates with individual financial success but also with regional economic structures and policies that support or hinder financial growth and accessibility.

Overall, the UBS Global Wealth Report for 2024 sheds light on the complexities of wealth distribution across the globe, emphasizing that while some regions thrive with concentrations of wealth, others struggle under the weight of poverty. This divide reflects broader socioeconomic trends that demand attention from policymakers worldwide. Understanding these patterns is crucial for addressing inequality and fostering a more inclusive global economy that provides opportunities for wealth generation across all societal levels.