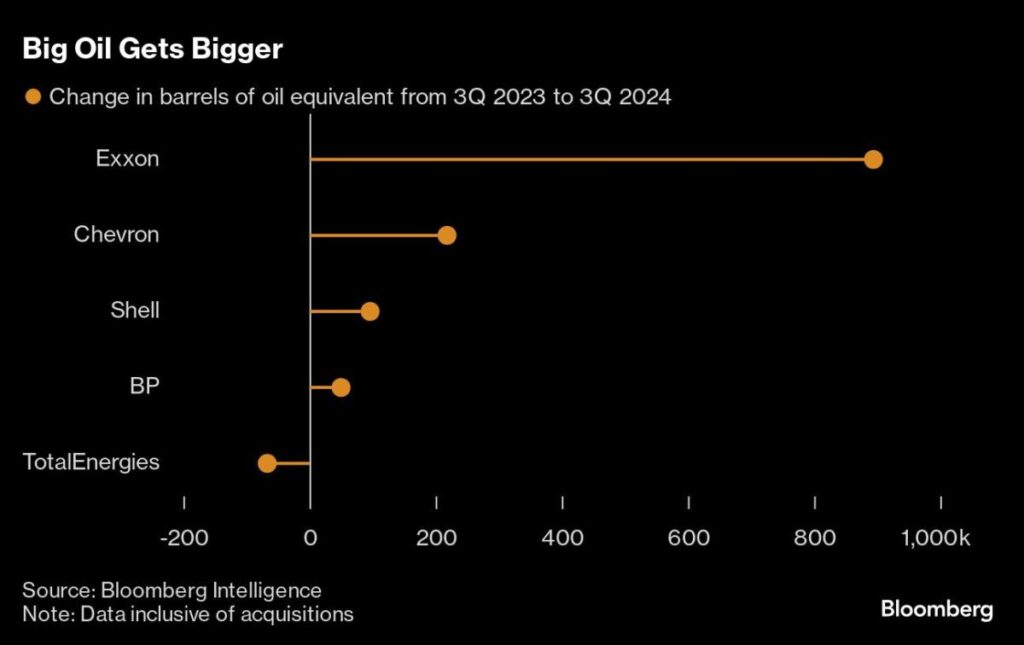

In the latest earnings season, Exxon Mobil Corp. and Chevron Corp., two of the leading US oil majors, reported significant increases in fossil fuel production that coincide with preparations by OPEC and its allies to boost crude supplies in the global market. Both companies saw production levels rise primarily due to intense drilling in the Permian Basin, a key area known for its potential and efficiency, which has continued to exceed analyst expectations. Specifically, Exxon announced a notable 24% increase in its oil and gas production, bolstered by its $60 billion acquisition of Pioneer Natural Resources Co., while Chevron posted a 7% rise. Other major oil firms like Shell and BP also made strides in production, increasing by 4% and 2%, respectively, even amid ambitious net-zero targets. These growing production levels project a more bearish outlook for oil prices, which have already experienced a 12% decline over the past six months, primarily due to tepid demand from China, the world’s foremost crude importer.

The current situation marks a sharp contrast to the previous few years, particularly during the pandemic when oil companies were compelled to scale back capital expenditures and faced mounting pressures from the ESG movement to invest in more sustainable practices. In a significant shift, the industry has now unified in its strategy, focusing on producing oil and gas affordably enough to endure various energy transition scenarios. Nick Hummel, an analyst at Edward D. Jones & Co., remarked that while Exxon and Chevron remain committed to their core oil and gas business, their growth in high-quality assets stands out. The looming potential for OPEC to increase supply, coupled with a softer near-term outlook for oil, adds further complexity for these companies.

Exxon’s transformation, particularly after losing a shareholder battle to the activist firm Engine No. 1 in 2021, exemplifies this strategic pivot. Company CFO Kathy Mikells highlighted that strategic acquisitions, divestitures, and efficiency improvements have effectively “doubled” profit margins per barrel since 2019, even amidst static oil prices. In a similar vein, Chevron has increased its oil and gas production by 27% compared to a decade ago, notably without scaling up capital expenditures. The increase is partially attributable to the completion of Australian gas projects and a heightened focus on the Permian Basin, where Chevron has seen its output double in the past five years.

Moreover, both companies have embraced improved efficiencies, with Chevron CEO Mike Wirth noting the firm is getting more output for every dollar spent. This increase in U.S. oil production, which is about 50% greater than that of Saudi Arabia, has enabled the retention of millions of OPEC’s barrels off the market. Analysts from Macquarie forecast that fresh supply coming from places like Guyana and Brazil means there could be 5 million barrels a day of productive capacity becoming available by 2025, despite relatively weak growth in global oil demand.

As oil prices show signs of falling, dipping to about $70 per barrel from approximately $73, the implications for Big Oil’s ability to maintain dividend payments and stock buybacks are becoming evident. For instance, BP recently hinted it may cut back on its share buyback program in response to declining oil prices. However, Exxon’s, Chevron’s, and Shell’s leadership remains optimistic, arguing that their investments in fields like Guyana and the Permian will yield profits even amid future downturns, given that they can extract crude for around $35 per barrel. According to Mikells, this transformation has placed the firms on a robust footing across diverse market conditions, particularly within a softening market landscape.

The balance between increasing production while facing potential price declines presents significant challenges for these oil giants. However, their strategies to bolster efficiency and focus on high-potential reserves may provide resilience in the face of fluctuating market conditions. Overall, as Exxon’s and Chevron’s recent results suggest, there is a concerted effort to harness growth without losing sight of the inherent volatility in the global oil market. This dual approach could become increasingly vital as the energy landscape continues to evolve in response to both market pressures and the increasing push for sustainability.